Accurately measuring and reporting on greenhouse gas (GHG) emissions, water and energy consumption is fast becoming a critical priority for the mining sector. Without effective sustainability accounting in place, mining organisations of all sizes will struggle to maintain their licence to operate, meet regulatory and compliance requirements, control costs, and attract the next generation of environmentally conscious employees.

According to EY, environmental, social and governance (ESG) remains the top risk and opportunity for mining and metals companies in 2023.i

Yet many organisations simply don’t have the right systems or tools in place to support effective, efficient and detailed GHG emissions, water and energy consumption accounting. In fact, according to a recent BCG report, just 9% of companies measure their total emissions comprehensively. ii As a result, organisations themselves lack confidence in the accuracy of the figures they are reporting – which impacts their ability to drive genuine change, as well as gain trust with investors and shareholders.

In this article we will outline the reasons why GHG emissions, water and energy consumption accounting can be so challenging, why it’s essential, and what tools and software are required.

A new era of legislated accountability

As the world strives to achieve net-zero emissions by 2050, mining organisations are under enormous pressure to operate more sustainably and efficiently. This pressure is coming from a range of sources – geopolitical issues, the energy crisis, demand for critical minerals, and the increased focus and legislative action on ESG from a compliance perspective, as well as from investors and shareholders.

In November last year, at the global COP26 conference (the UN’s 2021 Climate Change conference held in Glasgow), the International Financial Reporting Standards (IFRS) Foundation announced the formation of the International Sustainability Standards Board (ISSB). The aim of the ISSB is to create a comprehensive global baseline for sustainability disclosures. The driving force is investor demand for more transparent reporting of sustainability-related risks and opportunities.

The ISSB is now fully operational, and after extensive global consultation has committed to issuing its first two standards relating to sustainability disclosures for adoption in 2023. Countries are not obliged to follow the new provision. However, adoption is expected to be global.iii

At the most recent COP27 conference, Emmanuel Faber, Chair of the ISSB, said: “As we’ve heard from stakeholders here at COP27, the need for climate-related financial disclosures is increasingly urgent. We are working collaboratively towards the implementation of effective sustainability disclosures for capital markets, which will empower market participants with the right information to support better economic and investment decision making.”iv

The International Organisation of Securities Commissions (IOSCO), the global body for securities regulators from the United States, Europe, Asia and elsewhere, is also expected to endorse the standards.

Under these new standards, companies will now be required to publicly report annually on their emissions, demonstrating their commitment and strategies employed to reduce emissions.

A recent article by KPMG says of these standards: “This is a critical milestone in the journey towards a consistent global baseline of investor-relevant sustainability reporting. The standards will drive transparency and enable investors to make more informed and so better decisions, making companies accountable for sustainability reporting in the same way as they are for financial reporting.”v

What will the new standards expect of mining organisations?

Broader scope of reporting

Under the ISSB’s proposed standards, companies must now report on all relevant sustainability topics (not just on climate-related risks) across four content areas: governance, strategy, risk management, and metrics and targets. Organisations must also report on Scope 1, 2 and 3 emissions.

Scope 3 emissions now account for most of the mining sector’s emissions, and pressure is growing from investors, communities and governments for the sector to take a strategic approach to their reduction. Companies that have not yet begun calculating their Scope 3 emissions are already behind their competitors.

More accurate, quantifiable information

Rating agencies will now expect more quantitative information that is typically difficult to obtain from most miners’ systems. Complying with new standards and expectations will require miners to improve the availability, rigour, trust and reliability of data.

Focus on biodiversity

Mining organisations also need to address concerns around biodiversity. A lack of biodiversity is seen as a business risk – and can affect a mining organisation’s ability to secure finance and maintain a licence to operate.

According to EY, “Water stewardship and biodiversity are fast becoming urgent priorities amid a changing climate. Stakeholders expect miners to better assess risks and opportunities, and articulate these through transparent, outcome-based measurement and assurance.”vi

The problem: Lack of accurate measurement tools

While organisations know they need to be able to calculate emissions at a granular level and consolidate this across all their sites, most simply don’t have the technologies in place, specific to their process, to calculate this data accurately and transparently. They know their data is convoluted or flawed, yet don’t know where to begin to meet the new set of standards.

According to a recent survey by BCG, mining companies’ inability to measure accurately and exhaustively is the leading roadblock.

BCG notes that 85% of organisations are concerned about reducing their greenhouse gas emissions, and 96% have set targets for reducing emissions in at least one scope. Yet only 11% have managed to cut their emissions in line with their ambitions over the past five years.vii

At the same time, according to the surveyviii:

- Just 9% of companies measure their total emissions comprehensively.

- 81% confess to omitting some of their internal (scope 1 and 2) emissions.

- 66% of organisations do not report any of their external emissions.

- There is an average error rate of 30% to 40% in emissions measurement.

- 49% of respondents identified granular operating data as “hard” or “very hard” to find.

- 55% of respondents identified granular emissions factors as “hard” or “very hard” to find.

“If companies don’t have complete and high-quality emissions baselines, how can they analyse their current footprints, designate appropriate targets, design the right initiatives, and, ultimately, track the results?”, the BMG survey suggests.

