Why measuring emissions down to a product level is now a key priority for mining, minerals and resources operations

For the first time across the world, legislators, shareholders, investors, partners, employees and market sentiment have aligned to demand sustainability reporting transparency, particularly for energy-intensive industries.

The introduction of the Carbon Border Adjustment Mechanism (CBAM) in October 2023 put a price on carbon-intensive products entering the EU, with other countries set to follow. Mining and resources organisations are under pressure to get ready to meet the compliance and reporting deadline. The first reports were due from 31 January 2024, in advance of the full rollout in 2026.

Many organisations in the industrial sector are already falling behind on the basics of capturing, measuring and reporting sustainability and emissions data, with a global survey of industry executives finding that 91% fail to measure emissions comprehensively1. As a result, this new legislated accountability brings significant complexity and risk.

For leaders operating in impacted sectors, now is the time to prepare to meet the quarterly CBAM reporting requirements on emissions of products they import into the EU. Beyond compliance, reducing emissions across their supply chain will reduce tax and improve the bottom line.

Drawing on over 10 years of experience in process engineering, data-led software and ESG reporting in the mining and resources sector globally, in this guide we explain what CBAM is all about and how it may impact energy-intensive organisations.

To help mining and resources leaders better understand and respond to CBAM, we break down the essential details, the major risks and opportunities, how to prepare for it, and the technology solutions available.

Contents

- What is the EU’s Carbon Border Adjustment Mechanism (CBAM)?

- What is the purpose of CBAM?

- Why the urgency to take action now?

- What is the CBAM timeline?

- What industrial emissions will need to be reported on?

- What are the new reporting rules for the transition phase?

- CBAM risks: What are the consequences of not being ready?

- CBAM-like policies in Australia and other jurisdictions

- Recommended actions: How and when to prepare for CBAM compliance

- The CBAM challenge: A lack of digital data, measurement and analytics tools

- CBAM reporting is only achievable with effective digital software

- Take control of CBAM reporting compliance

- About Metallurgical Systems

- About the Authors

- References

What is the EU's Carbon Border Adjustment Mechanism (CBAM)?

Legislated as part of the European Green Deal, the Carbon Border Adjustment Mechanism (CBAM) – also referred to as the carbon border tax – is a tariff applied to a range of carbon-intensive products imported by members of the European Union (EU).

The CBAM regulation is a component of the European Council’s Fit for 552 package, with the objective of achieving a minimum 55% reduction in greenhouse gas (GHG) emissions by 2030, as measured against 1990 emissions levels. It came into effect in May 2023.

