A guide to digital transformation for mining and minerals processing

What is digital transformation in mining?

Mining digital transformation is all about the digitisation of large amounts of data, leveraging the latest industry 4.0 technological advances across the entire mining value chain to optimise processes and business outcomes. Industry 4.0 technologies for mining use high performance computing, advanced analytics, machine learning, and artificial intelligence to reduce costs, improve operational performance, achieve sustainability goals, and transform mining business processes. Mining digital transformation encompasses all aspects of the business to include not only technology activities, but a fundamental shift in the organisations business model, workflows, and operational processes.

Introduction

Digital transformation has been lagging in the mining sector for some time; however, a combination of competitive pressures, and a need to extract as much value as possible from declining ore grades, means the tide is finally starting to turn.

Under pressure to improve profits and output while simultaneously reducing emissions and meeting ESG requirements, mining leaders are realising the enormous benefits that digitisation can bring.

In a recent survey, 99% of mining company decisionmakers said technology and innovation were ‘critical’ to their organisation’s survival.1

The potential for digitisation of minerals processing is enormous. With the right insights, mining and minerals professionals can make proactive and accurate decisions based on their real data. This prevents problems from escalating and can help organisations to achieve their emissions targets as well as unlock huge financial gains.

However, despite the best intentions – and some impressive progress – many challenges remain.

For many organisations, the immediate and obvious solution to rapid digital transformation has been to invest in large-scale, multi-sector, overarching solutions that provide efficiencies and insights across the full mining value chain – helping with everything from extraction and exploration through to occupational health and safety.

However, while these ‘one-size-fits-all’ solutions do deliver some benefits at a high level, they’re not designed to handle the complexity of the various types of processes specific to minerals processing plants. As a result, this processing segment of the mining value chain is often overlooked, with huge opportunities being missed.

Contents

- What is digital transformation in mining?

- Digital transformation in mining: Industry 4.0

- Digital transformation for the mining sector: where the gaps lie

- Towards best-practice digital transformation for minerals processing: the automation pyramid

- Where does the ‘digital twin’ fit in?

- How does it all fit together?

- 5 components of best-practice digital-twin-enabled MES for minerals processing plants

- Focusing on digital transformation for the minerals processing segment of the mining value chain: the benefits

- How a gold plant used a purpose-built digital solution to optimise its gold calculations

- More reliable and accurate production reporting

- Creating a net smelter return model for a copper concentrator

- Process optimisation

- Reagent overdosing for a copper plant

- ESG Compliance/ Sustainability reporting

Digital transformation in mining: Industry 4.0

Also known as the ‘fourth industrial revolution’, Industry 4.0 is a term that refers to the digital transformation of industries like mining, processing and manufacturing. There are several innovations and developments that underpin Industry 4.0:

- The growth in high-performance computing, and capacity to process huge amounts of data.

- Developments in artificial intelligence and machine learning, which enable data analysis at a scale never seen before.

- The availability of secure and reliable cloud storage, which can store huge data volumes and make information accessible from anywhere.

- Growth in IoT devices that enable data to be automatically captured and processed from all kinds of locations.

- Increasing pressure on mining organisations not just to operate efficiently, but also, to demonstrate their ESG credentials and proactively reduce emissions.

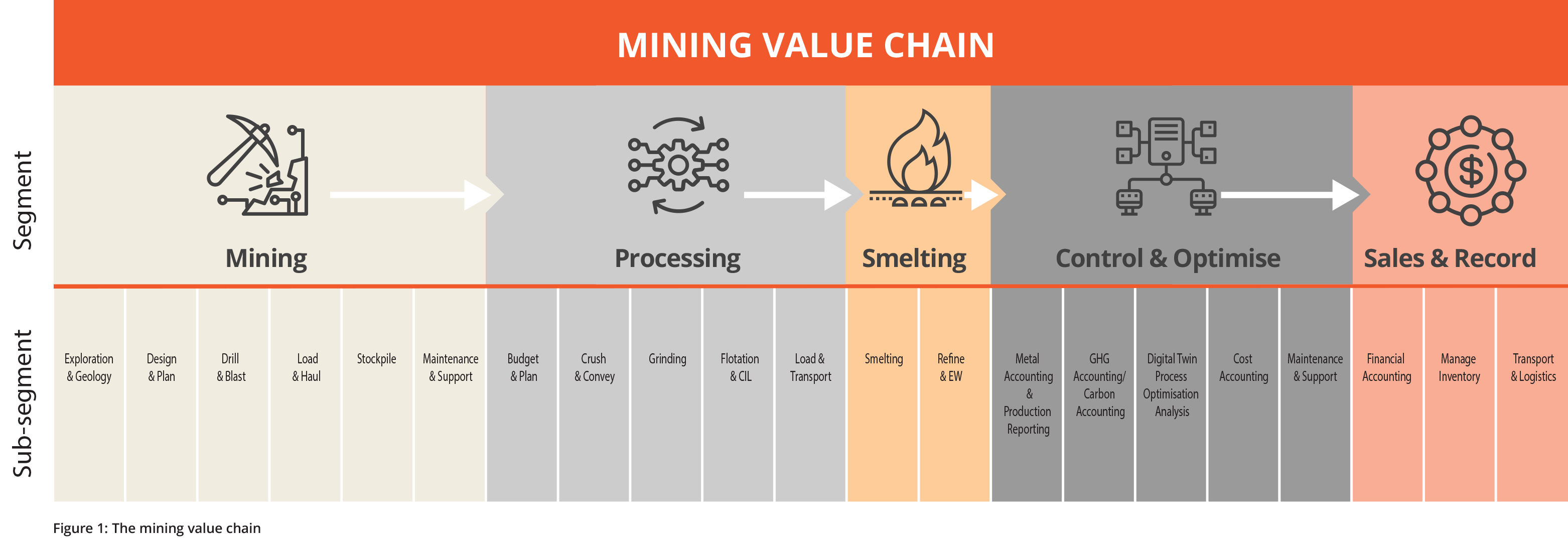

As a result of these innovations, the owners and operators of mining organisations are increasingly realising the vital economic and social benefits, as well as the importance of digital transformation across the entire value chain:

Digital transformation for the mining sector: where the gaps lie

While the promise of digital transformation is strong in the sector, there are some gaps that remain. In particular:

Failure to ‘close the loop’ between strategy and execution

Despite progress being made, there is often a considerable gap between an organisation’s digital strategy and execution. Most metals and mining companies have ambitious digital strategies in place; however, the gap between strategy and execution is significant—especially relative to other industries.3

Assuming a digital strategy is in place, the reasons for this can include:

- Lack of customisation:

According to a recent survey, only 25% of metals and mining companies use customised digital solutions4 – instead opting for generalised, off-the-shelf solutions. - ‘Big bang’ implementation:

When solutions are implemented all at once rather than with a phased approach, the process can often be quite disruptive and potentially debilitating for the organisation. While rapid implementations can be successful, this requires engaged leadership and subject matter expertise. - ‘Set and forget’ approach:

While digital solutions are designed to streamline workloads and automate processes, they also need to be actively utilised to deliver results. A robust digital solution can’t simply be implemented and then left to produce insights in the background.

Minerals processing segment is overlooked

Another key problem is that, while the need for digital transformation in the mining value chain is well understood, there is one piece of the puzzle that is often overlooked and undervalued: minerals processing.

A key reason is its complexity. There are few options in the market for digital transformation solutions that can be easily configured to suit different types of minerals processing. The optimisation of minerals processing is a specialised area and requires knowledge of many disciplines, including software engineering, IT architecture and data flows, chemical and process engineering, process design and simulation, and communication protocols. This segment of the mining value chain requires a unique balance of understanding metallurgy and its complexities, as well as how to integrate process chemistry with modern digital technology. As such, it is often overlooked or oversimplified with overly manual tools – meaning enormous opportunities for improvement and insight are missed.

Towards best-practice digital transformation for minerals processing: the automation pyramid

So what does quality digital transformation look like? How can minerals processing be optimised in order to make the most responsible and profitable use of scarce natural resources? And what should organisations in the mining and minerals sector be aiming for?

