Not only is mandatory sustainability reporting looming for the Australian mining and resources sector, but regulators are also increasingly embracing digital taxonomies.

Our regular newsletter aims to help you take control of your metallurgical accounting, process optimisation and sustainability reporting by embracing data.

In this edition we cover new GRI mining standards, the IFRS taxonomy release and Australia’s progress towards mandatory climate reporting. If you have questions or need more information, please get in touch.

IN THIS EDITION

- Implementation guide launched for GRI mining standard

- Digital tools essential to streamline GRI reporting

- IFRS Sustainability Disclosure Taxonomy published

- Mandatory climate reporting a step closer

- Sustainability reporting for minerals and mining

- MI Sustainability Explained

- CSRD in the Spotlight: Your questions answered

- We can help you tackle the data challenge

NEWS

Implementation guide launched for GRI mining standard

The Global Reporting Initiative (GRI) has launched the implementation guide for its new GRI 14: Mining Sector 2024 standard, outlining the common set of sustainability metrics mining organisations need to report on. The new standard comes into effect for reporting on 1 January 2026, with early adoption encouraged.

To help organisations report in accordance with GRI standards and communicate their impacts, the implementation guide for report preparers is available for download and includes guidance and examples for determining material topics and reporting disclosures.

Digital tools essential to streamline GRI reporting

After seeking input on its planned digital reporting taxonomy from specialists in XBRL – a global standard for exchanging business data – GRI has stressed the critical importance of digital tools to report sustainability metrics in a structured format that can be easily shared, compared and analysed.

“Digital tools are increasingly important in addressing an organisation’s need to disclose detailed information on their sustainability impacts. A fully digital taxonomy enables computer-readable report formats that allow switching among various reporting frameworks and regulatory requirements, [and makes] sustainability data more accessible, and facilitates faster and lower cost reporting practices.”

With GRI and many global frameworks increasingly embracing digital taxonomies, spreadsheets and manual data processes will no longer satisfy compliance requirements and market expectations.

IFRS Sustainability Disclosure Taxonomy published

The International Financial Reporting Standards (IFRS) is a set of global accounting standards for financial reporting. In April 2024 the International Sustainability Standards Board (ISSB) issued the IFRS Sustainability Disclosure Taxonomy to reflect sustainability-related financial information (IFRS S1) and climate-related disclosures (IFRS S2).

The IFRS taxonomy enables machine-readable tagging of sustainability information, such as risks and opportunities, in financial reports. This facilitates streamlined data extraction, comparison and analysis by investors and stakeholders. It is designed to benefit stakeholders including:

- Industrial operations, that can implement digital reporting efficiently and cost-effectively

- Report users, who can access and analyse sustainability data more easily

- Regulators, who require digital reporting for compliance

The final XBRL files and supporting materials are available here: IFRS Sustainability Disclosure Taxonomy 2024. If you need technical or advice on your next steps, contact our team.

Mandatory climate reporting a step closer

While still yet to be finalised by Treasury and by the Australian Accounting Standards Board (AASB), the coming mandatory climate-related reporting is a step closer.

AASB released the Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information which closed for comment on 1 March 2024. The AASB is currently reviewing feedback and has published its current board papers.

Meanwhile, proposed legislation to amend the Australian Securities and Investment Commission (ASIC) Act 2001 and Corporations Act 2001 closed for consultation on 9 February 2024. The Treasury Laws Amendment Bill 2024 was introduced to the House of Representatives on 27 March 2024, and passed on 6 June 2024. If the Bill passes the Senate (Second reading moved on 24 June 2024), mandatory reporting will begin for financial years starting on or after 1 January 2025.

ASIC will oversee the climate reporting regime once it’s enacted. In a recent speech, ASIC Chair Joe Longo urged organisations to prepare for mandatory reporting immediately:

“And this is a crucial point: you have to do this now. It’s simply not an option to put this off until after legislation has passed, and then scramble to comply. You have to figure out how you’re going to marshal data, support and capabilities and start keeping the necessary records now – today.”

