The race is on for accurate sustainability reporting

As the world strives towards net zero emissions, energy-intensive industries like mining, minerals, energy and manufacturing are under immense pressure from stakeholders including customers, partners, staff and government to measure and reduce their impact on climate change.

Now, with the introduction of EU CBAM, organisations have a short runway to meet the looming compliance and reporting deadline set for October 2023, in advance of the full rollout in 2027.

Accurately measuring and reporting on carbon emissions is a critical issue for organisations globally, however a Boston Consulting Group (BCG) survey found that just 9% of companies measure their total emissions comprehensively.1 So there is a lot of catching up to do, and fast!

For business leaders and CFOs, now is the time to prepare for CBAM to protect and grow your operations, financials and reputation.

CBAM explained

Drawing on over 10 years of experience in process engineering, data-led software and sustainability reporting in the resources sector globally, in this guide we aim to help you understand how CBAM impacts you.

What is CBAM? What are the big risks and opportunities? How can you prepare for it? Are there any shortcuts to CBAM compliance?

Contents

- What is the EU’s Carbon Border Adjustment Mechanism (CBAM)?

- Why is CBAM being implemented so urgently?

- When does CBAM reporting start?

- What emissions will need to be reported on?

- CBAM news & developments – updated Feb 2023

- CBAM risks: What happens if you’re not ready?

- Today’s carbon struggle and data roadblock

- Why CFOs should lead the new era of sustainability reporting

- How and when to prepare for CBAM compliance

- How is CBAM likely to impact different industries?

- Beyond CBAM: A new era of legislated accountability

- The problem: Lack of accurate data measurement tools

- Take the world’s only proven shortcut to CBAM compliance

- Proven in mining, customisable across industries

- Sustainability reporting and compliance case studies

- Related thought leadership

- CBAM readiness starts here

- About Metallurgical Systems

What is the EU's Carbon Border Adjustment Mechanism (CBAM)?

Legislated as part of the European Green Deal, the Carbon Border Adjustment Mechanism (CBAM) – also referred to as the carbon border tax – is a tariff applied to a range of carbon intensive products that are imported by the European Union (EU).

Taking into account both direct and indirect emissions, CBAM puts a price on carbon intensive products as they enter the EU. At this stage the categories impacted are likely to include iron and steel, cement, fertiliser, aluminium, electricity, chemicals, polymers and hydrogen.2

Whether your organisation manufactures in the EU or is a non-EU-based supplier to these organisations, CBAM compliance requirements will apply to in-scope products from October 2023.

Why is CBAM being implemented so urgently?

The overarching goal of CBAM is to create green supply chains and reduce carbon emissions as part of the accelerating global movement towards sustainability.

The European Commission is implementing policies to reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels3, with the broader goal to make the EU climate neutral by 2050.2 To help achieve this the EU have introduced the world’s first carbon border tax (CBAM), with other regions such as Australia, Canada and the UK weighing up similar policies.4

EU organisations already pay for the pollution they emit, so CBAM exists to reduce the risk of ‘carbon leakage’ by equalising the price of carbon between domestic products and imports – it evens up the playing field.2

When does CBAM reporting start?

While CBAM takes full effect in 2027, stage one reporting requirements start in October 2023, which has left many business operators scrambling to prepare the data and processes they will need to comply and operate without disruption.

What emissions will need to be reported on?

From October 2023, impacted organisations will be expected to comply with reporting requirements across Scopes 1, 2 and 3 of emissions reporting, in advance of the full CBAM rollout in 2027.

CBAM goes further than just reporting on an organisation’s direct emissions (Scope 1), requiring measurement and reporting on indirect electricity and other indirect emissions (Scopes 2 and 3).

With Scope 3 emissions accounting for most of the mining sector’s emissions – and a significant contributor to energy-intensive industries – organisations that have not yet begun to calculate their indirect emissions already have catching up to do.

Scope 1

Direct Emissions

Emissions from sources owned or controlled by the company directly, as well as emissions from chemical production in company owned or controlled process equipment.

Scope 2

Electricity Indirect Emissions

Emissions from the generation of purchased electricity consumed by the company, and emissions that physically occur at the facility where the electricity is generated.Scope 3

Other Indirect Emissions

All other indirect emissions that are a consequence of the activities of the company, but occur from sources not owned or controlled by the company.

CBAM news & developments – updated February 2023

As reported by Deloitte in their tax roundup on 23/2/23, CBAM will influence global regulations. For example, “The Australian government has also indicated that it is actively observing international developments in climate change policy. In January 2023, the Australian government announced that it will consider replicating the carbon border scheme being developed in the EU and impose tariffs on imported products with a large carbon footprint.”

CBAM risks: What happens if you’re not ready?