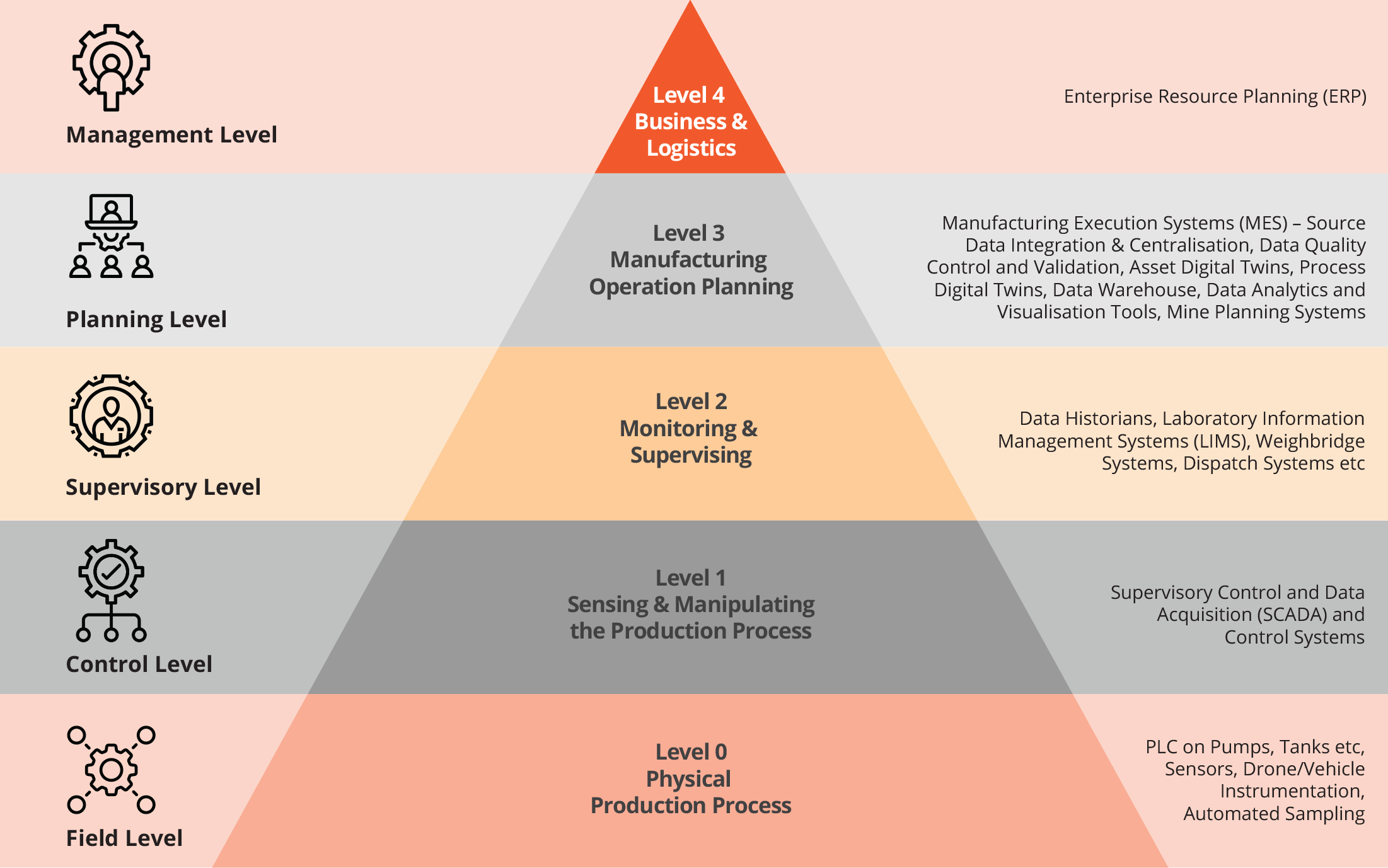

To understand how best-practice digital transformation can work in a mining and minerals processing plant, it can be helpful to reference the automation pyramid – a model based on the international standard ANSI/ ISA 95 developed by the International Society of Automation.5

Essentially, this model provides standards as to how different enterprise and control systems should work together to reduce errors, risk and costs. It is a well-established model that is widely adopted in many sectors, especially in industrial manufacturing.

Figure 2 provides an overview of this pyramid, demonstrating the levels of automation for the industrial manufacturing sector, with an added description of what each level would involve for the mining and minerals sector.

Automation Pyramid for Mining and Minerals Processing

Figure 2: The automation pyramid for mining and minerals processing, derived from ISA95 and adapted for mining and minerals processing industry

Here’s a quick overview of what these levels mean:

This is the essential ‘base’ level of any plant’s optimisation. It’s where data is captured through IoT devices that include flow meters, density gauges, weightometers and other instrumentation that actively monitor production variables. It also includes actuators such as valves, and pumps that keep variables within setpoints, such as flow, heat and pressure. In this model, there is constant communication between Level 1 and Level 0. The purpose of a control system (level 1) is to both monitor and dynamically, or manually, adjust process variables to the required level of the given control system implementation. For the purposes of production data flow (level 0) to management levels, only the production or performance data typically is sent to higher levels of the pyramid.

Devices in this level receive data from devices at the field level and use this data to control the production process. In the minerals processing segment, this is where you would find Supervisory Control and Data Acquisition (SCADA) and control systems. In the mining segment, there are several solution suites that interface with onboard vehicle systems and make this data available to higher-level dispatch and mine control software. In some instances, data can be recorded at a granular level, down to the millisecond.

For the processing segment, this level is where you would find production data historians and Laboratory Information Management Systems (LIMS). For the mining segment, mine control, operations, short-term planning, or haulage solutions may also be found here. These tend to report data on a slightly delayed or less granular level than the lower levels. They assist in planning and monitoring, often reporting at the intraday to five-day level.

This level monitors the entire production process, from raw material to finished goods. For the processing segment, this layer is where you will typically find a Manufacturing Execution System (MES). A MES is responsible for gathering, integrating, validating and centralising source data, as well as making the data available to employees through analytics and visualisation tools. A high quality MES will source data from right across the plant and from all levels of this automation pyramid. In the mining segment, medium- to long-term mine planning solutions would be found at this level. Common solutions such as health and safety may also be found here.

This is the ‘C-suite’ layer of the pyramid; the enterprise layer that gives the organisation’s decision-makers information extracted from all levels of the automation pyramid, and relating to all aspects of the plant’s or mine’s operation. This is where an Enterprise Resource Planning (ERP) solution would be found. These usually receive information from Level 3 and map it to financial aspects of the operation. Typically sales, marketing and perhaps supply chain solutions are introduced here, which may also have representation at lower levels of the pyramid, depending on complexity.

Where does the ‘digital twin’ fit in?

Over the last ten years, innovations in digitisation – part of Industry 4.0 – have led to some incredibly advanced solutions, or digital-twin-enabled MES, being developed for the planning level of the automated pyramid.

