ISSB Reporting Software

Data-driven solutions to meet your ISSB reporting obligations

How to use data-driven digital tools to meet ISSB reporting obligations

The International Sustainability Standards Board (ISSB) provides a consistent framework for reporting sustainability metrics globally. It focuses on meeting information needs of investors, enables companies to disclose comprehensive sustainability information to global capital markets, and facilitates interoperability with other voluntary and mandated standards, such as the CSRD and US SEC.

As a wide-reaching global standard that is fast becoming a new norm for sustainability reporting, it directly impacts energy-intensive sectors like mining and resources today, and as it evolves.

Drawing on a decade of data-led process engineering and ESG reporting in the sector, this page breaks down the likely impact of the ISSB on resources operations, outlines the reporting requirements and outlines the latest digital tools available to help them prepare.

What is the International Sustainability Standards Board (ISSB)?

The ISSB was established as part of the International Financial Reporting Standards (IFRS) Foundation in 2021 and builds on, consolidates and manages the work of market-led investor-focused reporting initiatives, including the:

- Climate Disclosure Standards Board (CDSB), the

- Task Force for Climate-related Financial Disclosures (TCFD), the

- Value Reporting Foundation’s Integrated Reporting Framework and industry-based Sustainability Accounting Standards Board (SASB) Standards.

On 26 June 2023, the ISSB issued two international standards for investor-focused sustainability reporting: IFRS S1 covers General Requirements for the Disclosure of Sustainability-related Financial Information, and IFRS S2 covers Climate-related Disclosures. The standards intend to create a global baseline for sustainability-related financial disclosures.

Both standards are based on the four pillars used in the TCFD framework: governance, strategy, risk management, and sustainability-related metrics and targets. The standards refer to these four pillars as the ‘core content’.

As outlined by the IFRS, the two standards are designed to disclose information to capital markets and securities regulators about all material sustainability-related and climate-related risks and opportunities that could reasonably affect an entity’s cash flow, access to finance and cost of capital.

IFRS S1 is the General Standard, and IFRS S2 is the Climate Standard. In the future, more standards covering other topics are expected.

The ISSB standards have a single materiality focus, which means they focus only on the organisation’s financial impact. Standards like the CSRD, which have double materiality, focus on the financial impact as well as the external social and environmental impact.

The ISSB standards require reporting on sustainability-related financial disclosures. Impacts and dependencies are reportable only if they provide insights into a sustainability-related risk or opportunity that could reasonably affect a company’s prospects.

The ISSB standards became effective on 1 January 2024, and it is up to individual jurisdictions to adopt and mandate them.

Interoperability of ISSB, other mandated standards and financial disclosures

The ISSB and the European Commission services, together with EFRAG, have worked together during the development of the European Sustainability Reporting Standards (ESRS) and the IFRS Sustainability Disclosure Standards (ISSB Standards) to achieve a high degree of alignment of the respective standards, with a specific focus on climate‑related reporting.

The ISSB has worked to achieve interoperability with other mandated standards, such as the CSRD and the US SEC requirements. This means organisations can report sustainability-related information using multiple frameworks without duplicating their efforts. Many resources are available to help organisations navigate this process.

ISSB and sustainability-related financial disclosures

Sustainability-related financial disclosures are required to be linked to a company’s financial statements to provide transparency about how sustainability-related factors impact the company’s financial performance and position.

This connection is crucial for investors and other stakeholders to understand the financial implications of sustainability-related risks and opportunities so they can make informed decisions.

Your digital roadmap to ISSB compliance

Whether you are just starting your sustainability journey or already have sustainability reporting and compliance processes and targets in place, digital ISSB reporting software can help at every stage.

Starting by centralising your data, the right digital tools are the only way to address today’s mandatory requirements, adapt to evolving legislative frameworks, and help set and achieve decarbonisation targets.

For complex mining and minerals organisations, Metallurgical Systems recommends a staged approach to ISSB digital reporting that starts with meeting mandatory compliance rules and moves towards advanced capabilities and emissions reduction strategies as your ESG strategy matures.

There are four broad steps in the recommended roadmap that align with our sustainability reporting software and compliance solutions:

Deploy ISSB reporting software to centralise data and use templates to meet today’s compliance regulations.

Set up the systems needed for centralised records that capture the in-depth ISSB data points needed to adjust to evolving ISSB reporting requirements.

On top of centralised data, the next step is to add automated data capture and data quality to your ISSB reporting.

This includes data cleansing, organisation and validation tools (using machine learning), and advanced visualisation tools to deliver dynamic, accurate and auditable near real-time ISSB reporting.

Beyond automation, the next step is enabling finance-grade sustainability reporting and automated validation of ISSB data against plant operations data using a mass and energy balance configured to your site/s.

You can report according to the ISSB reporting boundaries, time horizons (short, medium and long term) and extract reports in a machine-readable electronic format to meet ISSB requirements.

The final step is adding the granular analysis needed to plan, execute and evaluate your decarbonisation roadmap and adapt to evolving ISSB and sector-specific standards.

Running a steady-state simulation of your asset, validated finance-grade data is used to enable complex forecasting, transition planning, scenario analysis and climate resilience assessments.

You can then adjust inputs and compare final production, emissions and consumption using advanced visualisation tools.