As detailed in a report by BCG, How Technology Can Tame the EU Carbon Tax on Imports4, efficiently managing CBAM is critical for impacted organisations to avoid penalties and business losses, as well as remain competitive.

“Those that struggle could face significant administrative burdens, higher costs, and supply chain disruptions as goods get stopped at the border. Companies that have a firm grip on the new system could gain a competitive advantage.”

Deloitte2 and BCG4 also outlined key risks and consequences for EU-based producers and non-EU suppliers as summarised below:

CBAM risks and impacts for EU-based producers

Penalties, sanctions and fines

Strict penalties for non-reporting and/or inaccurate reporting are likely to come into effect in 2027. In addition, there could also be fines across multiple levels across different countries, jurisdictions and governing bodies.2

Default data could make your carbon footprint look worse

Importers who are unable to produce their own data will have to use default data which will be based on the worst 5% of emitters. The result of this could be that your organisation is rated worse than it should be, which may damage your reputation and expose you to higher tax costs.2

Blocked from importing

Without robust and accurate auditable data, you may be unable to achieve the third-party verification you need to acquire the CBAM certificates that you would require to import the products you need.2

Loss of licence

Without accurate reporting, importers could lose their CBAM declarant’s licence which means they will no longer be able to import in scope goods. This could freeze your supply chain and negatively impact your operations, financial performance and business outcomes.2

CBAM risks and impacts for non-EU-based suppliers

Loss of clients

If EU importers can’t get the information they need from you, they may need or choose to switch to a supplier who has more carbon transparency across their supply chain.4

Uncompetitive pricing

If suppliers can’t reduce their carbon emissions, the carbon tax will mean importers will pay more for their goods, making their products less competitive compared to alternatives.

For example, BCG forecast that the EU’s CBAM could sharply increase prices of raw materials such as imported steel.4

“To significantly reduce the carbon footprints of imported products, many EU companies will need to engage with foreign suppliers throughout the value chain, from design to manufacturing all the way through to logistics, to make their processes more carbon efficient. Alternatively, EU importers will need to switch to lower-carbon suppliers.” 4

Today’s carbon struggle and data roadblock

While energy-intensive organisations know they must be able to calculate emissions at a granular level and consolidate this across all their sites, most simply don’t have the technology in place, specific to their process, to calculate this data accurately and transparently.

As reported in a BCG Carbon Management Survey1 of executives across nine major industries globally, carbon emissions are top of mind with 85% concerned about reducing greenhouse gas emissions.

However, while 96% have set targets to reduce emissions in at least one area, only 11% have managed to cut emissions in the last 5 years and 91% fail to measure emissions comprehensively.

The emissions data struggle is real:

- 9% of companies measure their total emissions comprehensively

- 96% have set targets for reducing emissions in at least one scope

- 11% only have actually managed to cut their emissions over the past 5 years

- 81% omit some internal scope emissions (Scope 1 & 2)

- 66% do not report any external emissions (Scope 3)

- 30-40% is the reported average error rate in emissions measurement

- 55% identified granular emissions factors are ‘hard’ or ‘very hard’ to find (BCG Carbon Management Survey1)

Why CFOs should lead the new era of sustainability reporting

Evolving frameworks across global governing bodies are rapidly elevating sustainability reporting to the same level as financial statements in terms of accountability, scrutiny and priority – making it a CFO-level responsibility.

Built using a similar approach to accounting standards, the proposed new disclosure standards driven by the International Sustainability Standards Board (ISSB) will merge existing and developing frameworks with input from over 20 governing bodies and partner organisations. The ISSB is expected to issue final standards early in 2023. It is also important to note that these and other global standards will continue to evolve over time, particularly to take into account more specific requirements for different industries.

In advance of these standards and driven by stakeholder and society pressure, it is important for CFOs to drive a board-led governance structure that brings integrated finance and sustainability reporting to the boardroom table to inform strategic decisions.

“Having previously decided to require the disclosure of Scope 1, 2 and 3 greenhouse gas emissions, the ISSB has now drilled down and clarified what the requirements would be. All types of companies will need to get ready for reporting clear and consistent data.” 5

Julie Santoro, Vice-chair,

Global Corporate & Sustainability Reporting Topic Team, KPMG

How and when to prepare for CBAM compliance

Now is the time to start preparing for your data capture and reporting capabilities to meet the CBAM compliance requirements that begin from October 2023.

If you currently manufacture in the EU, then you would already have basic reporting systems and data on your own emissions to comply with the Emissions Trading System (ETS), however in our experience many producers have little or no visibility into the carbon footprints of the factories and mines of foreign suppliers across their supply chains (Scope 3).

Steps to CBAM readiness for EU producers

To be compliant with CBAM in time, EU producers need to prepare now. From October 2023, the onus is on EU-based producers to provide quarterly CBAM reports.

These reports will need to accurately state both direct and indirect emissions, by producer and by country it is produced in, down to raw materials and components included in the production process of the CBAM in scope products they import.