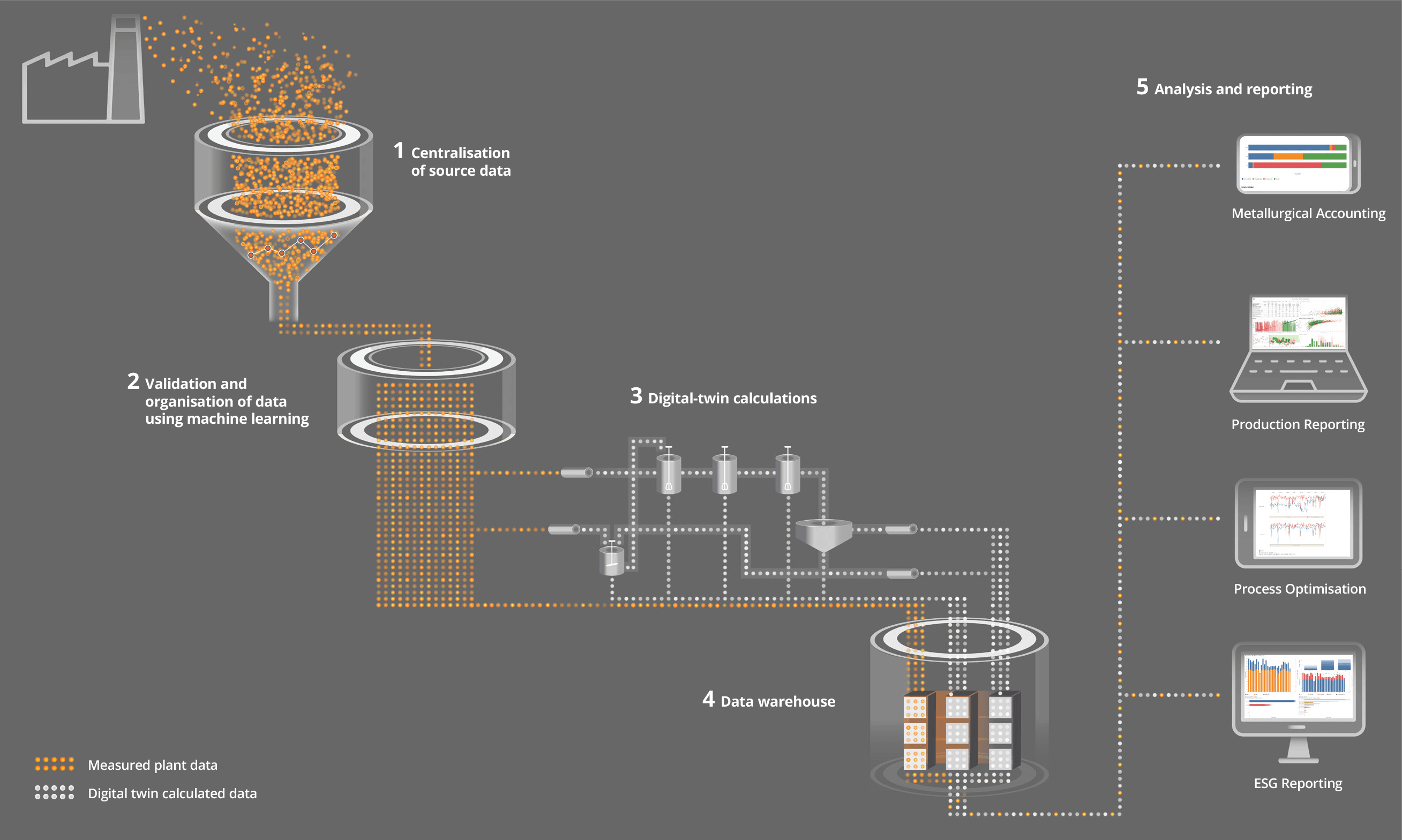

These fully automated digital-twin-enabled MES solutions are designed to take data from the field, control and supervisory level solutions and transform this raw data into contextualised information. The context is derived from using a detailed dynamic plant model, and incorporating appropriate chemistry based on an agreed flowsheet. Source-measured plant data is centralised, validated, organised, and subjected to data quality analysis, using intelligent new methods such as machine learning. Dynamic simulation technology is then used to process this data and perform a full plant-wide mass balance every hour. This provides a plant’s stakeholders with a level of granularity of processing information, including constant work-in-process inventories, directly traceable to plant data sources, that was never before possible.

By looking at the calculated ‘outcomes’ from the process digital twin, stakeholders can contextualise and cross-check their measured plant data and quickly determine where problems are occurring – or where opportunities for improvement lie. All of the data, such as the input data processed by the digital twin and output data calculated by the digital twin, are stored in a data warehouse. From this, user-friendly data visualisations and reports can be generated by authorised stakeholders. The digital-twin-enabled MES can in turn make its data available typically to a Level 4 solution, commonly an ERP solution, for overarching insights.

DIGITAL TWIN FOR MINING AND MINERALS PROCESSING

There are many different types of digital twins used across several different industries. Each twin is built differently and has different applications. For mining, there are two distinct types of digital-twin solutions that are used: asset digital twins and process digital twins.

Asset digital twins are used in the mining segment of the mining value chain. A digital twin is essentially a digital replica of the physical components of a mine, developed using CAD modelling. For example, this could include 3D models for mine planning such as pit designs, haul routes and mine layouts. This type of digital solution helps people visualise a facility from a remote location.

Process digital twins are far more sophisticated digital twins and are used at the processing segment of the mining value chain. A process digital twin is a digital replica of the actual processing of the ore body for a minerals processing plant – from raw material to finished product. This type of digital twin uses dynamic simulation, and considers a range of physical properties such as temperature and pressure. It’s also combined with the specific chemical equations and processes that occur at each step of the refining process.

Process digital twins form part of the core of a digital-twin-enabled MES at the planning level of the automation pyramid. The dynamic simulated model draws all the data from the automation layers beneath it. The outputs calculated by the dynamic model are connected directly to all the source data. It is this functionality that gives the model the ability to use machine learning to perform intelligent calculations for greater insight. The source data and calculated data from all of these layers is validated, organised, structured and pre-aggregated in the MES.

Some organisations may use a ‘bolt-on’ application or module with a traditional MES where data structures are not connected, and calculations are therefore limited – with no dynamic simulation of the process and no machine learning functionality.

How does it all fit together?

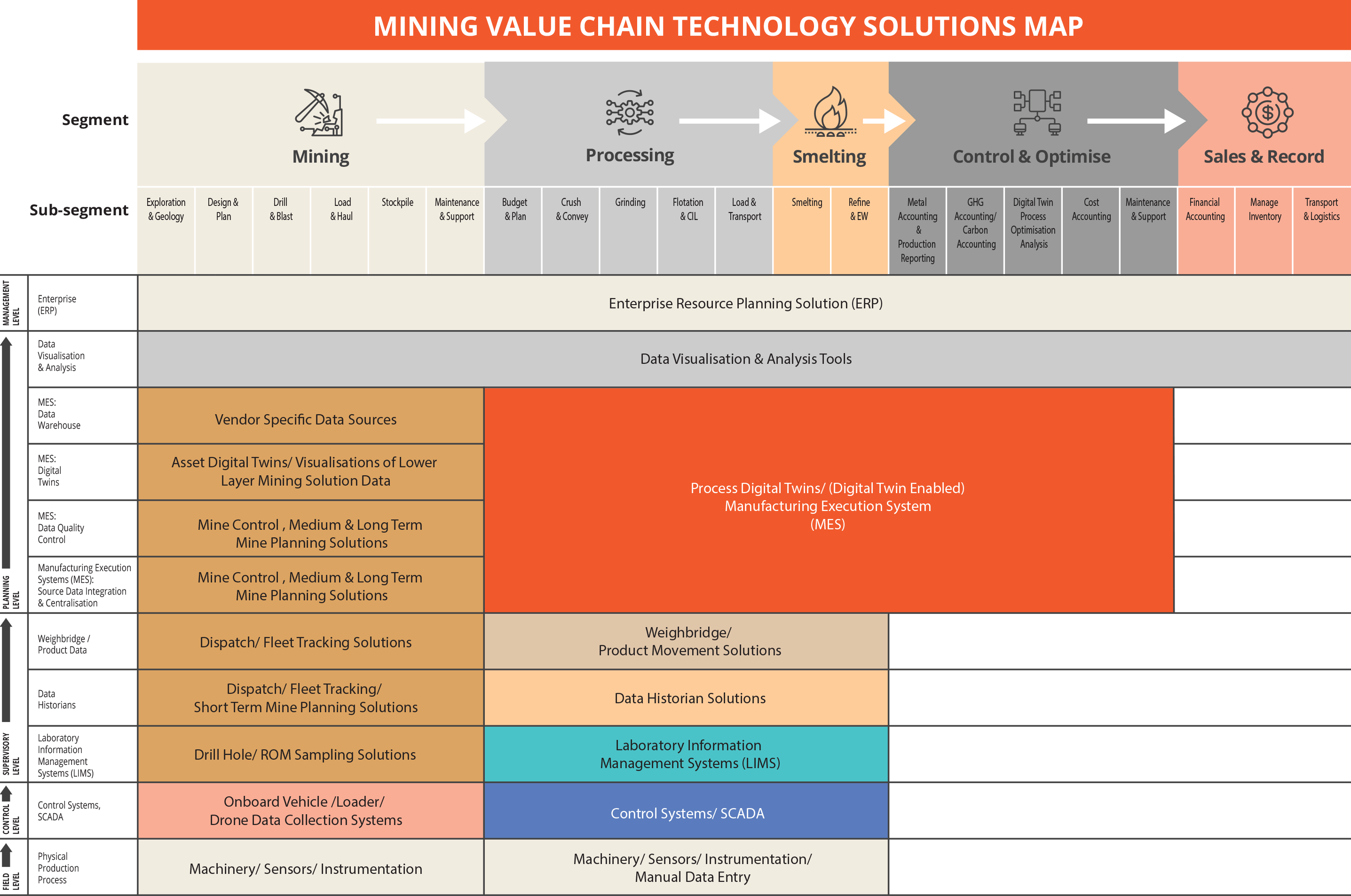

If we integrate the automation pyramid (figure 2) with the mining value chain (figure 1), we end up with a map that identifies the various solutions currently available in the market across each segment of the mining value chain, and within each layer of the automation pyramid.