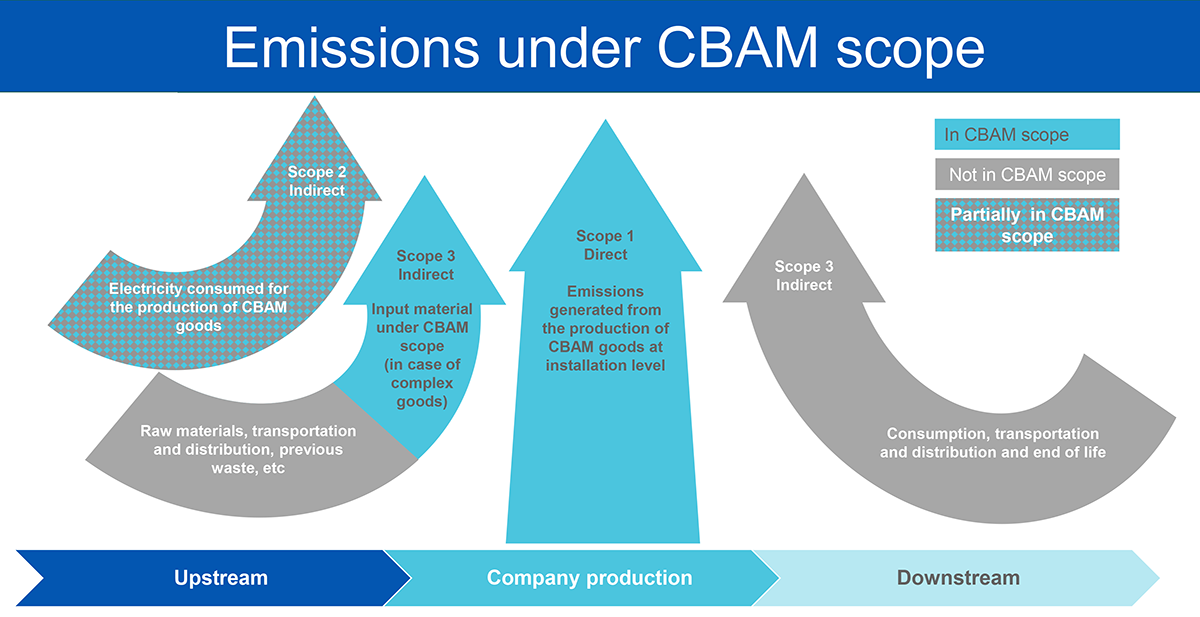

CBAM puts a price on carbon-intensive products as they enter the EU, taking into account both direct and indirect emissions (including Scope 1, Scope 2 and some Scope 3).

Initial industries covered by EU CBAM are electricity, hydrogen, cement, fertilisers, aluminium and iron & steel. More industrial sectors will be added by 2030 including oil refining, upstream (fuel production), all metals, pulp & paper, glass & ceramics, acids & organic chemicals, aviation, maritime and lime.

Whether an organisation manufactures in the EU or is a non-EU-based supplier to these organisations, CBAM compliance requirements apply to in-scope products from October 2023, ahead of the full rollout in 2026.

What is the purpose of CBAM?

The goal of CBAM is to address the issue of carbon leakage, which can happen when different policy settings mean that the costs of producing carbon-intensive products can be lower in one country compared to another.

The EU’s Emissions Trading Scheme caps overall emissions from selected industries including energy, aluminum production and other heavy industry. To cover their emissions, emitters buy and sell allowances, or credits, with the price of one tonne of CO2 trading at around EUR 80.

The problem here is that several EU trading partner countries operate at a much lower carbon price, or none at all. This disadvantages producers within the EU and also provides incentives to other governments to keep carbon prices low.

It can also encourage businesses to relocate their production to jurisdictions with low or no carbon price or to replace EU-manufactured products with equivalent carbon-intensive imports to cut costs.

To counter this issue and even the playing field, CBAM requires covered EU importers to pay the difference between the EU carbon price and carbon price of where the goods were produced.

Why the urgency to take action now?

With policy makers and global markets rapidly shifting towards sustainability and decarbonisation transparency, there are many reasons to move fast:

- With policies like CBAM, the EU has a bold target of reducing net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels3, with the broader goal to make the EU climate-neutral by 2050.

- CBAM is likely to expand into a wider range of industries and countries, while other regions like Australia, Canada and the UK are weighing up similar policies.5

- Beyond CBAM, other evolving regulations like the Corporate Sustainability Reporting Directive (CSRD), the International Sustainability Standards Board (ISSB) and the Securities and Exchange Commission (SEC) will also demand similar granular detail including GHG emissions, water, energy, air quality, waste hazardous materials and nature-related risk factors across the operation and supply chain, increasingly down to a product level.

- The Taskforce on Nature-related Financial Disclosures (TNFD) will also soon become mandatory in many cases, as will the evolving nature disclosures that fall within the ISSB and the CSRD, which both use the TNFD as a guide.

- While CBAM is currently limited to direct exports into the EU, it is also encouraging other countries to adopt carbon pricing. The World Bank reports that jurisdictions including Ukraine, Uruguay, Taiwan and China have cited CBAM as a driver to adopt a carbon price6.

- Exporters to the EU will have reasons to reduce carbon intensity of covered products and to accurately measure the embedded carbon at a product level.

- Siloed legacy systems and manual processes mean most industrial organisations lack the data and digital tools to measure and report to this level of detail. This needs to change.