Understanding the ISSB reporting requirements

For jurisdictions that have adopted the ISSB standards, they are relevant for companies and sectors, regardless of the financial reporting framework applied. They are not limited to companies reporting under the IFRS Accounting Standards.

- ISSB reporting is required at the same period as the financial statements.

- Information is material to disclose in reports if expected to influence investors’ decisions by affecting their assessment of the company’s future cash flows.

- The definition of material is investor-focused and consistent with IFRS Accounting Standards.

- Sustainability-related financial disclosures need to be connected to financial statements, and both are included in companies’ general-purpose financial reports.

- The standards require forward-looking insight into sustainability-related risks and opportunities that could reasonably be expected to affect the company’s prospects.

There are two components of ISSB reporting

Both the General Standard and the Climate Standard follow a structure consistent with the four pillars of the TCFD, reporting across areas of governance, strategy, risk management and metrics and targets. The structure of IFRS reporting will be familiar to those who already report under the TCFD.

Below, we break down the two primary standards:

1. General Standard (IFRS S1)

IFRS S1: General

- The IFRS S1 (General) is the core framework for the disclosure of material information about Sustainability-related risks and opportunities across the entity’s value chain.

- The general standard covers reporting under all IFRS Sustainability Disclosure Standards

- As outlined on the IFRS website: The objective of IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is to require an entity to disclose information about its sustainability-related risks and opportunities that is useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.

AND

This Standard requires an entity to disclose information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. For the purposes of this Standard, these risks and opportunities are collectively referred to as ‘sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects’.

- The scope of the standard – for example, Sustainability-related risks and opportunities that could not reasonably be expected to affect an entity’s prospects are outside the scope of this Standard.

- Provides core content (governance, strategy, risk management and metrics and targets), conceptual foundations and general requirements

- Requires disclosure of material information on all sustainability-related risks and opportunities (not just climate) that could reasonably be expected to affect the company’s prospects.

- In addition to IFRS Sustainability Disclosure standards, “an entity shall (shall means not optional) refer to and consider the applicability of the disclosure topics in the SASB Standards. An entity might conclude that the disclosure topics in the SASB Standards are not applicable in the entity’s circumstances.”

2. Topic Standards

Topic Standards are the second component of the ISSB guidelines, focusing on specific sustainability topics. The first and only Topic Standard published to date is IFRS S2 Climate-related Disclosures.

IFRS 2: Climate

- The IFRS 2 (Climate) sets out the requirements for entities to disclose information about climate-related risks and opportunities.

- As outlined on the IFRS website: The objective of IFRS S2 Climate-related Disclosures is to require an entity to disclose information about its climate-related risks and opportunities that is useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.

AND

This Standard requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. For the purposes of this Standard, these risks and opportunities are collectively referred to as ‘climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects’.

- Climate standard replicates the core content of IFRS S1 and expands on them with climate specific reporting requirements.

- This includes information on transition plans, scenario analysis and climate-specific metrics and targets.

- Provides industry specific guidance based on SASB Standards.

- Refers to the GHG Protocol for guidance on reporting GHG emissions.

- Other topics standards are expected overtime.

The ISSB qualitative and quantitative disclosures

Each ISSB standard requires specific disclosures to be reported. The IFRS Sustainability Disclosure Standards and IFRS Climate Disclosure Standard are based on the four pillars used in the TCFD framework: governance, strategy, risk management, and metrics and targets.

These four pillars are referred to as the ‘core content’. An entity must disclose material information concerning each of the four pillars.

Notably, the IFRS S2 (Strategy pillar) requires climate-related scenario analysis:

As per the IFRS S2 legislation: “An entity shall disclose information that enables users of general-purpose financial reports to understand the resilience of the entity’s strategy and business model to climate-related changes, developments and uncertainties, taking into consideration the entity’s identified climate-related risks and opportunities. The entity shall use climate-related scenario analysis to assess its climate resilience using an approach commensurate with its circumstances.”

It illustrates that if an entity has a high degree of exposure to climate-related risk, a more quantitative or technically sophisticated approach to climate-related scenario analysis would likely be required.

Of the four TCFD pillars, the ‘Metrics and targets’ pillar has a more quantitative focus. It requires organisations to disclose more granular metrics, including industry-based metrics such as GHG emissions broken down by types of gases and consumption data on water and energy.

Entities are required to report on any targets that they have set or are required to meet by the jurisdiction they operate in (by regulation or legislation). For each target, the entity is required to disclose any milestones or interim targets, performance against these targets, and an analysis of trends or changes in the entity’s performance.

The first table below summarises the core content, followed by a more detailed table detailing the IFRS S2 ‘metrics and targets’ disclosures.

Core content at a glance across IFRS S1 and IFRS S2

While the standards include other information, this table summarises the requirements under the four pillars of the TCFD framework: governance, strategy, risk management, and metrics and targets. Together, they are referred to as the ‘core content’.