Figure 3 shows the various segments of the mining value chain, and the automation pyramid layers of solutions that service these segments. This is a high-level consolidation of all the mining and minerals software solutions available in the market today.

The ‘mining’ segment of the mining value chain is well established, and there are several solutions available in the market – each addressing one or more sub-segments of the value chain, or the automation layers. These solutions allow organisations to capture source data, store data securely in a data warehouse, and integrate these data with management level solutions such as data visualisation, reporting tools and ERP systems.

However, once we move into the processing and smelting segments of the mining value chain, there are some glaring gaps.

This segment does have field, control and supervisory solutions that are well established, developed and readily adopted by the industry.

However, the ‘processing’, ‘smelting’ and ‘control and optimise’ mining value chain segments often do not have any planning solutions in place. Specifically, they typically lack a digital-twin-enabled MES. This is often poorly substituted with multipurpose software such as spreadsheets that are unable to perform detailed and complex mass and energy balances they are tasked to do, with limited data storage, minimal audit and transparency and manual and error-prone reporting. These spreadsheets are then provided to management to feed into the management level, ERP systems for decision making and external reporting.

Without a digital-twin-enabled MES, only partial digital transformation can be achieved. This also means the other sub-segments further down the mining value chain – metallurgical accounting, production reporting, process optimisation and inventory tracking – cannot be calculated accurately. Additionally, financial accounting, managing inventory and ESG reporting become impossible to report quickly, accurately and reliably.

For a complete transition to digital transformation across the entire mining value chain, it’s vital that processing plants implement digital solutions for all layers of the automation pyramid. This enables all segments to be calculated accurately and effectively.

Figure 3: The automation pyramid solutions map across the mining and minerals value chain

5 components of best-practice digital-twin-enabled MES for minerals processing plants

For the minerals processing segment of the mining value chain, even the smallest improvement in a processing technique, input or the measurement of an output can translate to huge efficiencies, revenue gains and improved sustainability.

There are typically five components of a sophisticated and purposebuilt digital solution for the minerals processing segment of the mining value chain:

#1 Centralisation of source data

Often, processing plants operate using data from disparate systems – with no ability to cross-reference or easily and accurately check information. Many plants are even still reliant upon data stored in spreadsheets, and manually entered by members of the team.

The first step in digitally transforming minerals processing is to centralise and digitise data from multiple sources across the plant. These data need to be fully traceable (so if an issue or anomaly is identified, it can be very easily determined) and offer a single, organised ‘source of truth’ for authorised stakeholders.

A key priority here needs to be interoperability: you need to ensure that you are extracting data from various existing systems across your plant and that data can be compared and considered. This could include instrument or laboratory data, as well as information from mining, maintenance, environmental or other departments. The digital solution for minerals processing should also incorporate budget, cost and forecast data, and other financial information, and be able to report directly to enterprise reporting systems.

#2 Validation and organisation of data using machine learning

Once you have centralised plant-wide source data, you can then set about validating and organising the data.

Ideally, your solution should use machine learning to support the analysis of huge volumes of data. There are usually three points at which this validation and organisation of data needs to occur to ensure the quality of the data.

- Extraction and load stage. Your solution should validate source data to determine if there are missing values or samples, and that the values are within an expected range.

- Pre-processing stage. Prior to conducting a mass balance, your solution should check measured data marked as ‘critical’ to spot any instability in the values. Data should also be constantly validated and crossed-checked across the mass balancing process to ensure the measured result aligns with the calculated result at that part of the process.

- Post-processing stage. Any calculated values should now be checked against the measured values, and any major deviation should be flagged for resolution or as an improvement opportunity.

#3 Digital-twin calculations

A process digital twin using dynamic simulation is increasingly essential in allowing mining and minerals professionals to cross-check results against a second comparative dataset that is generated from a dynamic plant mass balance.

It is important to note that the digital twin for minerals processing is not an Office spreadsheet nor a statistical data reconciliation algorithm. Neither of these methods account for the chemistry and process dynamics of the minerals process, nor do they use time as a dimension. They also cannot measure intermediate streams or inventory. These methods put boundaries across several nodes of the process; therefore, data is limited, many assumptions are made, and the probability for error is high. The mass balance process is very manual using these older techniques; because of this, it is done infrequently, usually once a month.

A process digital twin using dynamic simulation does use time as a dimension. It can measure inventory, track intermediate streams, and cross-check measured plant source data for superior process optimisation. There are no boundaries across nodes and no user assumptions made. Large volumes of calculated data and complete end-to-end automation mean a plant-wide mass balance can be performed hourly.

#4 Data warehouse

Once you have all of your measured and calculated data, you then need a place to store them. This is the fourth essential component of a quality digital solution for your plant: a high-performance, structured database that’s highly secure and stable, and that allows you to access large amounts of pre-aggregated and organised information.

#5 Analysis and reporting

Accurate and fast reports are critical for plant stakeholders. As well as providing configurable advanced data visualisation/analytics, the right tools will break down barriers and allow authorised personnel from across the organisation to have access to user-friendly and readily available data. A digital solution for minerals processing also automates the reporting function, leaving plant metallurgists to focus on more productive and skilled work for which they are trained. Automation allows them to make fast, timely decisions and to take prompt action where needed.

Focusing on digital transformation for the minerals processing segment of the mining value chain: the benefits

Adherence to compliance standards

Corporate governance is an extremely important consideration. A minerals processing plant can’t have sound corporate governance if there are shortcomings in its plant process information system.

A quality digital solution for a minerals processing plant should be Amira P754 compliant. It should adhere to all 10 principles of the code, ensuring data accuracy, transparency and best-practice corporate governance. Your digital solution should also allow you to create an audit trail, meet required stock exchange governance principles, and enable you to quantify, manage and minimise risk.

Sophisticated metallurgical accounting

The main objective of metallurgical accounting is to generate a material/ mass balance for your plant. This mass balance is then used to calculate and report process performance and production.

With a sophisticated digital solution in place, you should be able to:

- Calculate every stream

You need a complete, up-to-date process flow diagram. All site personnel should be able to rely on this as the most accurate representation of flows within the plant. As the plant operations are updated, so are the dynamic and steady state model flowsheets.

- Automate hourly mass balance measurements

The data from your instrumentation and laboratory data and other data sources should be imported automatically, and an hourly mass balance calculated. This should allow your metallurgists to analyse and assess the plant’s performance and to easily identify any instruments that may require calibration or sampling practices that may need to be improved. Also, all metallurgists should be able to understand how the mass balance of their plant is performed.

- Save time

Instead of chasing up data from disparate sources, metallurgists should have more time to analyse the accuracy and reliability of the data that is imported in their daily balance.

- Track inventory

In a sophisticated customised solution, every stream throughout your plant should be calculated at every hour using real plant data as inputs for the numerous calculations. These should include elemental composition of streams and intermediate inventories.