These main steps will help you prepare:

1. Allocate internal responsibilities

Identify which individuals and departments will be responsible for CBAM compliance, governance and reporting. Ensure they have adequate time and resources to understand and implement the new requirements in advance of the deadline.

2. Assess the full impact of CBAM on your business

This includes identifying and documenting which products are covered and their volume, where they are sourced, what their embedded emissions are, and what CBAM reporting is required across Scopes 1, 2 and 3.

3. Set up the emissions data collection processes

The first step is to identify where to source this information from your supply chain – what is contained within your internal enterprise resource planning (ERP) and other systems, and what will need to be sourced from your suppliers. Then put in place ongoing processes and responsibilities to capture and analyse this data.

4. Identify gaps in your emissions data

Review your existing data, systems, reports and supplier networks to determine precisely what level of direct and indirect emissions can be measured today across producers, suppliers and processes from country to country. Then calculate data gaps that need to be addressed to meet CBAM obligations.

5. Review your existing technology

Are you, like many organisations, currently relying on manual, siloed and non-auditable reporting tools such as spreadsheets? If so, investigate what specialised digital tools you need to collect, centralise and synchronise data to streamline and automate CBAM and carbon reporting. As we cover further on, using technology will be essential to integrate and contextualise your data in a way that is auditable and accurate enough to meet CBAM reporting guidelines.

6. Create a CBAM action plan and timeline

Once you have assessed the impact, collected available data and reviewed existing tools, make a plan to close the gaps in data, systems and processes to prepare and deliver auditable quarterly reports that meet CBAM requirements. Once the data collection and reporting processes are in place, quarterly reports become much simpler.

Steps to CBAM readiness for non-EU suppliers

It is important that non-EU minerals, mining and other energy-intensive suppliers also prepare for CBAM to attract and retain clients.

Proactively reducing and reporting carbon emissions will help make it easier and more affordable for EU operators to do business with you as the less carbon suppliers emit means less carbon tax EU importers will pay.

These key steps will help you prepare:

1. Gather data across Scopes 1, 2 and 3

Start by identifying which of your EU export products and relevant suppliers are likely to be impacted by CBAM reporting requirements. Proactively collect and record your direct and indirect emissions and country production along the end-to-end supply chain. Consider how to best share access to this information with your clients.

2. Review your existing technology

If you are still using manual, siloed and non-auditable reporting tools such as spreadsheets, it is time to invest in the digital tools you need to collect, centralise and synchronise data to streamline and automate CBAM and sustainability reporting.

3. Gain independent verification

Once you have the data you need, source a non-EU independent verifier who can visit your site and verify your CBAM reporting compliance. This can make it faster and simpler to deal with EU producers and give you a competitive advantage against slower moving suppliers in your sector.

4. Communicate with current EU clients

Reach out to your EU clients about the work you are doing to help their CBAM compliance by making it easier for them to do business with you and access the data they need for their reporting.

5. Find new business opportunities

Communicate with EU businesses that may be looking for verified CBAM-ready suppliers to meet their obligations. Explore whether there are CBAM registers and groups or other opportunities to promote awareness that you are CBAM verified.

6. Position yourself as a low-carbon supplier

Beyond CBAM, tightening emissions regulations and frameworks in other markets like Canada, Australia and the UK will make low carbon options more attractive to buyers and help you add value to existing and new customers and markets.

How is CBAM likely to impact different industries?

As the world strives to achieve net-zero emissions by 2050, large emitting sectors like mining, metals, manufacturing, energy, coal, hydrogen, building materials, chemicals and polymers are under enormous pressure to track, analyse and reduce their footprints. Now CBAM puts a strict deadline on making it happen for impacted EU producers and non-EU-based suppliers.

The full impact of CBAM – and the accelerating global shift towards sustainability – on specific businesses and industries remains to be seen. However, here we touch on a few key sectors facing immediate change, with a deeper look at the risks and challenges facing the mining sector.

How will CBAM impact the manufacturing sector?

Today, manufacturing processes use approximately one-third of the world’s energy6, making it one of the largest emitters of greenhouse gases. Beyond emissions, energy represents a significant cost for manufacturers which will only rise as energy prices increase.

This means there are powerful financial and compliance motivations for organisations to measure and reduce emissions to lower costs, increase margins and protect their licence to operate as EU producers or non-EU-based suppliers of manufactured goods that fall under CBAM.

Over the past decade, the accelerating rollout of lean processes and digitalisation of supply chains – also referred to as Industry 4.0 – has given manufacturers more visibility across their operations. This puts them ahead of other industries when it comes to improving sustainability and meeting CBAM and other reporting requirements.