SOLVING PROBLEMS

Sustainability reporting for minerals and mining

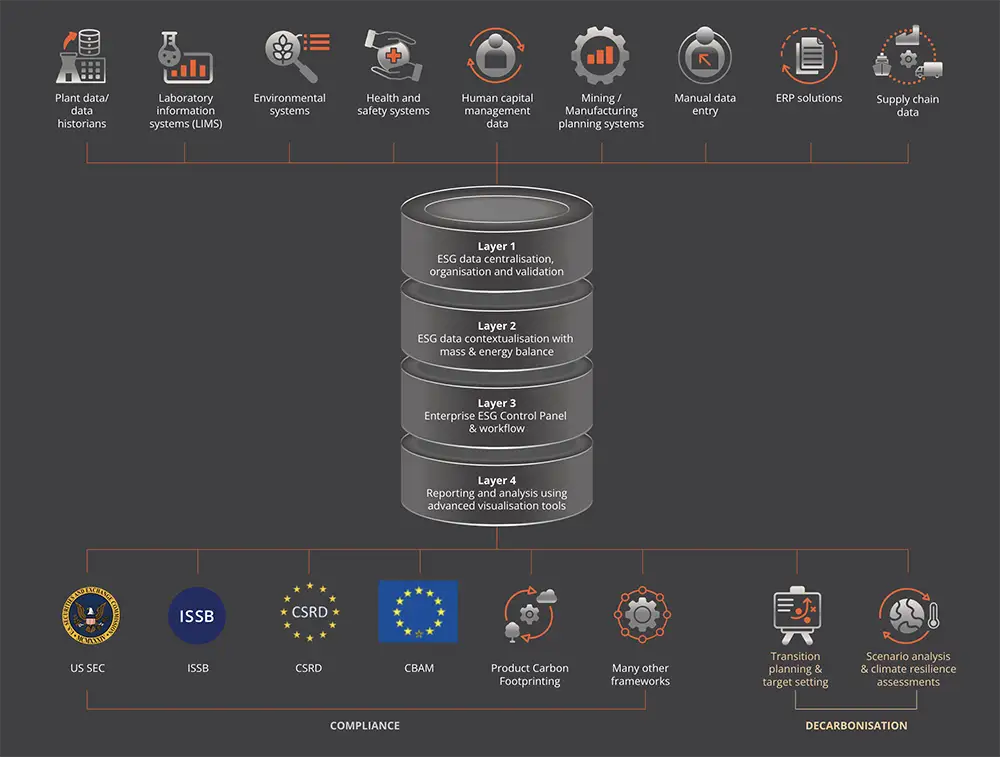

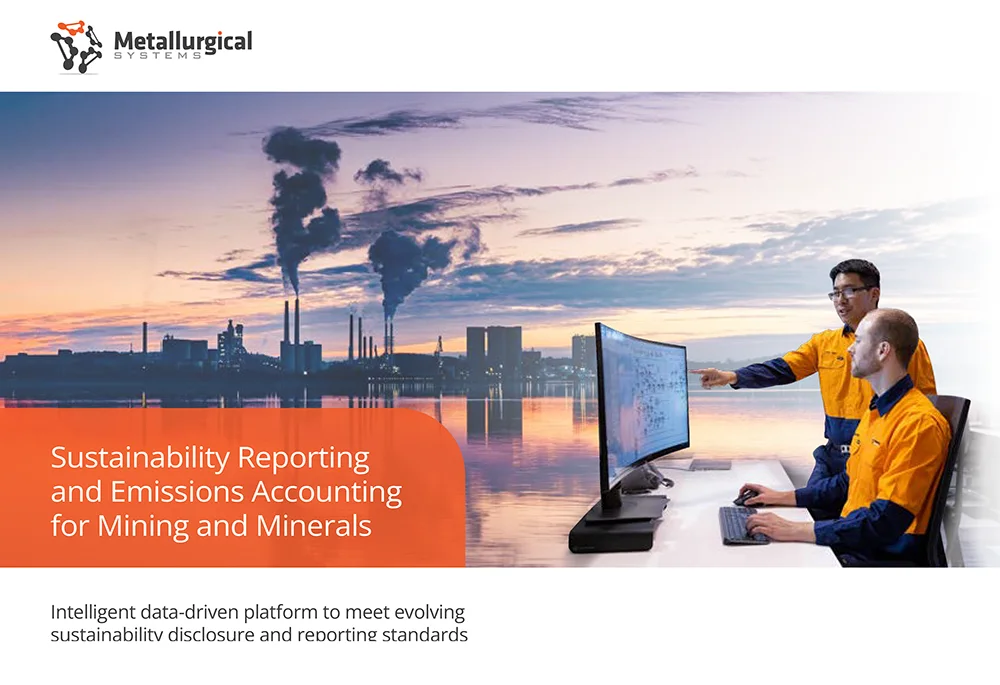

The world’s only sustainability analytics and reporting solution designed for minerals and mining, MI Sustainability enables you to produce accurate data-driven sustainability reports to satisfy evolving global legislative frameworks and set and achieve decarbonisation targets.

RESOURCE

MI Sustainability Explained

As the world strives towards net zero, energy intensive industries face increasing pressure to