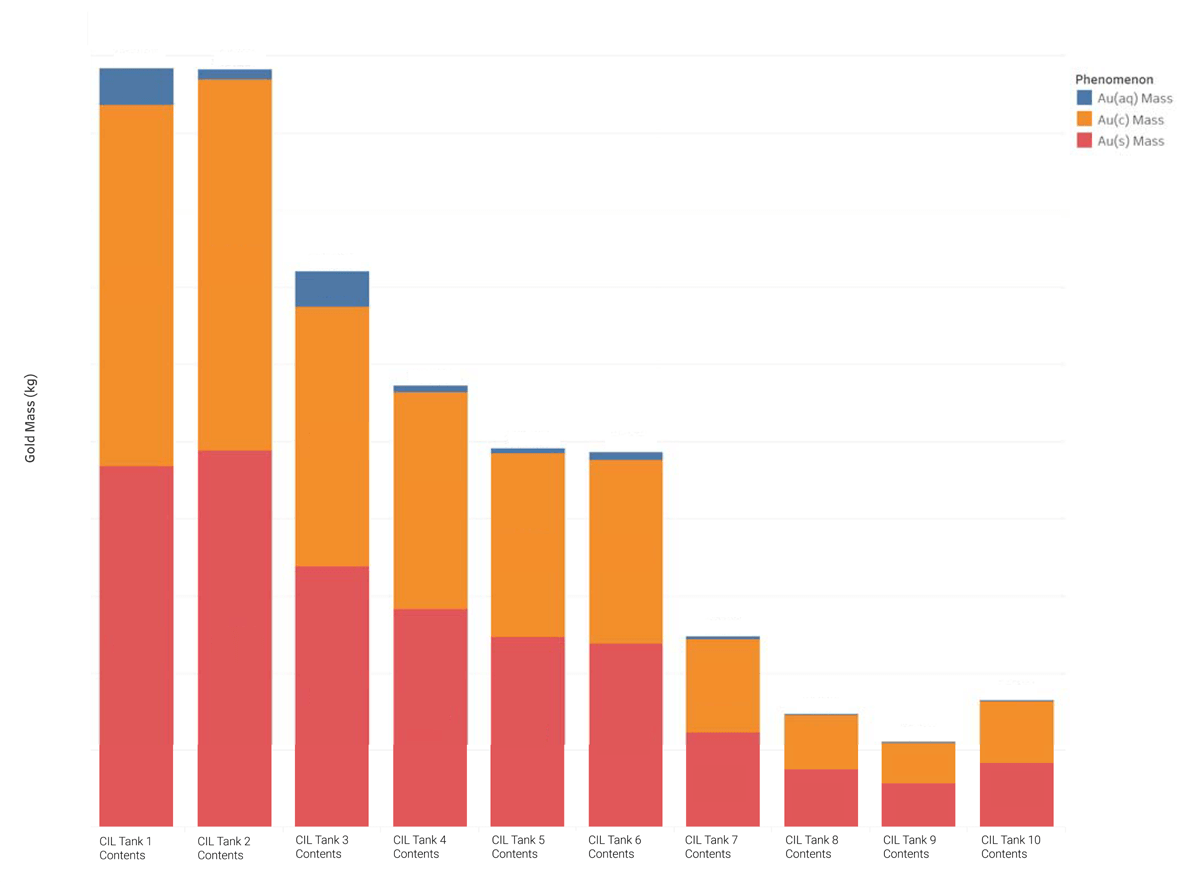

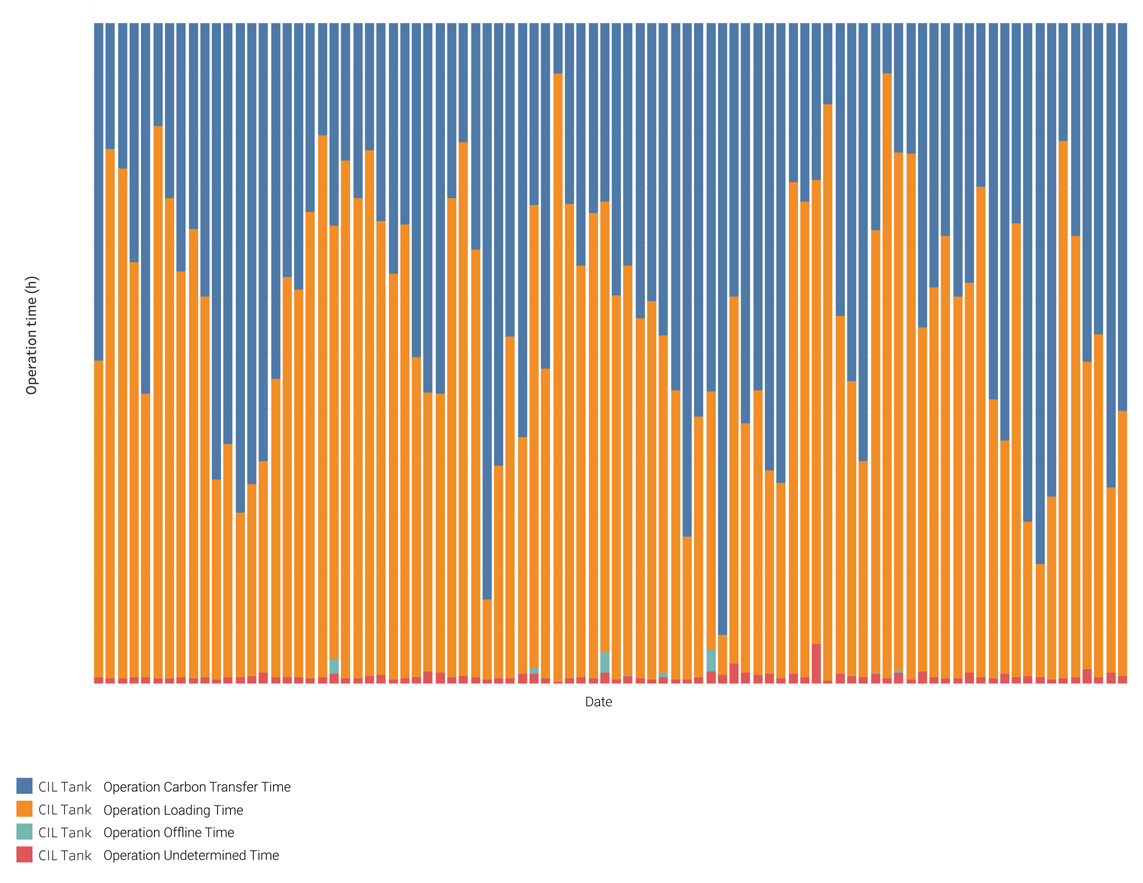

How a gold plant used a purpose-built digital solution to optimise its gold calculations

Carbon-in-leach (CIL) tanks are difficult to sample, therefore difficult to track due to multiple processes occurring at the tanks. These tanks are continually fed with slurry, and absorption of gold into the carbon occurs in the tanks. The carbon is loaded with gold throughout and transported counter-current to the slurry flow. Given long residence times, it is computationally difficult to calculate gold in different forms for each tank on a frequent basis. Knowing your work-in-progress gold is vital.

Since a minerals processing digital solution has been in place at this plant, the calculation of gold in the CIL tanks is automated, meaning the inventories can be tracked seamlessly. The digital twin performs a mass balance on the CIL tanks in the circuit every minute and incorporates the equipment operational states of the CIL tanks. This means operators can easily determine when loading/absorption and carbon transfer occurs. Up-to-date LIMS grade for the gold in the solids and carbon absorbed phase are also used in the model when performing the mass balance. Up-to-date analysis of the residue, carbon and solution are captured in mass balance so that the deportment of gold is well understood.

Gold mass in each tank in different phases

Different operating states/times for CIL tank

More reliable and accurate production reporting

Accurate production reporting is used to quantify the performance of processing plants, such as recovery and waste. It is also used to establish an accurate estimate of inventory. If there is a large discrepancy between actual and estimated inventory, there can be significant financial consequences. Poor estimation of recovery and losses can hide process issues and affect production planning.

A sophisticated and purpose-built solution will help a mine achieve zero-based budgeting – where forecasts and budgets require a revised mix of cost and revenue estimates rather than using historical results, plus or minus a few per cent. Estimated production and processing costs are therefore based on cost drivers that have been derived from the physical production activities and the physical characteristics of the waste and ore material to be processed at that stage of the life of the mine.

In 2017, a global mining organisation released the findings of a public investigation into their production accounting that found that copper cathode production in 2014 had been overstated by 6,650 tonnes. This was equivalent to overstating financial performance by US$41.9 million. It was also found that in-process inventories were overstated by US$122 million.

Accurately capturing the mass of concentrate produced is crucial when planning shipments and performing financial activities. Over-estimation of the concentrate stock can result in an over-estimation of the financial value of the concentrate within the plant.