Without the right digital tools for greenhouse gas accounting/carbon accounting, mining organisations cannot accurately track, report and take the steps to reduce emissions in line with these standards.

What does quality sustainability accounting look like for mining and minerals?

In response to this new reporting requirement, there are many new ‘sustainability accounting’ solutions appearing in the market. However, many are limited in their capabilities and don’t provide the level of detail – nor predictive insights – required for effective measurement and control.

When looking for a quality GHG emissions, water and energy consumption accounting solution, non-negotiable components should include:

- A process digital twin – so you can conduct accurate and granular calculations right across your operation.

- Broad scope – ideally, your solution should give you the ability to capture all emission-creating activities across all stages of your plant’s processes – including carbon dioxide (CO2), methane (CH4), sulphur dioxide (SO2), sulphur hexafluoride (SF6), nitrous oxide (N2O), specified kinds of hydrofluorocarbons and perfluorocarbons, as well as energy and water consumption. Your solution should also be able to capture information on fuels like coal and diesel, as well as emissions resulting from specific processes such as the roasting of sulphide ores.

- Flexible scope – as reporting requirements will inevitably change, it’s important that any carbon accounting solution can be adapted and changed accordingly.

- Central visibility – you should have clear visibility of all this data via an easy-to-use dashboard, through which you can track, report on and manage your plant’s emissions in granular detail.

- Predictive insights – your solution should also allow you to accurately set budgets, targets and forecasts for greenhouse gas emissions as well as power and water consumption. You should be able to test scenarios to see how changes to your process operations – such as installing different equipment, altering throughput rates, using alternative fuel or testing new reagent suppliers – have an impact on emissions as well as power and water use.

It’s also critical that you have sufficiently skilled and knowledgeable professionals within your organisation who can ensure any data captured can be effectively interpreted and acted upon.

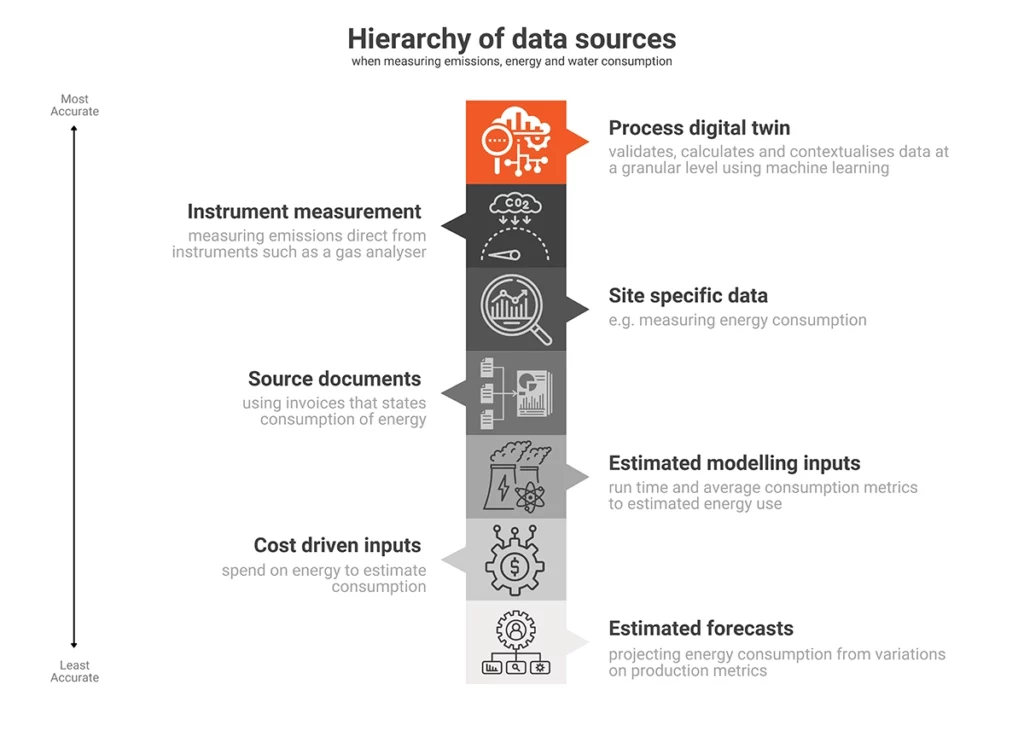

A quality GHG emissions, water and energy consumption accounting solution should be able to capture and analyse information from a wide range of data sources. As the below image demonstrates, not all data sources are equal. There’s a clear hierarchy in terms of the accuracy and level of insight provided by each source. When an organisation is relying only on estimated forecasts, cost-driven inputs or estimated modelling inputs, their results and reporting will lack the level of accuracy that can be generated by relying on sources further up the accuracy scale like source documents, site-specific data, instrumentation measurement and – most importantly – a process digital twin.

Why digital tools are critical in measurement: a real-life example

Direct measurement of greenhouse gases through plant instrumentation is often recommended as the most accurate and reliable method of recording emissions – particularly Scope 1 emissions. However, it’s important to be aware these instruments often perform with a high degree of uncertainty and can also experience calibration issues, which often leads to misreporting of emissions.