General standard

IFRS S1 Sustainability-related Disclosures

Governance

- Governance processes, controls and procedures to monitor and manage sustainability-related risks and opportunities

Strategy

- Sustainability-related risks and opportunities

- Business Model and value chain

- Strategy and decision-making

- Financial position, financial performance and cash flows

- Resilience

Risk management

- Processes used to identify, asses, prioritise and monitor sustainability-related risks and opportunities

Metrics and targets

- Metrics for sustainability-related risk and opportunities

- Progress towards targets for sustainability-related risk and opportunities

Topic/ Thematic standard

IFRS S2 Climate-related Disclosures

Governance

- Governance processes, controls and procedures to monitor and manage climate-related risks and opportunities

Strategy

- Climate-related risks and opportunities

- Business model and value chain

- Strategy and decision-making

- Financial position, financial performance and cash flows

- Climate resilience – climate-related scenario analysis

Risk management

- Processes used to identify, assess, prioritise and monitor climate-related risks and opportunities

Metrics and targets

- Climate-related metrics – cross cutting and industry-based

- Climate-related targets

Note: See the table below for more details on IFRS S2 metrics and targets disclosures.

Spotlight on IFRS S2 ‘metrics and targets’ disclosures

IFRS S2 Metrics and targets

Cross-industry climate-related metrics

There are 7 cross-industry metrics:

- Greenhouse gases

- Disclose its absolute gross greenhouse gas emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent – classified as Scope 1, Scope 2 and Scope 3, in accordance with the GHG Protocol: A Corporate Accounting and Reporting Standard (2004), unless the jurisdiction mandates otherwise.

- Scope 1 and Scope 2 emissions disaggregated between a consolidated accounting group and other investees.

- Disclose Scope 2 as location-based Scope 2 GHG emissions.

- Disclose categories included in Scope 3 GHG emissions in accordance with the GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011) and additional information (financed emissions) of Category 15 for an entity’s activity asset management, commercial banking or insurance.

- Climate-related transition risks

The amount and percentage of assets or business activities vulnerable to climate-related transition risks. - Climate-related physical risks

The amount and percentage of assets or business activities vulnerable to climate-related physical risks. - Climate-related opportunities

The amount and percentage of assets or business activities aligned with climate-related opportunities. - Capital deployment

The amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities. - Internal carbon prices

For investments decisions, scenario analysis and cost assessments. - Remuneration

Climate related considerations on executive remuneration and the % linked to these considerations.

Industry-based metrics

There are 68 volumes of industry-based guidance.