What is the CBAM timeline?

From its introduction, CBAM requires EU importers to report on emissions embedded in a limited range of products in the initial sectors of electricity, hydrogen, cement, fertilisers, aluminum and iron & steel.

This period allows time for impacted organisations to develop and refine their processes without financial consequences.This phase requires quarterly reports detailing quantity of goods imported in the preceding quarter, their embedded emissions (direct and indirect), and the carbon price due in the country of origin for the emissions.

After the transition period, EU importers will be obliged to start paying for their emissions, with these financial obligations ramping up progressively. The EU will also review other products to be added to the CBAM over this period.

This phase will require an annual CBAM declaration detailing quantity of goods imported during the preceding calendar year, their total embedded emissions as verified by an EU accredited verifier, number of CBAM certificates to be surrendered, and the carbon price effectively paid in the country of origin for the embedded emissions.

Over time, the EU plans to add new products to the CBAM scope to include sectors that are covered by the EU Emissions Trading System (ETS)

The CBAM will be fully rolled out covering goods and materials within the initial sectors. ETS allowances will be phased out.

What industrial emissions will need to be reported on?

CBAM requires reporting on direct and indirect emissions (Scopes 1, Scope 2 and some Scope 3) of a range of carbon-intensive products as they enter the EU. At launch, CBAM will apply to a limited number of sectors at a higher risk of carbon leakage, including electricity, hydrogen, cement, fertilisers, aluminum and iron & steel. Covered EU importers began reporting from 1 October 2023 and must start making payments from 2026.

More sectors will be added by 2030 including oil refining, upstream (fuel production), all metals, pulp & paper, glass & ceramics, acids & organic chemicals, aviation, maritime and lime.

Operators from all jurisdictions will report embedded emissions to covered EU importers. The importers report to their national authority who will then report to the European Commission. All reporting will be done through a central registry planned to integrate with EU customs systems.

Organisations that cannot yet provide transparent, consistent and complete reports around both direct and indirect emissions need to act fast.

The EU Implementing Regulations7 (summary table below) outline what emissions – direct or indirect – and what GHG gases are to be reported on by product. Initially, only indirect emissions are required to be reported for electricity, cement, and fertilisers. However, the CBAM regulation states that ‘as soon as possible’ indirect emissions will be required to be reported across all products.

Source: EU Commission Presentation 8

Definitions of direct and indirect emissions

As published in the EU Implementing Regulations:

- Direct emissions means emissions from the production processes of goods, including emissions from the production of heating and cooling that is consumed during the production processes, irrespective of the location of the production of the heating or cooling;

- Indirect emissions means emissions from the production of electricity which is consumed during the production processes of goods, irrespective of the location of the production of the consumed electricity.

However, other emissions (considered to be Scope 3 from the GHG Protocol) for ‘complex’ goods do need to be included in the calculation of embedded emissions.

- Complex goods means goods other than simple goods;

- Simple goods means goods produced in a production process requiring exclusively input materials (precursors) and fuels having zero embedded emissions.

The calculation of complex goods includes the embedded emissions of the input materials (precursors) consumed in the production process.

For determining the specific actual embedded emissions of complex goods produced in a given facility, direct and, where applicable, indirect emissions shall be accounted for. For that purpose, the following logic is to be applied:

The specific embedded emissions in a unit good at the product level = the sum of the attributed embedded emissions of goods at the facility level + the embedded emissions of input materials (precursors) consumed in the production process used to produce the goods at that facility. This total is divided by the quantity of goods produced in the reporting period in that facility.

Where:

‘Attributed emissions’ means the part of the installation’s emissions during the reporting period that are caused by the production process resulting in goods when applying the system boundaries of the production process defined by the implementing acts adopted pursuant to Article 7 of the EU regulations.