In a recent survey of manufacturing executives two thirds said that a sustainable supply chain is a competitive advantage, however visibility into sustainable practices within the extended supply chain remains low7, which is a requirement for CBAM reporting. Embracing technology to take control of sustainability is both a major a challenge and opportunity for manufacturers.

How will CBAM impact the energy sector?

Power generation contributes to over 41% of the global carbon dioxide emissions, which makes it priority number one for sustainability initiatives. Despite the global push towards net zero, coal is expected to still fuel 22% of global power even in 2040.8

With public acceptance of traditional power plants on the decline in many countries, operators are under pressure to report their progress towards reductions and alternatives. And policies are following suit, with 44 countries and the European Union – accounting for ~70% of global CO2 emissions – pledging to meet a net‐zero emissions target as of April 2021.9

With CBAM incorporating indirect emissions from the generation of purchased electricity (Scope 2), suppliers and producers will be incentivised to source more sustainable power sources to assist in their compliance and lower costs.

While traditionally slow to adapt, power plants are increasingly embracing digital tools as a way to streamline their operations and transparency.

How will CBAM impact the building materials sector

Between them, steel and cement account for approximately 14% of greenhouse gas emissions, with the rise of industrialisation and urbanisation fuelling their continued growth, along with other minerals, polymers and chemicals.10

Materials like plastic, silicon, aluminium, glass, iron, steel and copper go into the millions of products produced every day around the world – including the solar panels and batteries needed for renewable energy solutions.

With many of these materials used by businesses that manufacture in the EU or are non-EU-based suppliers to these organisations, CBAM will put a price on many of these products as they enter the EU. This will apply to in-scope products from October 2023.

While many of these sectors are slowly but surely working towards net-zero goals in coming years, being directly impacted by CBAM from next year will require urgent acceleration of sustainability data collection and reporting.

How will CBAM impact the mining industry? Risk and opportunity

A high-profile target, the mining industry is under intense pressure to confront climate change and embrace sustainability. This pressure is coming from a range of sources – geopolitical issues, the energy crisis, demand for critical minerals, CBAM, global legislative action on ESG compliance, customers, investors and shareholders.

In their analysis of the top 10 business risks and opportunities for mining and metals in 202311, EY identified ESG as the main risk for the industry, even above geopolitical unrest and climate change.

“ESG remains the top risk and opportunity for mining and metals companies in 2023. The issue is now firmly integrated within corporate strategies due to its impact on almost every aspect of operations.”

Risk of falling behind

Without data-led sustainability accounting and reporting tools in place, mining organisations of all sizes will struggle to maintain their licence to operate, meet regulatory and compliance requirements, control costs, maintain their brand reputation, and attract the next generation of environmentally conscious employees.

Opportunity to lead the way

On the other hand, the ability to effectively track, optimise and report on tangible reductions in greenhouse gas emissions, power consumptions and water usage will give leading players a significant competitive advantage as the markets increasingly favour sustainable operations.

“Stakeholders expect miners to better assess risks and opportunities, and articulate these through transparent, outcome-based measurement and assurance. Miners that achieve this can get an edge on competitors in many ways — from accessing capital to securing license to operate and attracting talent.” 11

CBAM challenges for the mining and resources sector

CBAM presents imminent risks for EU mining operators (importers) as well as their global supply chains (exporters) that will need to be urgently addressed before the October 2023 reporting obligations kick in.

Having worked with global mining organisations for over a decade, at Metallurgical Systems we have identified several critical risks and challenges:

Don’t know what they don’t know

Most mining and minerals operators are at the very early stages of understanding precisely what greenhouse gas emissions and sustainability data they need to track, measure and report on across their business and supply chains. Even mines with sophisticated digital tools may be uncertain what CBAM and other compliance regulations will require of them.

Poor data and reporting capabilities

While they may capture data from some mines, machinery, production processes, equipment and suppliers, most operators are struggling with unconsolidated, historical and incomplete data from multiple sources.

Not ready for the added burden of CBAM

In many instances historical import data is not well organised or accurate, which means they can’t adequately understand and plan for how CBAM will impact their portfolio, suppliers and financials.

Missing data granularity

While some data on direct emissions and electricity use (Scopes 1 and 2) will be available from within existing operations and reporting systems, CBAM compliance requires dynamic granular data on raw materials, country of origin and indirect supplier emissions (Scope 3) which is beyond many mines today.

Siloed operations and processes

Producing auditable reports will require co-ordination and collaboration across multiple internal departments and external suppliers, with clearly defined tasks and responsibilities. This means mining operations will be forced to overcome the disconnected data silos so common across the sector.

Manual spreadsheets

Often, reporting is still done manually using spreadsheets and assumptions. Not only are these slow, error-prone and complex to manage, but they lack the flexibility to handle evolving CBAM requirements and are not independently auditable.