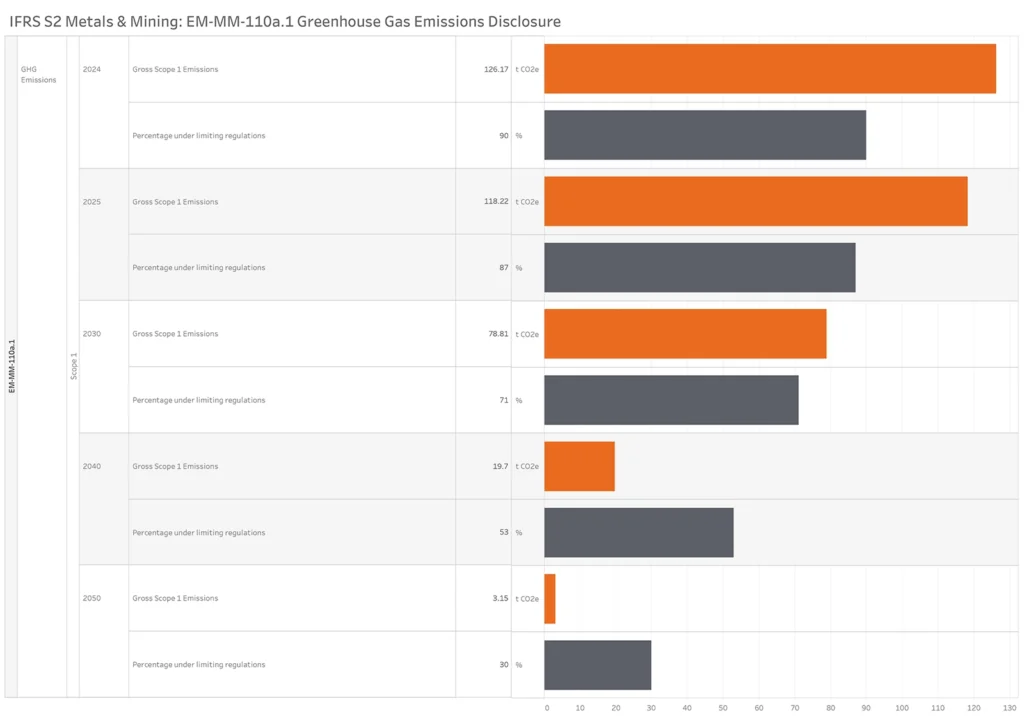

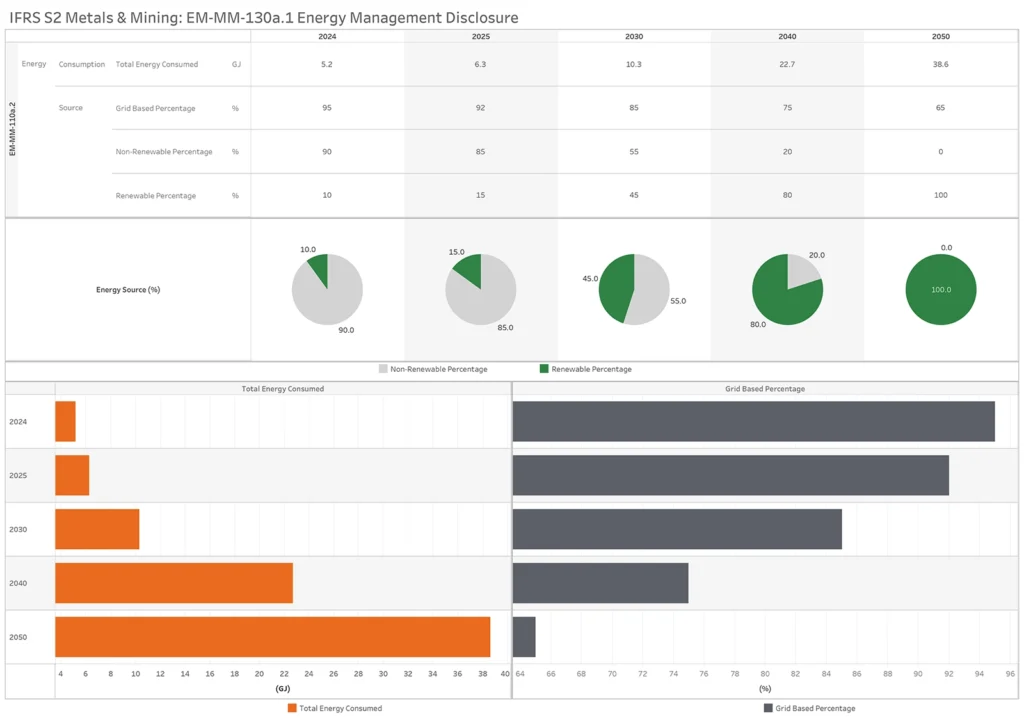

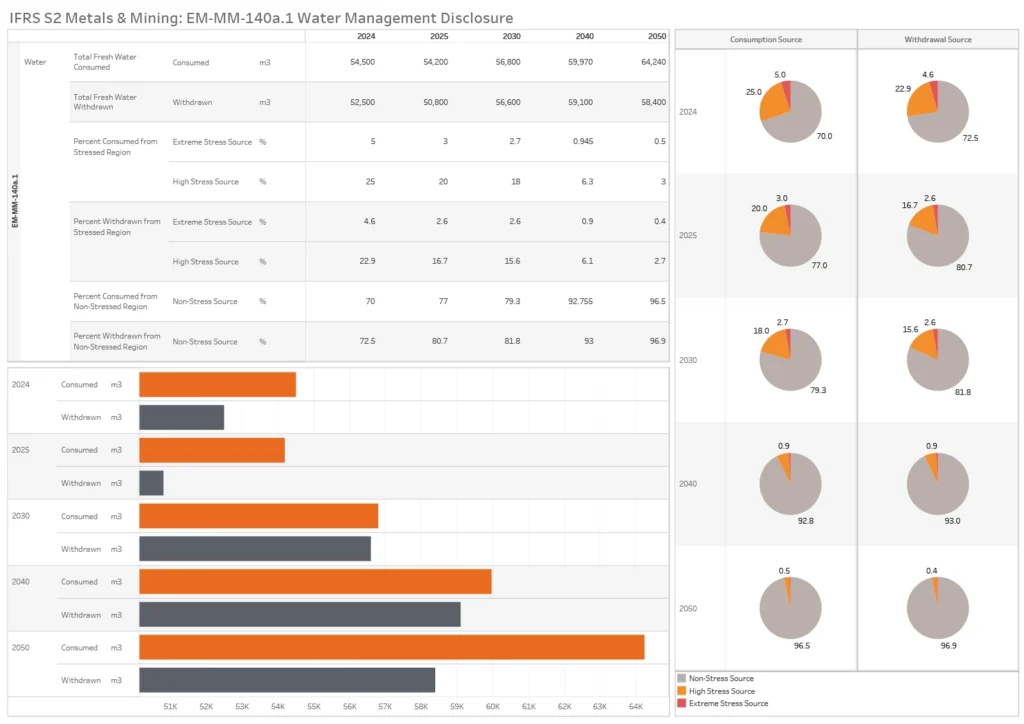

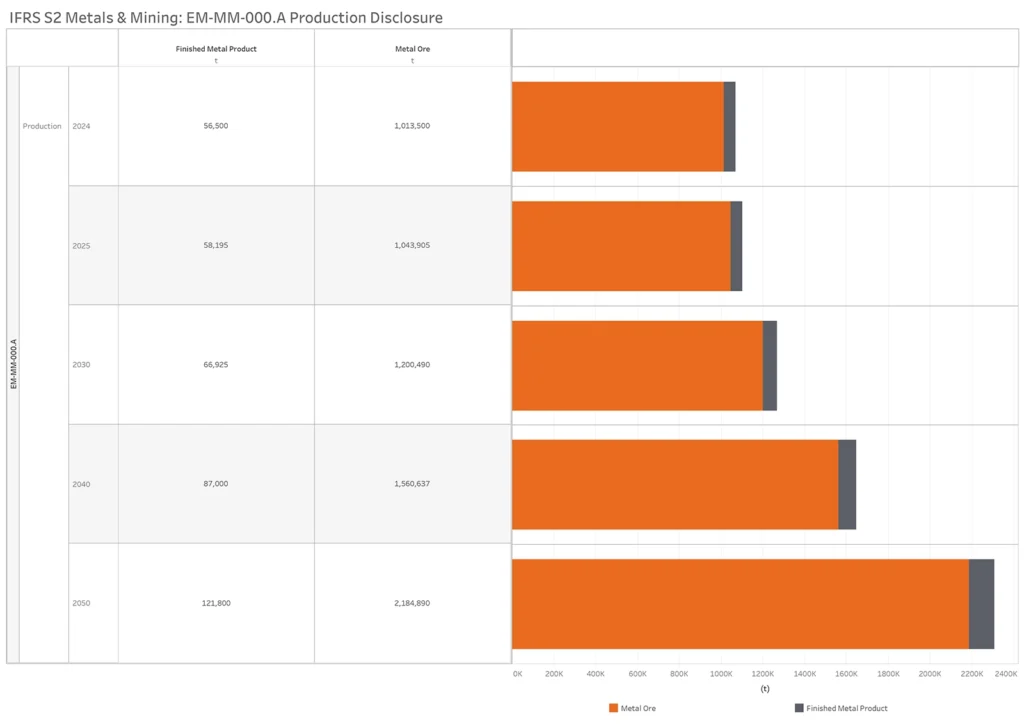

Below is an example of the “Metals and Mining” industry.

Sustainability disclosure topics and metrics include:

- Greenhouse Gas Emissions

- Gross global Scope 1 emissions, of the seven GHGs covered under the Kyoto Protocol—carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3).

- Scope 1 emissions are defined and calculated according to the methodology contained in The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (GHG Protocol), Revised Edition, March 2004. These emissions include direct emissions from mobile and stationery sources.

- Percentage covered under emissions limiting regulations.

- Discussion of long-term and short-term strategy or plan to manage Scope 1 emissions, emissions reduction targets, and an analysis of performance against those targets.

- Energy management

- Total energy consumed.

- Percentage grid electricity.

- Percentage renewable.

- Water Management

- Total fresh water withdrawn.

- Total fresh water consumed.

- Percentage of each in regions with High or Extremely High Baseline Water Stress.

- Number of incidents of non-compliance associated with water quality permits, standards, and regulations.

- Activity metrics include:

- Production of (1) metal ores and (2) finished metal products.

- Total number of employees, percentage contractors.

- Entity must disclose climate-related targets set by the organisation or targets required to be met by law or regulation. For each target the entity shall disclose:

- The metric used to set the target.

- The objective of the target.

- The part of the entity the target applies, such as geographical region.

- The period which the target applies.

- The base period from which progress is measured.

- Any milestones and interim targets.

- If the target is quantitative, whether it is an absolute target or an intensity target.

- How the latest international agreement on climate change has informed the target.

- Disclosures for setting, reviewing and monitoring the progress of each target.

- Whether the target and the methodology for setting the target has been validated by a third party;