accurately measure, report on and reduce their impact – fast. Until now, the question has been ‘How?’ This brochure provides your roadmap with a comprehensive introduction to MI Sustainability.

CSRD IN THE SPOTLIGHT

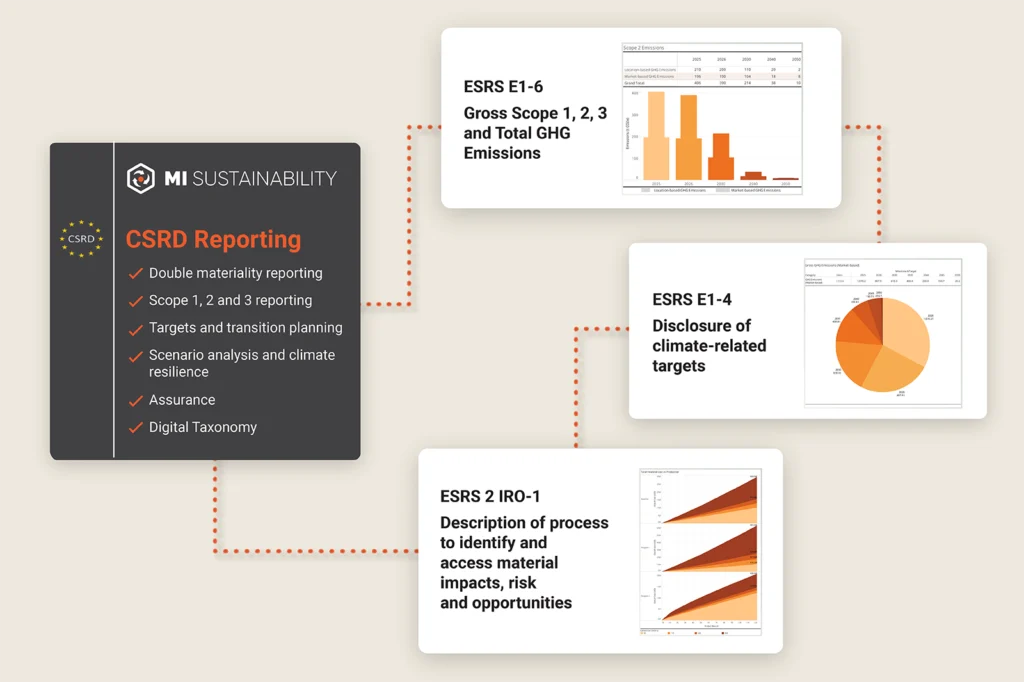

Your questions answered

What is the Corporate Sustainability Reporting Directive (CSRD)? How does it impact mining and resources? When does it apply? Who to? How can technology help meet your reporting and compliance obligations? We’re here to help with the answers and solutions to make sure you’re ready.