Creating a net smelter return model for a copper concentrator

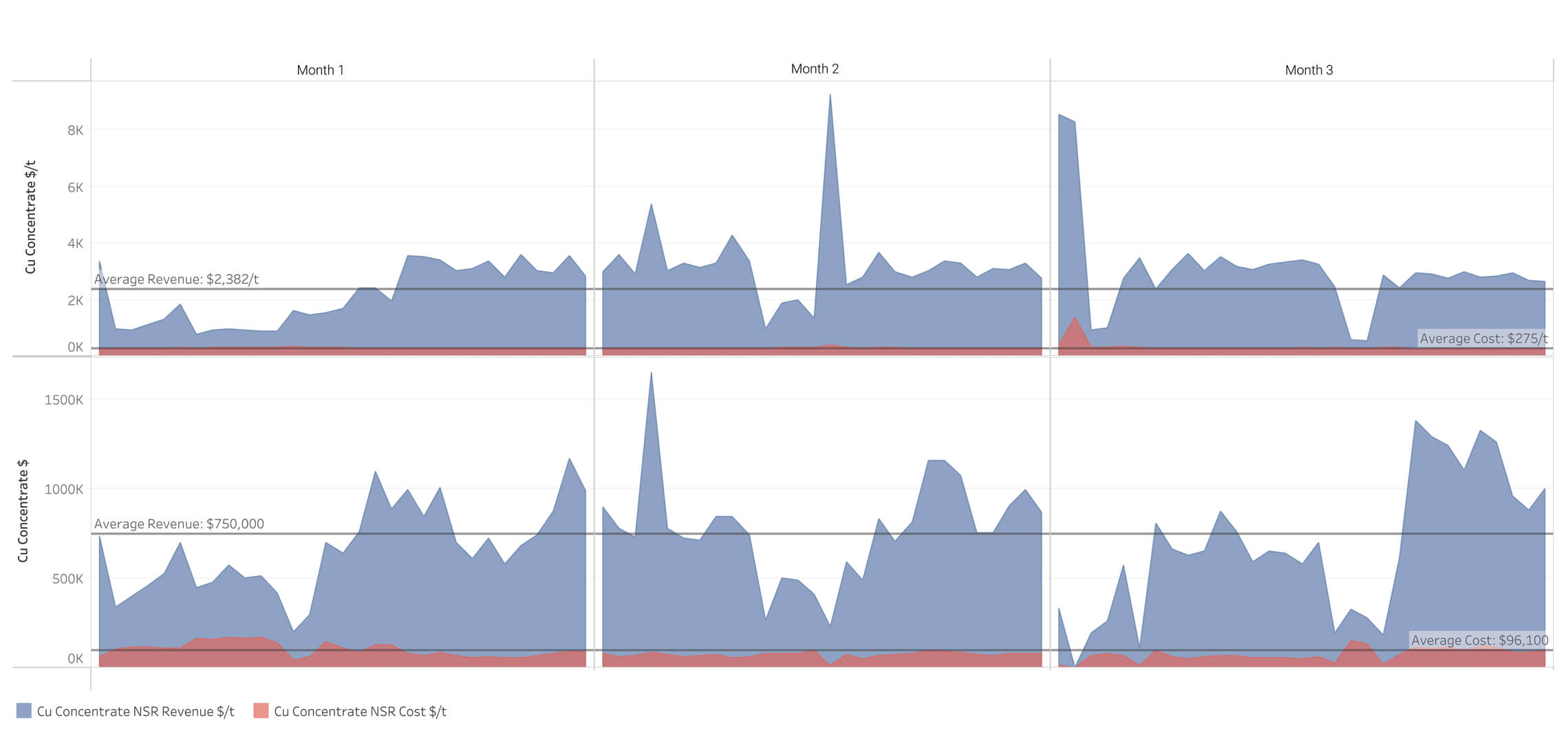

Here is an example of using accurate production reporting from a digital-twin minerals processing solution to develop a net smelter return model for this copper plant.

This model quantifies all associated revenues and costs related to the concentrate products. The model factors in the value of the primary metal in the concentrate, freight and treatment charges, smelting and refining charges, and even penalty charges related to secondary species reducing the recovery of primary species in the smelter.

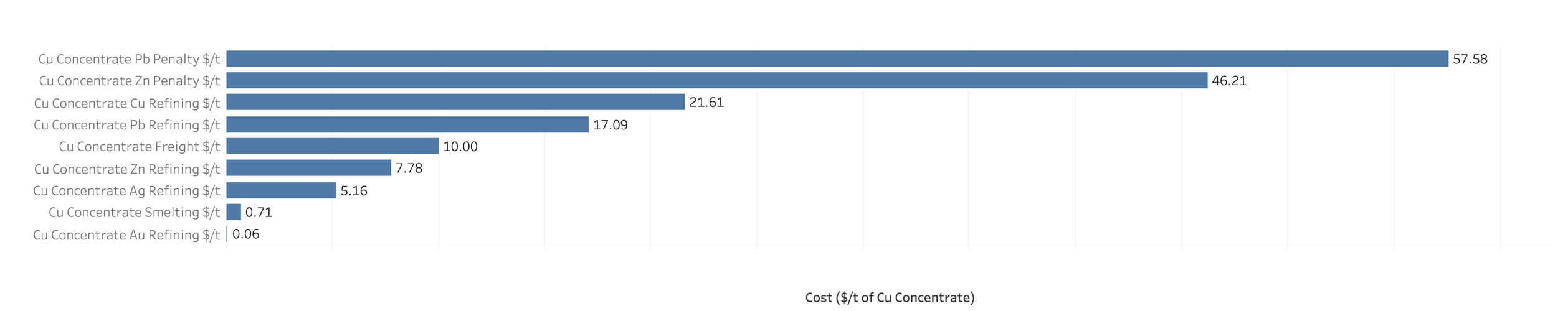

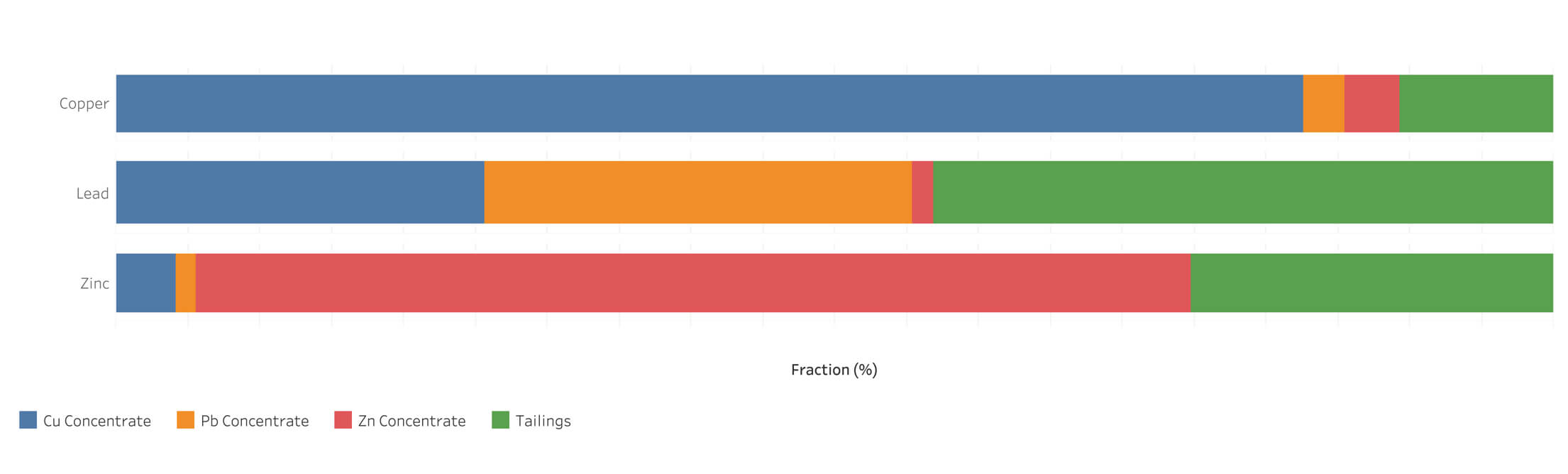

By using data from the digital twin, the site is now able to use a broad range of factors to quantify the value of concentrate. The images here extracted showcase the plant’s estimated copper concentrate revenue and cost value and provide an average breakdown of copper concentrate costs. It was found that a large amount of lead and zinc was reporting to the copper concentrate, resulting in significantly reduced copper recovery, as well as increasing the refining charges due to the lead/zinc not reporting to lead or zinc concentrate.

Concentrate Revenue & Costs

The image here showcases the elemental distribution to the different concentrate products or tailings. While copper was found to generally be recovered to copper concentrate (83% recovery), it was revealed that the majority of lead was being lost to tailings or reports to copper concentrate, as there is only a 30% recovery of lead-to-lead concentrate. In addition, zinc was recovered at 69%, with a sizeable fraction reporting to tailings. This equated to a loss of US$128 million per year. Enabling metallurgists with this information allows them to track progress and implement meaningful changes.

