CBAM Reporting and Compliance

MI Core® is the world’s only proven shortcut to accurate sustainability reporting

The race is on for accurate sustainability reporting

As the world strives towards net zero emissions, energy-intensive industries like mining, minerals, energy and manufacturing are under immense pressure from stakeholders including customers, partners, staff and government to measure and reduce their impact on climate change.

Now, with the introduction of EU CBAM, organisations have a short runway to meet the looming compliance and reporting deadline set for October 2023, in advance of the full rollout in 2027.

Accurately measuring and reporting on carbon emissions is a critical issue for organisations globally. However, a BCG Carbon Management Survey1 of executives across nine major industries globally found that 91% fail to measure emissions comprehensively. So there is a lot of catching up to do, and fast!

For business leaders and CFOs, now is the time to prepare for CBAM to protect and grow your operations, financials and reputation.

Drawing on over 10 years of experience in process engineering, data-led software and sustainability reporting in the resources sector globally, we can help you understand how CBAM impacts your organisation and share digital tools to make sure you’re ready.

What is the EU's CBAM?

Legislated as part of the European Green Deal, the Carbon Border Adjustment Mechanism (CBAM) – also referred to as the carbon border tax – is a tariff applied to a range of carbon intensive products that are imported by the European Union (EU).

CBAM puts a price on carbon intensive products as they enter the EU. At this stage the categories impacted are likely to include iron and steel, cement, fertiliser, aluminium, electricity, chemicals, polymers and hydrogen.2

Whether your organisation manufactures in the EU or is a non-EU-based supplier to these organisations, CBAM compliance requirements will apply to in-scope products from October 2023. While the EU is leading the way, other regions such as Australia, Canada and the UK are weighing up similar policies.3

The overarching goal of CBAM is to create green supply chains and reduce carbon emissions in line with the accelerating global movement towards sustainability.

More in-depth sustainability reporting than ever

CBAM goes further than just reporting on an organisation’s direct emissions (Scope 1), requiring measurement and reporting on indirect electricity and other indirect emissions (Scopes 2 and 3).

With Scope 3 emissions accounting for most of the mining sector’s emissions – and a significant contributor to energy-intensive industries – organisations that have not yet begun to calculate their indirect emissions already have catching up to do.

Scope 1

Direct Emissions

- Emissions from sources owned or controlled by the company

- Emissions from chemical productions in owned or controlled process equipment

Scope 2

Electricity Indirect Emissions

- Emissions from the generation of purchased electricity consumed by the company

- Emissions that physically occur at the facility where electricity is generated

Scope 3

Other indirect emissions

- All other indirect emissions that are a consequence of the activities of the company, but occur from sources not owned or controlled by the company

What happens if you’re not ready?

“Those that struggle could face significant administrative burdens, higher costs, and supply chain disruptions as goods get stopped at the border. Companies that have a firm grip on the new system could gain a competitive advantage.”

CBAM risks and impacts for EU‑based producers

Direct penalties

- Sanctions and fines for inaccurate or non-reporting are likely.

Reputation damage

- If you don’t have accurate data, default data from the worst 5% will be applied.

Blocked from importing

- Risk of losing third-party verification needed for CBAM certificates.

Loss of CBAM licence

- Potential loss of CBAM declarant’s licence – which is needed to import in scope goods.

CBAM risks and impacts for non‑EU‑based suppliers

Loss of clients

- EU importers may switch to supplier with supply chain carbon transparency.

Uncompetitive pricing

- Higher emissions will lead to higher carbon taxes and higher prices for importers.

Why CFOs should lead the new era of sustainability reporting

Evolving frameworks across global governing bodies are rapidly elevating sustainability reporting to the same level as financial statements in terms of accountability, scrutiny and priority – making it a CFO-level responsibility.

Built using a similar approach to accounting standards, the proposed new disclosure standards driven by the International Sustainability Standards Board (ISSB) will merge existing and developing frameworks with input from over 20 governing bodies and partner organisations. The ISSB is expected to issue final standards early in 2023.

How to prepare for CBAM compliance

EU producers and non-EU suppliers will need to prepare data capture and reporting capabilities to meet the quarterly CBAM reporting requirements that begin from October 2023.

Steps to CBAM readiness for EU producers

- Allocate responsibilities

Identify which individuals and departments will be responsible for CBAM. - Assess the impact

Identify which products are covered and embedded emissions. - Collate emissions data

Determine what data you have internally and what you’ll need from suppliers - Identify data gaps

Consider what you are missing across direct and indirect emissions. - Review existing technology

Investigate what digital tools you’ll need to collect and synchronise data. - Create a CBAM action plan

Set up the data and systems to deliver auditable quarterly CBAM reports.