- The entity’s processes for reviewing the target;

- The metrics used to monitor progress towards reaching the target; and

- Any revisions to the target and an explanation for those revisions.

- Disclosure on the performance against each climate-related target and an analysis in trends or changes in the entity’s performance.

- For each GHG emissions target the entity is to disclose:

- Which Greenhouse Gases are covered by the target.

- Whether Scope 1,2 or 3 GHG emissions are covered by the target.

- Whether the target is a gross or net GHG emissions target.

- Whether the target was derived using sectorial decarbonisation approach.

- The entity’s planned use of carbon credits to offset GHG emissions to achieve any net GHG emissions target.

Why digital reporting is the only solution for ISSB reporting

The need for regular reporting in a machine-readable digital taxonomy across hundreds of disclosures and the increasing requirement for detailed scenario analysis and forward-looking statements means that data-driven technology is the only solution to meet ISSB’s evolving sustainability disclosure rules and reporting standards.

Manual spreadsheets cannot capture or process the volumes of data needed to deliver immutable, unalterable and auditable sustainability reports.

The good news is that digital tools proven to solve these data challenges for complex industrial processes liking mining and resources are available.

MI Sustainability, as part of the Metallurgical Intelligence® suite of solutions, is an established platform that centralises plant-wide data and dynamically simulates your processing operation as a digital twin.

It performs a plant-wide mass and energy balance, and runs deep analysis across sustainability indicators, to deliver granular reports that are mapped to the IFRS Sustainability Disclosure Standard reference to be reported per the ISSB.

Examples of using MI Sustainability ISSB reporting software

The following examples demonstrate how the MI Sustainability ISSB reporting software can satisfy ISSB compliance and help achieve decarbonisation goals with granular reports that map directly to the disclosures required.