Cu Concentrate Costs ($/t)

Elemental Distribution

Process optimisation

The ability to optimise your plant’s processes is a fundamental benefit – and is also where your digital transformation project will quickly pay for itself, often before the implementation has even been completed.

Process optimisation opportunities using a minerals processing solution can be identified in several ways.

Looking at the alignment between measured and calculated data will allow your metallurgists to detect instruments or sampling practices that may need to be assessed. This means issues can be resolved before they escalate.

For instance, if a plant’s filter conveyor weightometer’s measured value is greater than the calculated value, this indicates either that the weightometer is over-reading or the flotation matrix is not producing enough of a particular concentrate due to inaccurate inputs. This prompts metallurgists to check the calibration of the weightometer to ensure it is reading correctly, and check the assays used in the flotation matrix to ensure these samples are representative.

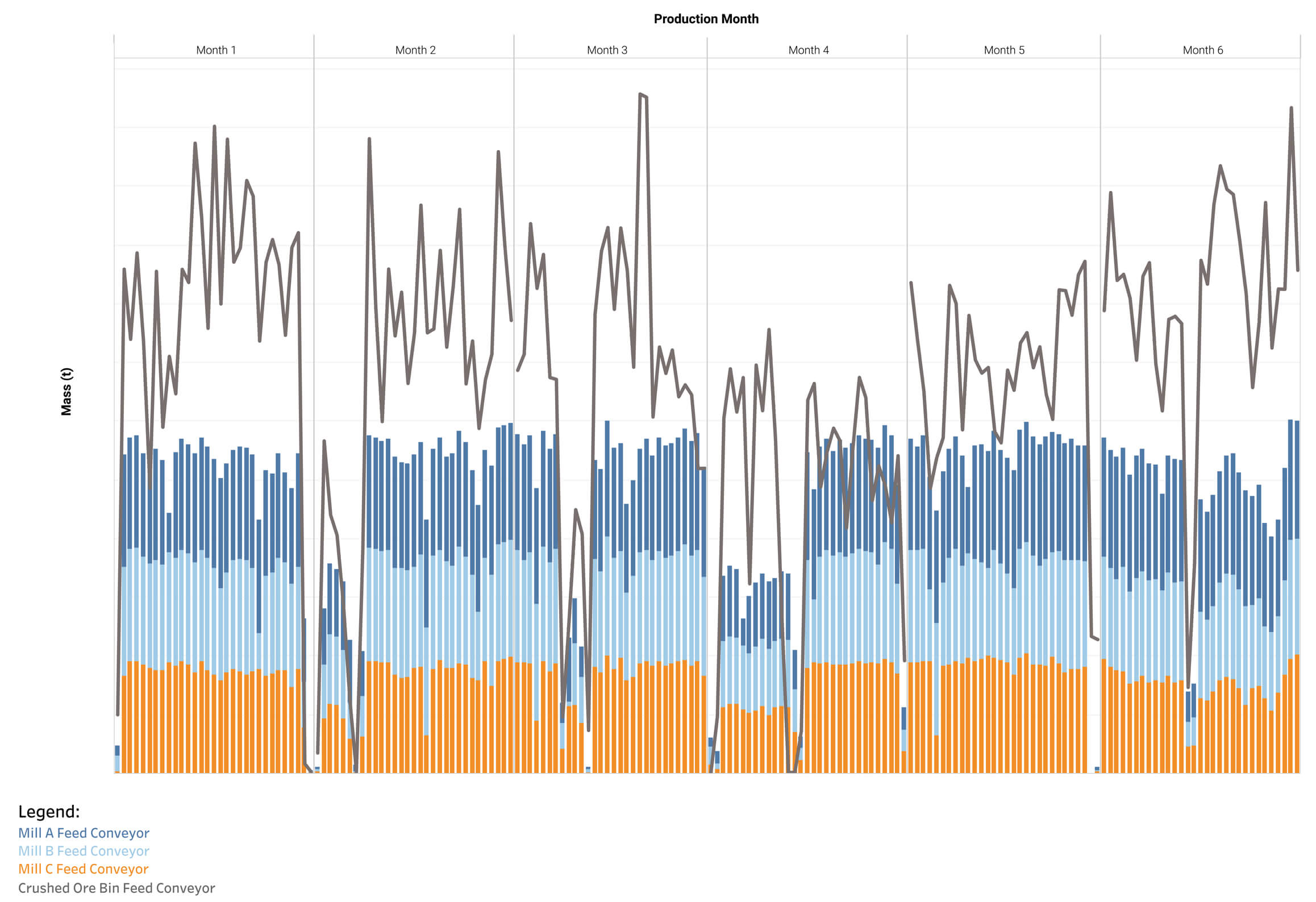

Comparison of weightometer readings on the crushed ore bin feed conveyor and the crushed ore bin discharge conveyors

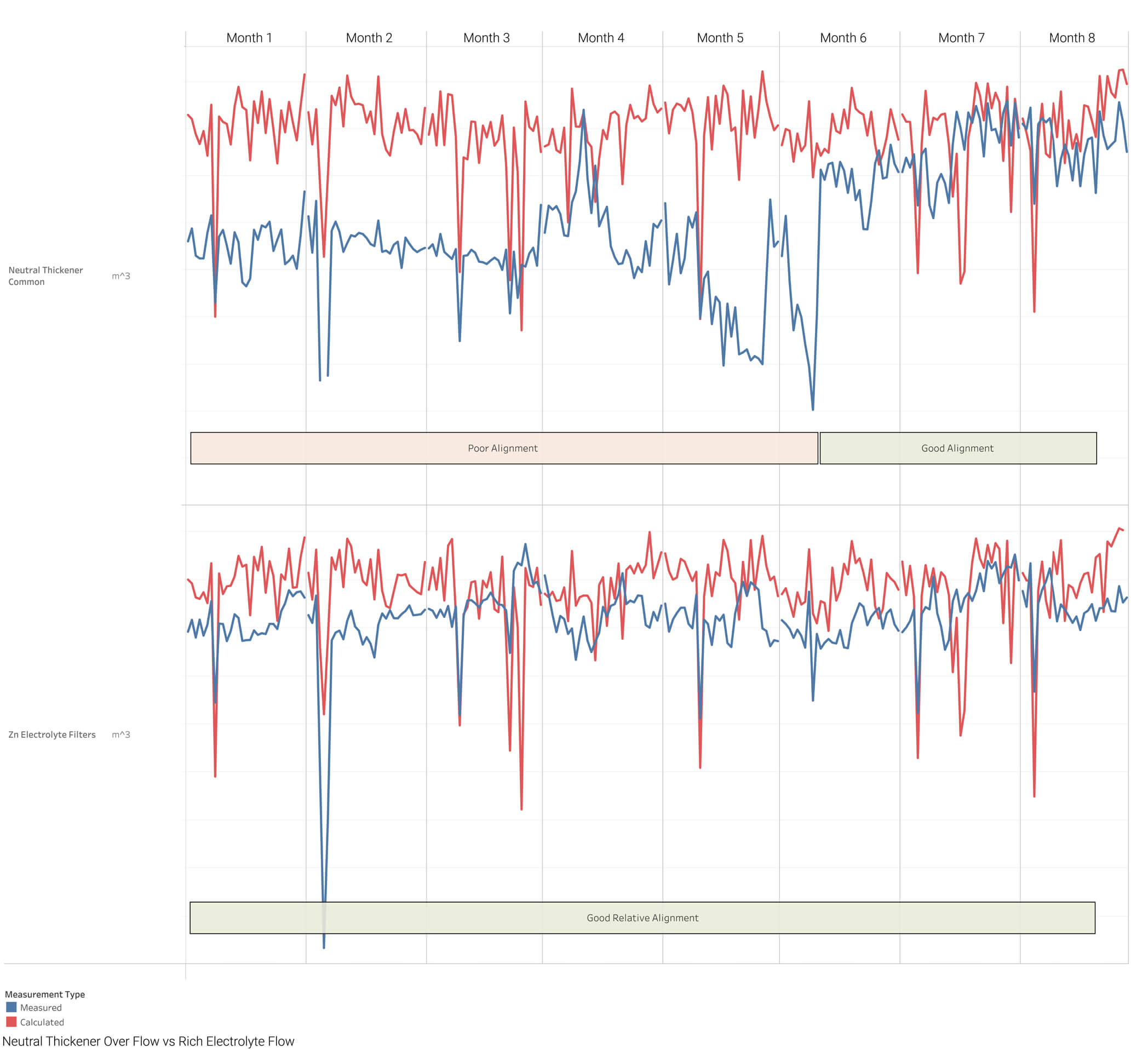

In the following example, the flows in and out of a plant area are expected to be roughly the same. In this example, the input streams are represented by the neutral thickener common (consisting of four volume flow instruments) and the output streams are represented by the Zn electrolyte filters (consisting of three instruments). The chart demonstrates that the alignment between the measured and calculated data is poor for the neutral thickener common stream, indicating that maintenance resources should be allocated to these instruments. After maintenance of the instruments, the measured data for the input and output streams align.