Steps to CBAM readiness for non-EU suppliers

- Gather data across Scopes 1, 2 and 3

Identifying how to measure products and suppliers impacted by Scopes 1, 2 and 3. - Review existing technology

Investigate what digital tools you’ll need to collect and synchronise data. - Gain independent verification

Source a verifier who can visit your operation to verify your CBAM compliance. - Communicate with EU clients

Let existing clients know you have the data they need to streamline CBAM compliance. - Find new opportunities

Promote your business as a verified CBAM-ready supplier. - Be a low-carbon supplier

As the world goes green, low carbon options will attract new buyers.

For mining CBAM is a major risk AND opportunity

Risk of falling behind

Without data-led sustainability accounting and reporting tools in place, mining organisations of all sizes will struggle to maintain their licence to operate, meet regulatory and compliance requirements, control costs, maintain their brand reputation, and attract the next generation of environmentally conscious employees. Increasingly, access to funding can also be contingent on a strong ESG rating.

Opportunity to lead the way

On the other hand, the ability to effectively track, optimise and report on tangible reductions in greenhouse gas emissions, power consumptions and water usage will give leading players a significant competitive advantage as the markets increasingly favour sustainable operations.

CBAM challenges for the mining and resources sector

Disparate data

Unconsolidated, historical and incomplete data across sites, equipment, processes and suppliers prevents comprehensive reporting.Not CBAM-ready

Insufficient historical data, simulated data and synthetic data to accurately calculate how CBAM will impact their portfolio, suppliers and financials in 2023 and beyond.Missing data granularity

CBAM demands data on raw materials, country of origin and indirect supplier emissions (Scope 3) which is beyond many mines today.

Siloed operations

Producing auditable reports requires integration across multiple internal departments and external suppliers – a huge challenge with disconnected data silos so common across the sector.

Manual spreadsheets

Manual reporting based on assumptions is slow, error-prone and inadequate to deliver the independently auditable reports required for CBAM compliance.

Inaccurate mass balances

Without integrated data connected to a dynamic simulation that is customised to the chemistry and process dynamics of a plant, tracking inventory (and therefore the associated emissions, water and energy consumption) from start to finish is impossible.

Take the world’s only proven shortcut to CBAM compliance

Introducing Metallurgical Intelligence® (MI), a sophisticated technology platform that captures, centralises, validates and organises huge amounts of disparate data into a digital twin of your processing operations.

MI’s core functionality powers metallurgical accounting, process optimisation and production reporting. On top of this, it has in-built world-leading capabilities around auditable reporting for direct and indirect GHG emissions, energy and water consumption – ideally suited to CBAM compliance.

Having been proven over a decade in mining and minerals – and readily customisable across diverse industries – MI is the world’s only established sustainability reporting solution to quickly and accurately calculate, validate and report according to the new EU CBAM requirements.

Already implemented in plants across 8 countries globally – and translated into English, Spanish, French and Russian – MI is an enterprise-wide data software platform that captures, centralises, consolidates and validates huge amounts of data from multiple sources, across the end-to-end mining value chain into a digital twin replica of a plant’s processing operations.

It provides unique and unprecedented transparency with the ability to forecast and deliver near real-time auditable reports for emissions and energy use across Scope 1, 2, and 3 levels critical for CBAM. It also covers the increasingly important area of water consumption to keep you a step ahead of critical sustainability measures and fast-changing policies. Custom reports are automated to simplify complexity and significantly reduce time to comply with diverse frameworks, standards and requirements including CBAM, International Sustainability Standards Board (ISSB), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), European Sustainability Reporting Standards (ESRSs) and International Accounting Standards Board (IASB).

Fully automated and seamless integration with your existing systems, MI empowers mining leaders to draw on historical, near real-time live data, synthetic and simulated data to understand how CBAM impacts portfolios, operations, emissions targets and financials at any given time.