Inaccurate mass balance calculations

Without integrated data sources, connected to a dynamic simulation that is customised to the chemistry and process dynamics of a plant, tracking inventory from start to finish is impossible. Without the right tools, many plants are unable to determine accurate mass balances and materials at every step of the process. For example, they may estimate the amount of reagent used over a year by looking at their purchase history, rather than referencing an exact mass balance to calculate Scope 3 embedded emissions.

Beyond CBAM: A new era of legislated accountability

In line with the EU’s CBAM, governments and jurisdictions across the globe are making it compulsory to report to the United Nations Framework Convention on Climate Change, and individual countries have their own reporting requirements and emissions trading schemes. Shareholders are demanding better disclosure, too.

At the 2021 COP26 conference – the UN’s global climate change conference – the International Financial Reporting Standards (IFRS) Foundation announced the formation of the International Sustainability Standards Board (ISSB). The aim of the ISSB is to create a comprehensive global baseline for sustainability disclosures. The driving force is investor demand for more transparent reporting of sustainability-related risks and opportunities.

The ISSB is now fully operational, and after extensive global consultation has committed to issuing its first two standards relating to sustainability disclosures for adoption in 2023. Countries are not obliged to follow the new provision. However, adoption is expected to be global.12

At the 2022 COP27 conference, Emmanuel Faber, Chair of the ISSB, said:

“…the need for climate-related financial disclosures is increasingly urgent. We are working collaboratively towards the implementation of effective sustainability disclosures for capital markets, which will empower market participants with the right information to support better economic and investment decision making.” 13

The International Organisation of Securities Commissions (IOSCO), the global body for securities regulators from the United States, Europe, Asia and elsewhere, is also expected to endorse the standards.

Under these new standards, companies will be required to publicly report annually on their emissions, demonstrating their commitment and strategies employed to reduce emissions.

Rating agencies will also expect more quantitative information that is typically difficult to obtain from most miners’ systems. Complying with new standards and expectations will require miners to improve the availability, rigour, trust and reliability of data.

The problem: Lack of accurate data measurement tools

Having partnered with mines across the world for over a decade, the main problem we see at Metallurgical Systems is that organisations simply don’t have the right digital tools and technology in place to support effective, efficient and detailed GHG emissions, water and energy consumption accounting.

If you can’t measure and report transparently on your operations at a granular level, then there is no baseline from which to accurately report on current emissions to meet compliance regulations or calculate reductions.

While some organisations are making great progress, others are still relying on the same legacy systems and processes they have been using for many years. For these organisations, accurate greenhouse gas accounting is going to become increasingly challenging.

Without the right data-driven sustainability platform, it’s impossible to meet CBAM and other reporting requirements, let alone implement effective decarbonisation strategies.

In their report, How Technology Can Tame the EU Carbon Tax on Imports4, BCG believe that CBAM requires a digital response.

“Information technology is the key to efficiently implementing the CBAM in a way that will enable the tax to achieve its full potential in achieving the goals of the European Green Deal and driving global action on climate change.”

To become more sustainable – and meet increasingly strict sustainability compliance obligations including CBAM – companies are on the look-out for better ways to not just measure and report on greenhouse gas emissions, power and water consumption, but reduce consumption, too.

Take the world’s only proven shortcut to CBAM compliance

Introducing Metallurgical Intelligence® (MI), a sophisticated technology platform that captures, centralises and consolidates huge amounts of disparate data into a digital twin of your operation’s processing operations.

MI’s core functionality powers metallurgical accounting, process optimisation and production reporting. On top of this, it has in-built world-leading capabilities around auditable reporting for direct and indirect GHG emissions, energy and water consumption – ideally suited to CBAM compliance.

Having been proven over a decade in mining and minerals – and readily customisable across diverse industries – MI is the world’s only established sustainability reporting solution to quickly and accurately calculate, validate and report according to the new EU CBAM requirements.

Already implemented in plants across 8 countries globally – and translated into English, Spanish, French and Russian – MI is an enterprise-wide data software platform that captures, centralises, consolidates and validates huge amounts of data across multiple sources, across the end-to-end mining value chain into a digital twin replica of a plant’s processing operations.