Climate-related scenario analysis

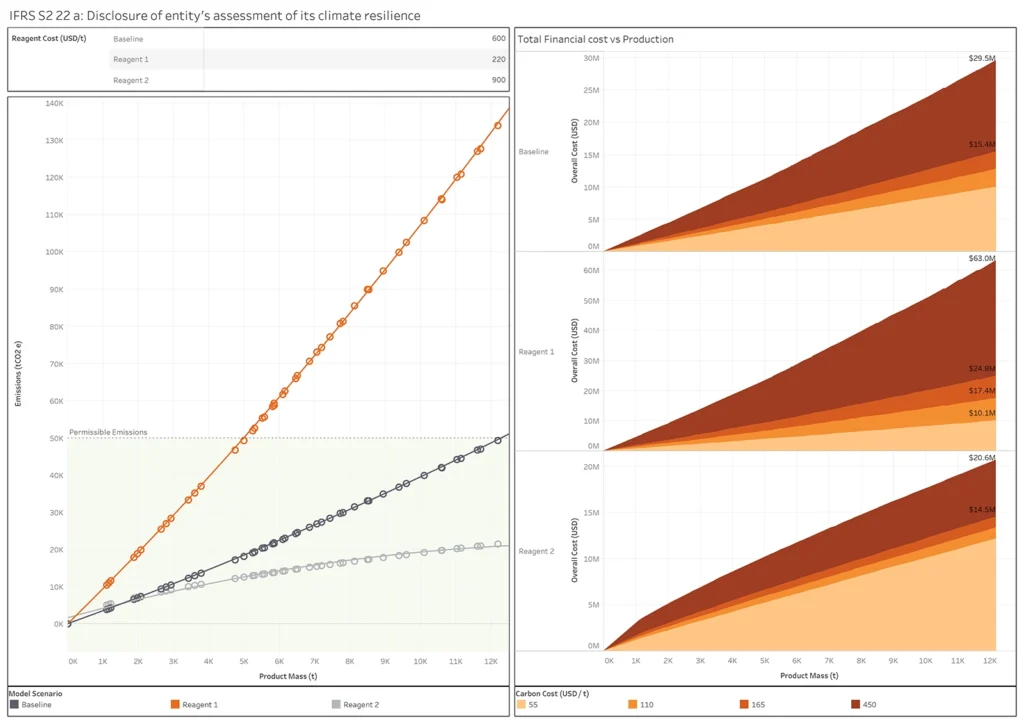

IFRS S2.22 requires an entity to use climate-related scenario analysis to assess its climate resilience, using an approach that is commensurate with its circumstances.

For entities with a high degree of exposure to climate-related risk, a quantitative or technically sophisticated approach to climate-related scenario analysis is required.

Quantitative Climate Scenario Analysis

Here is an example of the use of quantitative climate scenario analysis as referenced in the Disclosure Requirement related to IFRS S2.22

Total emissions from using different reagents has been calculated compared to a set baseline, including the associated cost to the organisation. Using varying inputs under different climate scenarios, users of general purpose financial reports can understand the resilience of the entities strategy and business model.

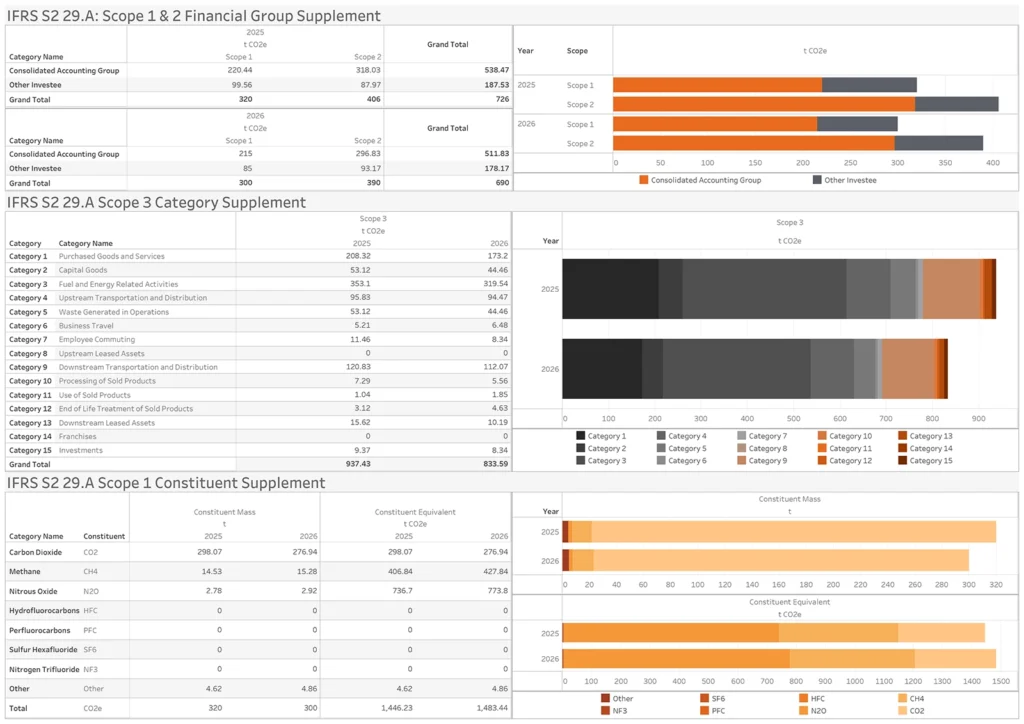

Scopes 1, 2 and 3 Reporting

There are seven cross-industry metric categories in IFRS S2.29 that include quantitative and qualitative components if material.

MI Sustainability can accurately measure and report Scopes 1, 2 and 3 across your value chain and adjust organisational boundaries as per the ISSB reporting requirements.

Scope 3 reporting is mandatory and can be broken down into categories.

Gross Scope 1,2,3 and Total GHG Emissions Report:

Example of cross-industry metrics to be reported as per the IFRS S2.29 Disclosure of GHG emissions.