Proven in mining, customisable across industries

CBAM-ready

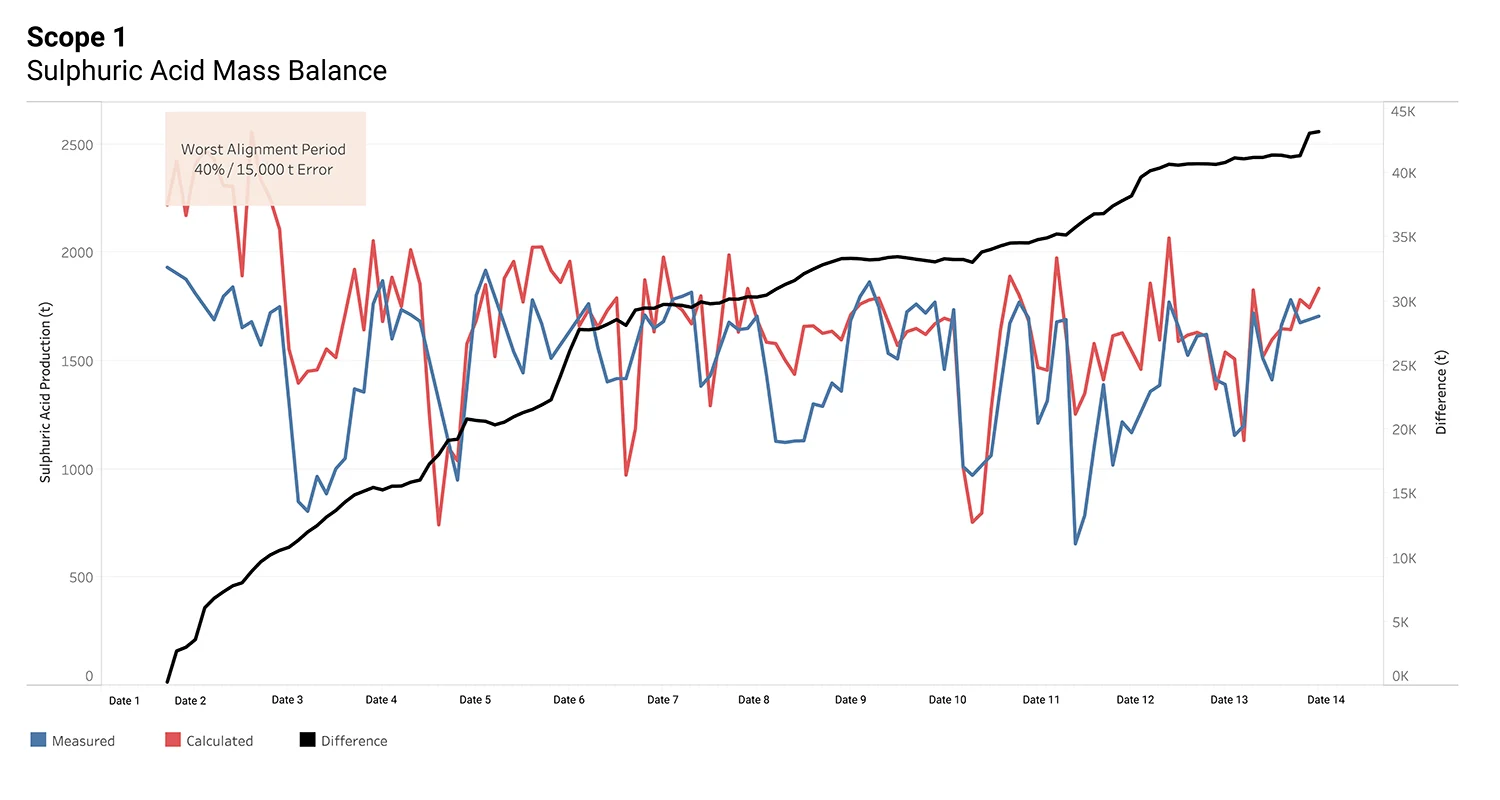

Equipped to manage CBAM’s complex reporting and compliance policies, providing granular reports on GHG emissions, energy and water consumption. For example, this case study details see how we identified US $21m per year in lost acid production through data-driven sustainability reporting.

CBAM Scopes 1, 2 and 3

Reports on direct and indirect greenhouse gas emissions and plant energy consumption on an hourly and daily basis (automated) in near real time.

Third party data

MI can capture and report on data directly related to the industrial asset it has been implemented in, including transportation emissions and emissions on third party reagents and chemicals used as part of the production process.

CBAM verification

Metallurgical Systems is able to assist with CBAM verification and compliance by providing a complete auditable dynamic mass and energy balance of the industrial process at every step of production.

Compliant with global standards

MI is compliant with dominant global frameworks including SASB, GRI and local stock exchange guidelines. It gives you the freedom to generate custom reports on GHG emissions, air quality, energy management, water management, waste and hazardous materials management, tailing storage facilities management, Product Carbon Footprint or Life Cycle Assessment (LCA) metrics can be queried – so you have the power at your fingertips to meet the demands of evolving guidelines.

Global flexibility

Easily adapts to diverse regulations and governance frameworks and requirements across different sites and countries as well as captures changes in emissions caused by any variations in the production process across the supply chain.