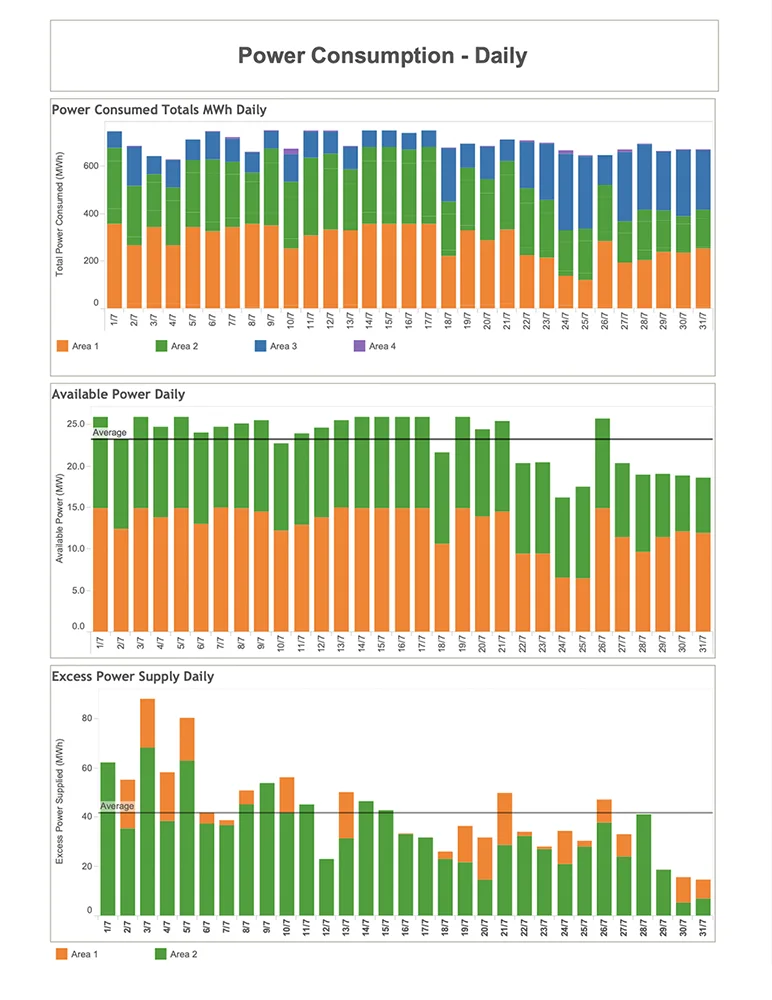

It provides unique and unprecedented transparency with the ability to forecast and deliver near real-time auditable reports for emissions and energy use across Scope 1, 2, and 3 levels critical for CBAM. It also covers the increasingly important area of water consumption to keep you a step ahead of critical sustainability measures and fast-changing policies.

Custom reports are automated to simplify complexity and significantly reduce time to comply with diverse frameworks, standards and requirements including CBAM, International Sustainability Standards Board (ISSB), Sustainability Accounting Standards Board (SASB), European Sustainability Reporting Standards (ESRSs) and International Accounting Standards Board (IASB).

Fully automated and seamlessly integration with your existing systems, MI empowers mining leaders to draw on both historical and near real time live data to understand how CBAM impacts portfolios, operations, emissions targets and financials at any given time.