For instance, a prominent smelter facility was recording its SO2 emissions through the use of gas analysers that, unknown to the plant, were not operating properly for large periods. This gas was then feeding into an acid plant and it was simply assumed there was little to no loss as there was no instrumentation at the acid plant boundaries to suggest otherwise.

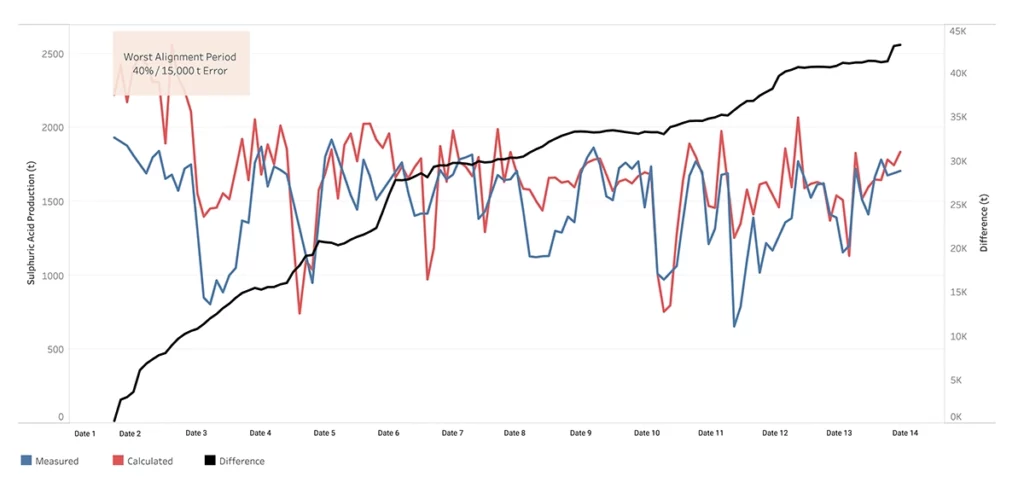

Once the plant put a process digital twin solution in place, it was quickly identified that the SO2 analysers were not working correctly and there was a large discrepancy between the daily sulfuric acid production mass according to the historical daily balance (shown in the below image by the blue line) versus the mass that was produced according to the digital twin solver model (represented by the red line).

Daily sulfuric acid production (t)

Using a process digital twin, the smelter was able to determine that it was under-reporting Scope 1 greenhouse gas emissions through unrecorded SO2 gas losses.

Importantly, by implementing a process digital twin solution, a facility like this also now has the ability to:

Further enhance its Scope 1 measurement to include CO2:

In a plant such as this, it’s easy for instrumentation to overrepresent the mass of CO2 released. A combination of both measured data alongside a digital twin dynamic model is needed to measure CO2 emissions accurately.

Report effectively on Scope 2 emissions:

Often, Scope 2 emissions are calculated solely through the use of billed consumption from grid electricity and other utilities. However, this may be a poor estimate of consumption, and Scope 2 emissions, at some facilities. With a process digital twin, a plant can get a far more accurate reading by incorporating all instrumentation and power data to provide accurate cost estimates and total required power draw.

Report effectively on Scope 3 emissions:

While Scope 3 carbon emissions form a critical part of a site’s carbon accounting, they tend to be deprioritised. With a global shift towards decarbonisation and new standards requiring broader greenhouse gas emissions reporting, truly understanding sources of Scope 3 emissions is essential. Yet Scope 3 emissions, despite making up a large portion of a mineral processing facility’s carbon footprint, are often poorly understood. The key to understanding and lowering Scope 3 emissions is a detailed breakdown of the different components by contribution.

A process digital twin solution can connect to numerous data sources including plant instrument historians, production databases and laboratory management systems. The data sources are consolidated into a single centralised location and fed into a process digital twin dynamic model. This allows for the reconciliation of key measurements, so stakeholders know the data is as accurate as possible, and also enables emissions to be calculated (including Scope 1, 2 and 3).

It’s time to get our carbon accounting in order

With regulatory requirements becoming increasingly rigorous and well-defined, it’s critical that plants put the right GHG emissions, water and energy consumption accounting solutions in place – now – to ensure preparedness for the future. If you are interested in finding out more, the experts at Metallurgical Systems can analyse your organisation’s level of sustainability accounting and help you implement and maintain a solution that meets your requirements.

To find out more, get in touch.

References:

i EY, The top 10 business risks and opportunities for mining and metals in 2023.

ii BCG, Use AI to Measure Emissions—Exhaustively, Accurately, and Frequently.

iii WeForum, Explainer: First guidelines for company sustainability disclosures.

iv IFRS, ISSB Cop27 – ISSB makes key announcements towards climate-related disclosure standards in 2023.

v KPMG, ISSB Sustainability reporting disclosures guide.

vi EY, The top 10 business risks and opportunities for mining and metals in 2023.

vii BCG, Use AI to Measure Emissions—Exhaustively, Accurately, and Frequently.

viii BCG, Use AI to Measure Emissions—Exhaustively, Accurately, and Frequently.

About the authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.