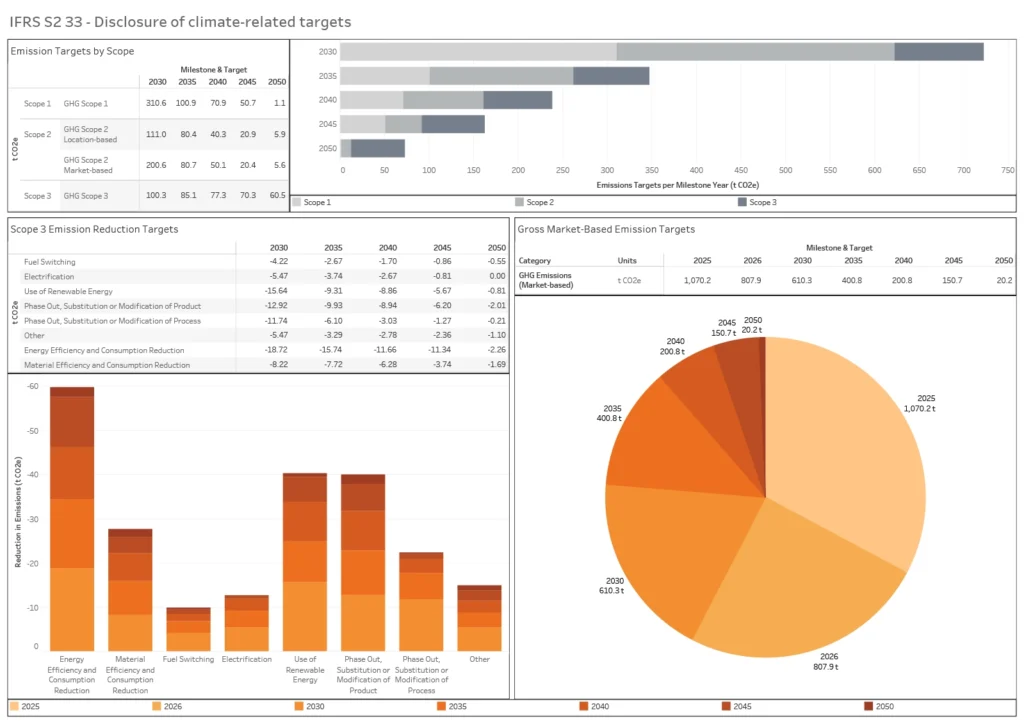

Targets & Transition Planning

IFRS S2.33 and IFRS S2.34 requires an entity to disclose the quantitative and qualitative climate-related targets it has set, monitor progress towards set targets and any targets required by law or regulation.

For each target it is required to disclose how the latest international agreement on climate change, including jurisdictional commitments that arise from that agreement, has informed the target.

The entity is required to disclose information about its performance against each target and an analysis of trends or changes in the entity’s performance.

Climate-related targets:

Here is an example of reporting on targets that MI Sustainability can automate such as the IFRS S2 33 –37, Disclosure of climate-related targets.

Industry-based disclosure requirements

IFRS S2 requires an entity to disclose industry-based metrics that are associated with one or more particular business models, activities or other common features that characterise participation in an industry. In determining the industry-based metrics that the entity discloses, the entity shall refer to and consider the applicability of the industry-based metrics associated with disclosure topics described in the Industry-based Guidance on Implementing IFRS S2.

There are 68 volumes of industry-based guidance.

Example of the industry-based disclosure metrics for “Metals and Mining”

Sustainability Disclosure Topics & Metrics

Greenhouse Gas Emissions EM-MM-110a.1

Activity Metrics

Production EM-MM-000.a

Sustainability Assurance

The International Auditing and Assurance Standards Board (IAASB) has proposed the International Standard on Sustainability Assurance 5000 (ISSA 5000), which provides general requirements for sustainability assurance engagements. Developed in collaboration with global and regional bodies, ISSA 5000 aims to establish a global baseline for sustainability assurance to improve the quality, accountability and transparency of sustainability information. The proposal closed for public consultation on December 2023, with final approval due September 2024.

For complete assurance, organisations should demonstrate that they can track sustainability metrics back to source data such as instrumentation data and follow an audit trail to the reported values.