Proven in mining, customisable across industries

CBAM-ready

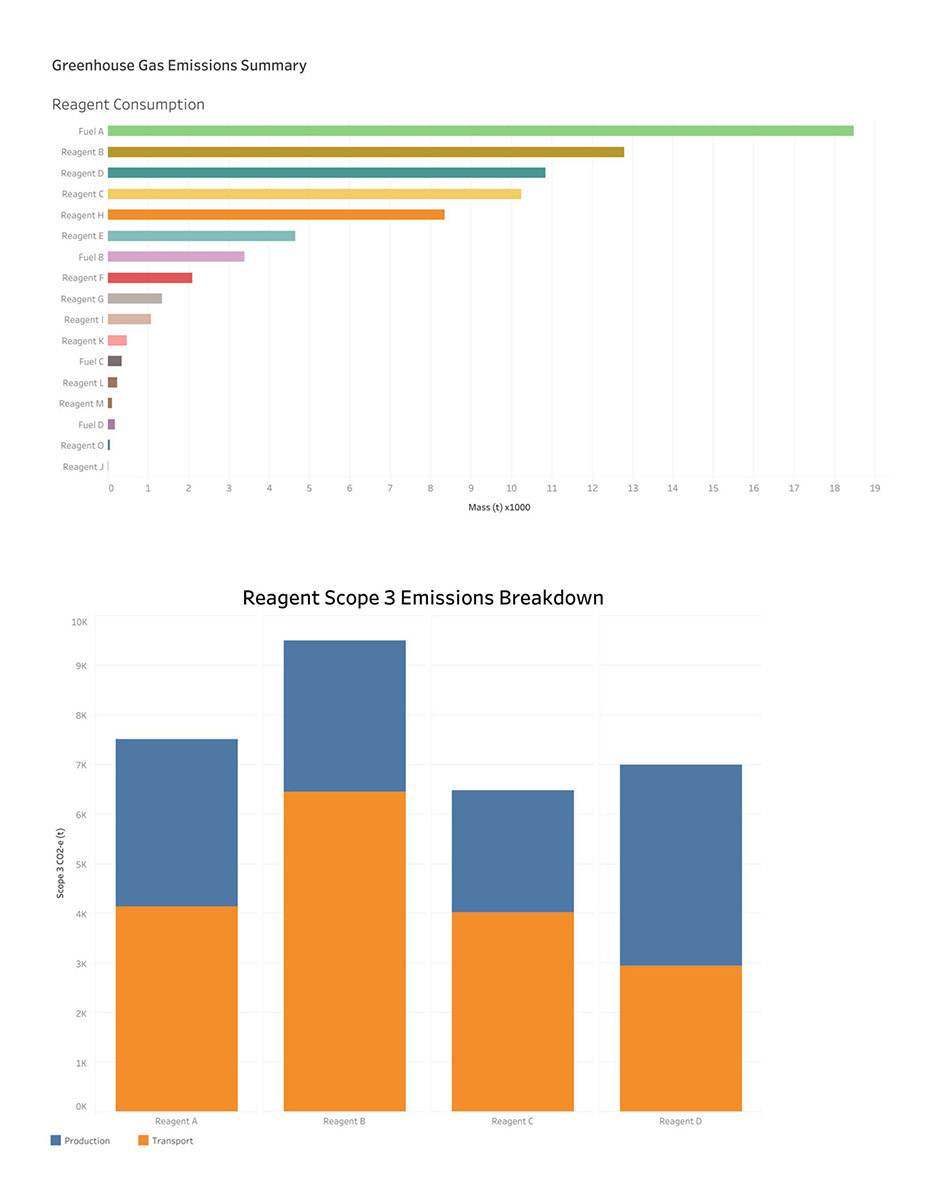

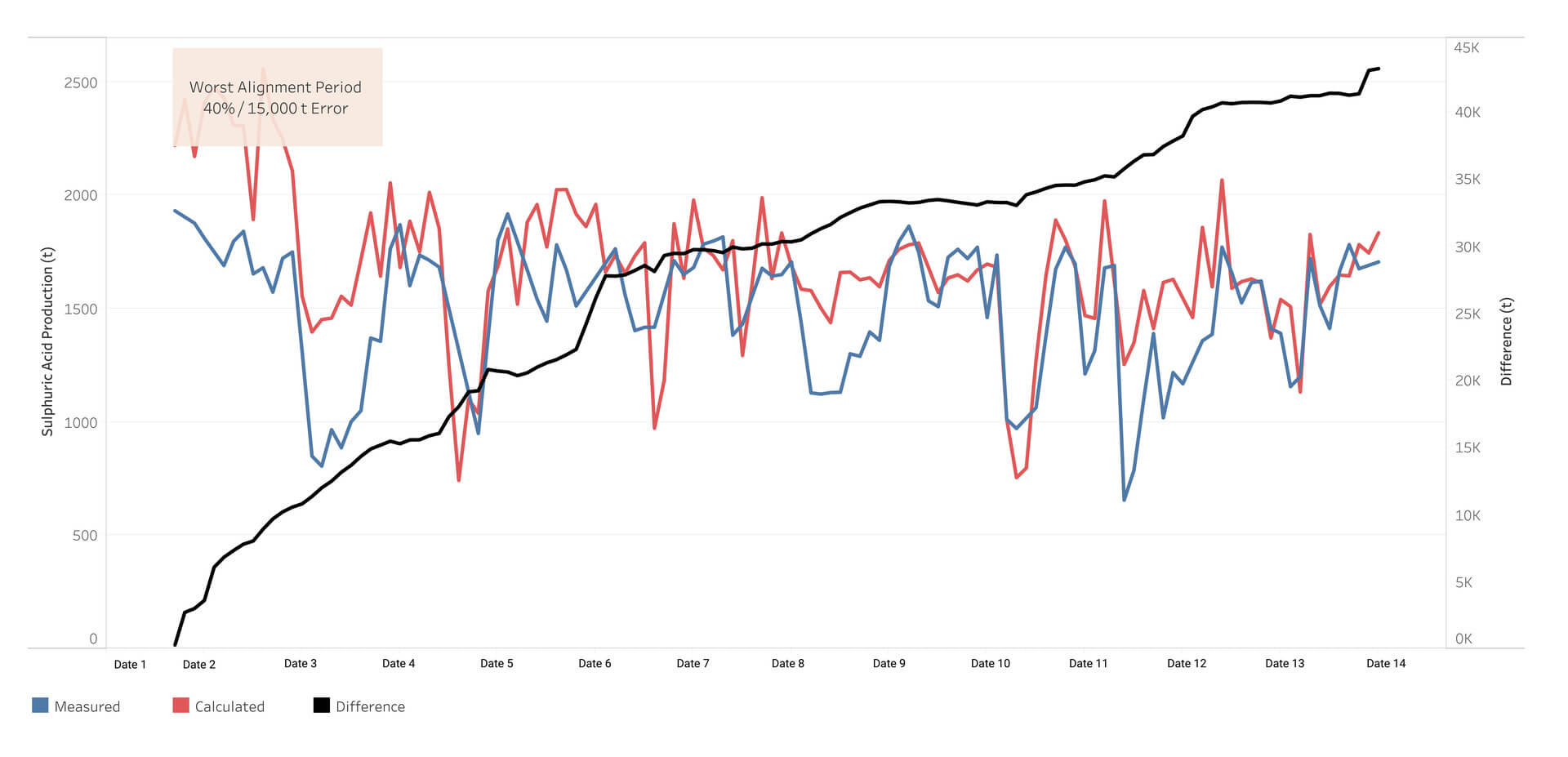

Equipped to manage CBAM’s complex reporting and compliance policies, providing granular reports on GHG emissions, energy and water consumption. For example, this case study details see how we identified US $21m per year in lost acid production through data-driven sustainability reporting.

CBAM Scopes 1, 2 and 3

Reports on direct and indirect greenhouse gas emissions and plant energy consumption on an hourly and daily basis (automated) in near real time.

Third party data

MI can capture and report on data directly related to industrial assets for Scope 3 including transportation emissions and emissions on third party reagents and chemicals used as part of the production process.

CBAM verification

Metallurgical Systems is able to assist with CBAM verification and compliance by providing a complete auditable mass balance of the industrial process at every step of production.

Compliant with SASB guidelines

MI gives you the freedom to generate custom reports on GHG emissions, air quality, energy management, water management, waste and hazardous materials management, tailing storage facilities management, Product Carbon Footprint methodology or Life Cycle Assessment (LCA) – so you have the power at your fingertips to meet the demands of evolving guidelines.

Global flexibility

Easily adapts to diverse regulations and governance frameworks and requirements across different sites and countries as well as captures changes in emissions caused by any variations in the production process across the supply chain.

Proactive optimisation

Functionality to test future scenarios and tie information back to financials to set budgets and forecasts in line with CBAM requirements. Helps identify trouble spots and poor performance enabling informed and proactive optimisation.

Accurate plant-wide mass balance

MI is unique in that it generates a plant-wide mass balance derived directly from automated integration to source data. Applying Industry 4.0 technology such as big data, machine learning, dynamic simulation, multi-dimensional databases and advanced analytics and visualisation tools, it delivers granular hourly reporting at every step in the process. Many plants assume input = output. With MI, input = output + accumulation, with inventory traced as a function of time. This is the secret to true transparency and accuracy.

Sustainability reporting and compliance case studies