Correctly aligned measured and calculated data once issue have been resolved

- Concentrate solids recovery and production rates can be calculated proficiently.

- Measured feed rates and feed blend can be verified to optimise recovery.

- Intermediate streams and inventories can be tracked by performing mass balance every minute, down to the tank level – mass, volume and elemental composition.

- Waste (product to tailings) can be managed effectively, and reagent consumption monitored (dosage rates, consumption and cost of reagents and its relationship to recovery).

- Root cause analysis for mine-mill reconciliation process, and ability to determine batches of concentrate that may need to be re-sampled, or which may be below specifications and could be reprocessed, can be executed.

- Expensive plant shutdowns can be avoided by using modelling to determine optimum plant operating conditions.

- Recommended design modifications can maximise asset utilisation and reduce process bottlenecks or irregularities. Key maintenance activities can be conducted to reduce unplanned downtime.

- Capital allocation to equipment and instruments that will not improve asset utilisation, production rates or recovery can be avoided.

- Operators can identify process conditions that could be expected for different ore types and the best treatment strategy.

Reagent overdosing for a copper plant

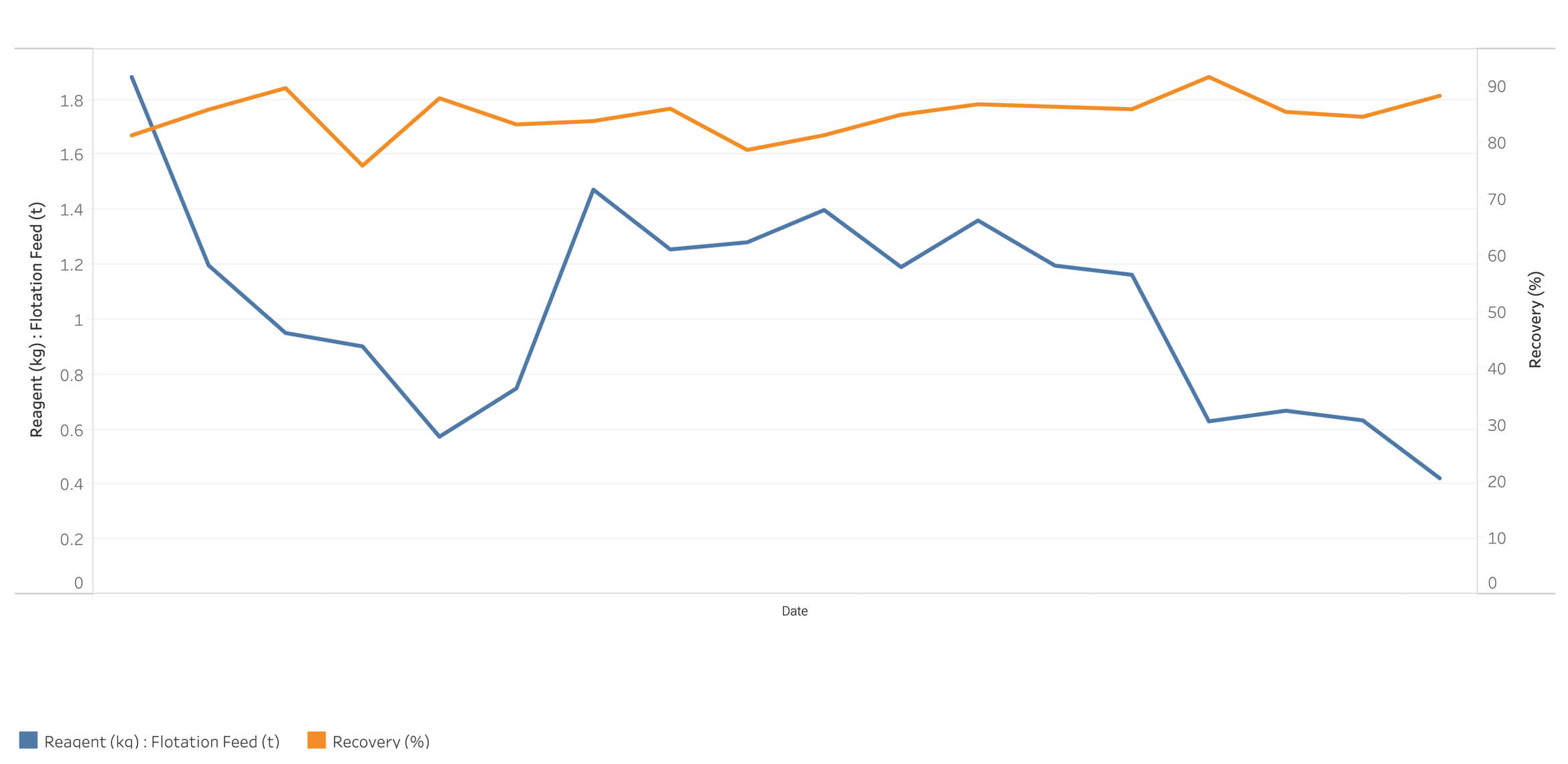

A digital solution for minerals processing is often used to develop standard reagent consumption reports. In the following example, these reports include dosage rates, consumption and cost of reagents used in the flotation circuit relative to the plant feed.

This analysis identified that the dosage rates utilised at the plant were almost double the ideal rate, with no improvement in recovery. Once this error was identified, engineers were able to adjust the operation, saving US$26m per year on one reagent alone.

Reagent Dosing & Recovery

ESG Compliance/ Sustainability reporting

Increasingly, companies in the sector are being called upon to improve their ESG capabilities – enhancing their environmental management, improving worker protection and health, and demonstrating greater care to the communities in which they operate.

Requirements are moving beyond being loose guidelines to compulsory obligations for individual jurisdictions, and in most countries, reporting on emissions is now mandatory.

Regulators, both internationally and in Australia, welcome the prospect of global standard settings relating to climate and sustainability disclosure. Listed entities are being encouraged to publish these disclosures, year on year, in their annual reports.

Meeting all of these diverse frameworks, standards and requirements is complex and time-consuming. Some require granular detail, and compliance requirements are also changing frequently.

A purpose-built mineral processing solution can help organisations with their ESG in four key areas: ensuring energy efficiency and yield improvement, reducing greenhouse gas emissions, and driving new, green processes.

A ROBUST SOLUTION SHOULD

- Provide the organisation with at- a- glance information about their emissions and water consumption, in accordance with reporting standards.

- Enable mining and minerals organisations to test future scenarios. This information can be tied back to financials so organisations can budget and forecast in accordance with ESG principles.

- Track direct process carbon emissions and plant electricity consumption on a daily and hourly basis. This includes consumption of fuels such as coal and diesel, as well as calculated emissions based on plant instrumentation and process chemistry.

- Identify poor performance and optimise performance – resulting in lower overall carbon emissions, and reduced operating costs.

- Be compatible with asset management requirements and for scenario analysis and predictive analytics for process operations.

References

1 International Mining, Axora survey reveals mining sector moves towards digital transformation, https://im-mining.com/2021/10/05/axora-survey-reveals-mining-sector-moves-towards-digital-transformation/

2 AFR 22 March 2022. Newcrest mines data in the cloud for a $100m virtual goldmine

3 BCG. Adopting a digital strategy in the metals and mining industry. https://www.bcg.com/en-au/publications/2021/adopting-a-digital-strategy-in-the-metals-and-mining-industry

4 BCG. Adopting a digital strategy in the metals and mining industry. https://www.bcg.com/en-au/publications/2021/adopting-a-digital-strategy-in-the-metals-and-mining-industry

5 ISA. ISA95. https://www.isa.org/standards-and-publications/isa-standards/isa-standards-committees/isa95

About the authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.