The EU CBAM regulation (#65) notes that indirect emissions will be included for all goods in time:

“The Commission should regularly evaluate the application of this Regulation and report to the European Parliament and to the Council. Those reports should in particular focus on possibilities to enhance climate actions towards reaching the objective of a climate-neutral Union at the latest by 2050. The Commission should, as part of that reporting, collect the information necessary with a view to the further extension of the scope of this Regulation to embedded indirect emissions in the goods listed in Annex II as soon as possible, as well as to other goods and services that could be at risk of carbon leakage, such as downstream products, and to developing methods of calculating embedded emissions based on the environmental footprint methods, as set out in Commission.

Those reports should also contain an assessment of the impact of the CBAM on carbon leakage, including in relation to exports, and its economic, social and territorial impact throughout the Union, taking into account also the special characteristics and constraints of outermost regions referred to in Article 349 TFEU and of island States which are part of the customs territory of the Union.”

What are the new reporting rules for the transition phase?

In August 2023, the official EU Law online gateway published the reporting regulations for the CBAM transitional period. While there is a depth of information that requires expert advice to adapt to individual organisations and sectors, here we aim to highlight the essential details to know now that CBAM is in effect.

Reporting obligation of reporting declarants:

- The first reporting period (Q4 2023) starts from 1 October 2023 and must be submitted by 31 January 2024.

- The final report of the transition period (Q4 2025) is due by 31 January 2026.

- Key elements to be reported on by EU importers or reporting declarants is outlined by the Commission Implementing Regulation (EU) 2023/1773. Some of the key elements include:

- The type of goods (identified by their CN code)

- The quantity of imported goods (megawatt hours for electricity and tonnes for other goods)

- The embedded emissions of the covered goods (direct and indirect) calculated by one of the EU Implementing Regulation Methods as detailed below

- The country of origin for the imported goods, including the geographical coordinates of the main emissions source of the facility in which the goods were produced, and the production routes used for the production of the goods for determining embedded direct emissions

- Specific embedded indirect emissions – reporting declarant shall report electricity consumption, megawatt hours of the production process per tonne of goods produced, specify actual or default emission values, and emissions factors used in calculations

Reporting of carbon price due:

- If applicable, a reporting declarant must report any carbon emissions price previously paid in a country of origin for the embedded emissions. This includes the type of carbon price, any rebates or compensation received, the amount of the carbon price due, and the quantity of embedded direct or indirect emissions covered. For a full list refer to Article 7 of the EU regulations.

Submission and modification of CBAM reports:

- Standardised quarterly CBAM reports are to be submitted electronically to the CBAM Transitional Registry database. There is a standard period of two months where revisions or corrections can be made. During the transition period, the first two reports can be amended up until 31 July 2024.

Penalties:

- Penalties for non-compliant, inaccurate or incomplete reports will be determined by each Member State, but will fall within the range of EUR 10 to EUR 50 per tonne of unreported embedded emissions. The penalty will increase in accordance with the European index of consumer prices. For more details refer to Article 16 of the EU regulations.

Approved methods for calculating embedded emissions

For the purpose of measuring embedded emissions of goods produced in a facility (note that the EU Regulation refers to a facility as an ‘installation’), the EU Regulation provides a choice of two methods:

- Calculation-based methodology: This involves measuring GHG emissions from source streams using activity data collected from measurement systems, along with additional calculation factors obtained from laboratory analyses or standard values. The calculation-based methodology may be implemented according to the standard method or the mass balance method.

- Measurement-based methodology: This involves calculating from emission sources by continuous measurement of the concentration of the relevant greenhouse gas in the flue gas and the flue-gas flow.

To provide time and flexibility for importers and producers to align their processes with the CBAM rules, the EU regulations include additional alternative approved monitoring methods until 31 July 2024 and 31 December 2024 which include:

- Until December 2024: embedded emissions of goods produced may be determined using other monitoring or reporting methods, if they are within a similar coverage and accuracy of embedded emissions data namely:

- A carbon pricing scheme where the facility is located

- A compulsory emissions monitoring scheme where the facility is located, or

- An emission monitoring scheme at the facility.