Metallurgical Systems has specialised in data-led process engineering for over a decade. Our market-leading optimisation and reporting software has uncovered millions of dollars in savings for some of the world’s largest processing operations. Read our case studies to learn more.

To discuss how we can help your organisation take control of your CBAM readiness and sustainability goals, please contact our experienced team of engineers, metallurgists and technology professionals on +61 2 7229 5646 or info@metallurgicalsystems.com

Related resources

Learn more

Download: Your Guide to CBAM Readiness

About Metallurgical Systems

Founded in 2010, Metallurgical Systems is a world-leading technology company that achieves operational excellence for minerals processing plants.

Based in Sydney, Australia, our solutions are deployed across the globe – in 8 countries, 4 continents and in 4 different languages – and are supported by a highly experienced team of metallurgists, chemical engineers and technical experts.

Metallurgical Systems has invested over 400,000 hours of product development over the course of 10 years to build our market-leading solutions, and the advanced calculations they are capable of are unparalleled. We continue to invest in research and development to ensure they remain at the forefront of the industry.

Highly customisable to suit the unique needs of every plant, Metallurgical Systems’ award-winning solutions are available as CAPEX or OPEX investments and can be deployed 100% remotely.

References:

- BCG, Carbon Measurement Survey, 2021

- Deloitte, EU Carbon Border Adjustment Mechanism (CBAM) Soon to be applicable, 2022

- World Economic Forum, CBAM: What you need to know about the new EU decarbonization incentive, 2022,

- BCG, How Technology Can Tame the EU Carbon Tax on Imports, 2022

- KPMG, Greenhouse Gas Emissions, 2023

- Deloitte, Sustainable manufacturing: Fixing the factory floor, 2022

- Forbes, Sustainability is a balancing act for industrial manufacturers, 2021

- TCS, Toward sustainable and clean thermal power, 2022

- IEA, Net Zero by 2050 – A Roadmap for the Global Energy Sector, 2021

- IFC, Strengthening Sustainability in the Steel Industry and Strengthening Sustainability in the cement industry, 2021

- EY, Top 10 business risks and opportunities for mining and metals in 2023

- World Economic Forum, Explainer: First guidelines for company sustainability disclosures, 2022

- IFRS, ISSB Cop27, ISSB makes key announcements towards climate-related disclosure standards in 2023

About the authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.