Proactive optimisation

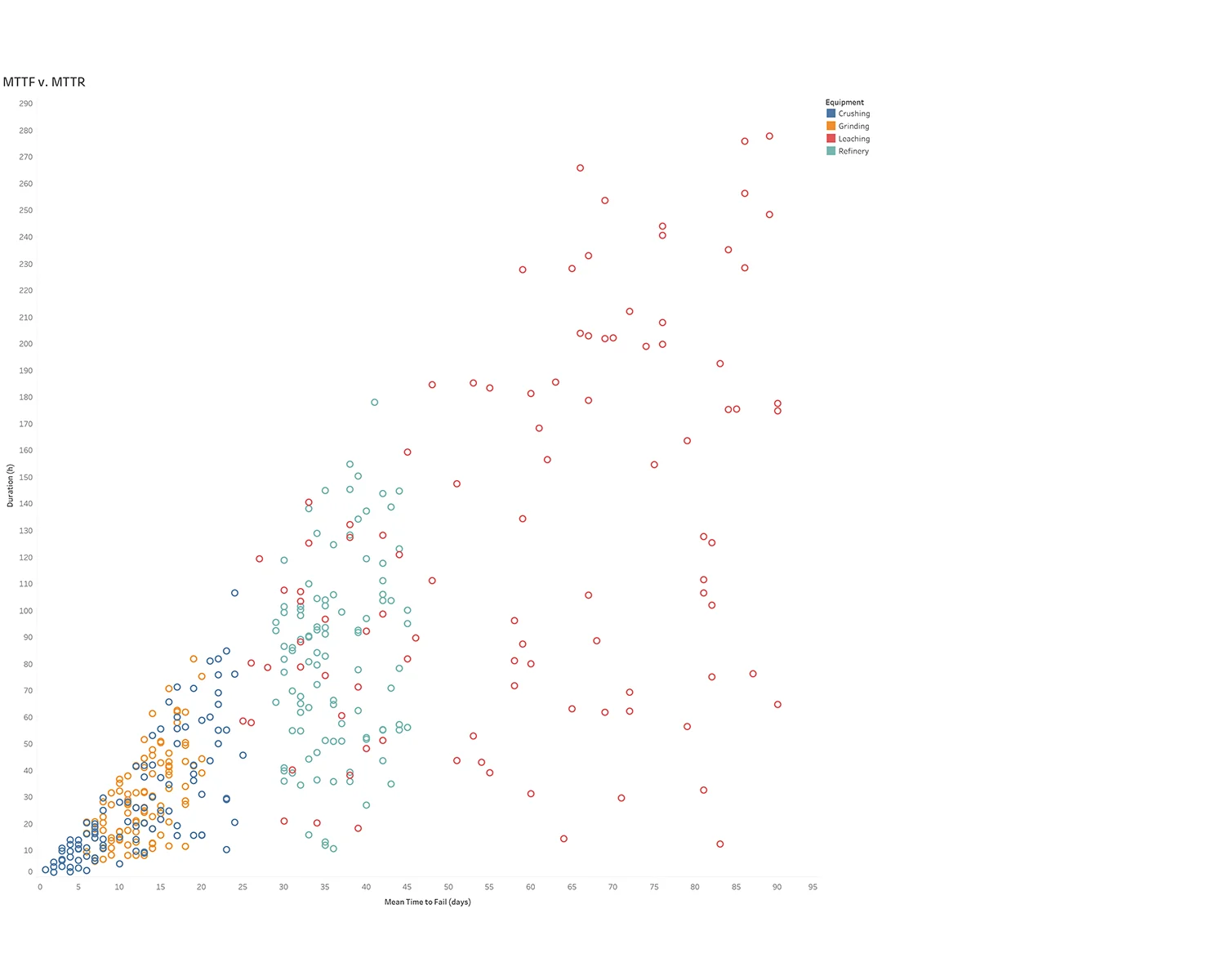

Functionality to test future scenarios and tie information back to financials to set budgets and forecasts in line with CBAM requirements. Helps identify trouble spots and poor performance enabling informed and proactive optimisation.

Accurate plant-wide mass balance

MI is unique in that it generates a plant-wide mass and energy balance derived directly from automated integration to source data. Applying Industry 4.0 technology such as big data, machine learning, dynamic simulation, multi-dimensional databases and advanced analytics and visualisation tools, it delivers granular hourly reporting at every step in the process. Many plants assume input = output. With MI, input = output + accumulation, with inventory traced as a function of time. This is the secret to true transparency and accuracy.

To discuss how we can help your organisation take control of your CBAM readiness and sustainability goals, please contact our experienced team of engineers, metallurgists and technology professionals on +61 2 7229 5646 or info@metallurgicalsystems.com