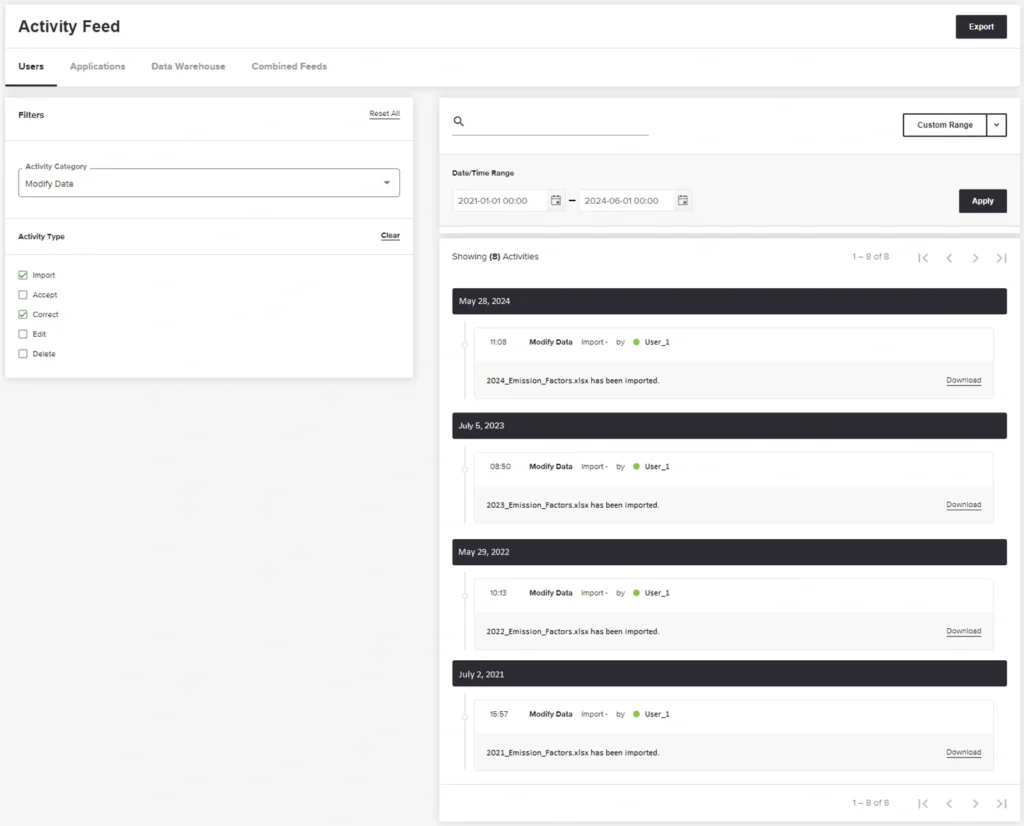

Example of an Assurance Report:

This is an example of the audit trail in the activity feed that details any changes or modifications to data.

Digital Taxonomy

ISSB published the IFRS Sustainability Disclosure Taxonomy (ISSB Taxonomy) on 30 April 2024.

ISSB Electronic Reporting format:

Designed to be consistent with the IFRS accounting taxonomy the ISSB digital taxonomy can also be used with other digital taxonomies. MI Sustainability can map ISSB disclosures to digital tags as per the taxonomy.

ISSB Frequently Asked Questions

What is The International Sustainability Standards Board (ISSB)?

The ISSB is an independent, global standard-setting body that develops and issues sustainability-related disclosure standards for companies to report on environmental, social, and governance (ESG) matters. It aims to promote transparency, consistency, and comparability in sustainability reporting.

When does the ISSB come into effect?

The ISSB standards became effective on 1 January 2024, and it is up to individual jurisdictions to adopt and mandate them.

Is the ISSB single materiality or double materiality?

The ISSB standards have a single materiality focus, which means they focus just on the financial impact of the organisation. Standards like the CSRD that have a double materiality focus on the financial impact as well as the external social and environmental impact.

What are the benefits of complying with the ISSB?

Compliance with the ISSB offers several benefits, including:

- Increased transparency and investor confidence

- Improved risk management and identification of opportunities

- Ensure compliance with emerging regulations

- Build stakeholder engagement and trust

- Enhanced brand reputation and credibility

- Access to sustainable finance options and investors that value transparency

What are the risks of not complying with the ISSB?

Companies that aren’t ready to meet their ISSB compliance regulations may face risks such as:

- Legal and regulatory risks, including possible fines and penalties

- Reputation and brand damage, leading to loss of stakeholder trust

- Financial risks, including increased costs, loss of investments or more challenging access to capital

- Loss of business opportunities and competitive disadvantage

- Backlash by stakeholders, including investors

Why Excel is no longer compatible with sustainability reporting

Many mining and minerals operations continue to use Excel spreadsheets to perform sustainability reporting. However, given the complexity of data, multiple data points and the requirement that reports be provided in an auditable electronic reporting format to be compliant, it’s become clear that Excel can no longer keep pace. Error-prone and time-consuming, using Excel exposes risks. Without the right data-driven sustainability platform, it’s impossible to meet ISSB reporting requirements, let alone implement effective decarbonisation strategies.

How does MI Sustainability help with ISSB reporting?

MI Sustainability simplifies ISSB reporting with a user-friendly interface, providing a comprehensive framework that covers all necessary disclosures. It automates data collection and calculation to reduce manual effort in producing reports in the ISSB digital format. It also enables companies to set targets, track progress, and benchmark performance.

MI Sustainability: Your proven fast-track sustainability reporting solution

- Track end-to-end sustainability indicators spanning Scopes 1, 2 & 3, and Climate & Nature

- Single source of centralised, validated, organised and integrated sustainability data

- Accurate plant-wide mass and energy balance customised to your exact process as a digital replica of your operations

- Contextualise your measured activity data using source data as inputs

- Analyse, track and report activity data right down to a product level

- Track and consolidate on-site and off-site renewable energy sources

- Capture and report on data directly related to the mining asset it has been implemented in, including integration with third-party data

- Track, simulate, test, analyse and forecast scenarios

- Future-proof technology delivered in a scalable cloud-based SaaS platform

Take control of your ISSB sustainability reporting

To learn how MI Sustainability can help you meet your ISSB sustainability reporting obligations and minimise emissions, energy, water and waste across your supply chain, contact our expert team on +61 2 7229 5646 or info@metallurgicalsystems.com.

About the Authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.