- Until 31 July 2024: For imports of goods where the reporting declarant does not have all the necessary information to use either the EU Methods or other methods, any methodology may be used, including using default values made available and published by the Commission for the transitional period or any other default values (specified in Annex III of the implementing regulation). In such cases, the reporting declarant shall indicate, and reference in the CBAM reports the methodology followed for establishing such values.

During the transition phase, when calculating embedded emissions, certain ‘complex goods’ will need to include a portion of their Scope 3 emissions on raw materials (this will expand out to other goods in time). If the facility or producer is not able to supply this data to the operator, then up to 20% of the total embedded emissions of complex goods may be based on estimations made available by the operators of the production facility. For more information, see Article 5 of the EU regulations.

Transparency of data

The official EU regulations are clear on the requirement for verifiable and transparent data in Annex III: “Monitoring data shall be obtained, recorded, compiled, analysed and documented, including assumptions, references, activity data, emission factors, calculation factors, data on embedded emissions of purchased precursors, measurable heat and electricity, default values of embedded emissions, information on a carbon price due, and any other data relevant for the purpose of this Annex, in a transparent manner that enables the reproduction of the determination of emissions data including by independent third parties, such as accredited verifiers. Documentation shall include a record of all changes of methodology.”

What information do operators (non-EU suppliers) need to monitor?

To help maintain relationships and be attractive to EU importers, non-EU suppliers and producers will need to be equipped to report necessary emissions information to help EU importers meet their obligations. For example, this would include:

- The complete direct emissions produced by the facility, accurately assigned to distinct products.

- The volumes of particular input materials used in the manufacturing process, along with the emissions embedded in these precursor materials.

- The indirect emissions stemming from the electricity generation utilised in the production process, connected to the goods manufactured. This should also consider emissions embedded in precursor materials when applicable.

- Any applicable carbon pricing associated with the production of the commodity within its own jurisdiction.

- Establishing reporting systems to communicate this information to customs or relevant authorities.

CBAM risks: What are the consequences of not being ready?

CBAM reporting and compliance regulations took effect in October 2023, which will be followed by financial obligations from January 2026. CBAM initially includes the electricity, hydrogen, cement, fertilisers, aluminum and iron & steel sectors, with more to follow by 2030.

So for organisations that haven’t already made the necessary preparations, now is the time to understand the potential risks and impacts, and deploy the systems and gather the data needed to meet the granular and auditable finance-grade reporting requirements.

Not being ready poses potentially significant operational risks, including:

Penalties, sanctions and fines

Strict penalties for non-reporting and/or inaccurate reporting are set to come into effect in 2027. In addition, there could also be fines across multiple levels across different countries, jurisdictions and governing bodies.4

Default data could make carbon footprints look worse

Importers who cannot produce their own data using the approved EU Methods, or where reliable average data is not available, will need to use default data. As these may be higher than actual emissions, this could result in organisations being rated worse than they should be, which may cause reputational damage and increase exposure to higher tax costs. 4

Blocked from importing

Without robust and accurate auditable data, organisations may be unable to achieve the third-party verification needed to acquire the CBAM certificates required to import certain products.4

Loss of licence

Without accurate reporting, importers could lose their CBAM declarant’s licence, which means they can no longer import in-scope goods. This could freeze supply chains and negatively impact operations, financial performance and business outcomes.4

Even those who supply to the EU but reside outside could face detrimental impacts, including:

Loss of clients

If EU importers can’t get the information they need from suppliers, they may need or choose to switch to an organisation that has more carbon transparency across their supply chain.1

Uncompetitive pricing

If suppliers can’t reduce their carbon emissions, the carbon tax will mean importers will pay more for their goods, making their products less competitive compared to alternatives.

For example, it is forecast that the EU’s CBAM could sharply increase the prices of raw materials such as imported steel.1

“To significantly reduce the carbon footprints of imported products, many EU companies will need to engage with foreign suppliers throughout the value chain, from design to manufacturing all the way through to logistics, to make their processes more carbon efficient. Alternatively, EU importers will need to switch to lower-carbon suppliers.”1

When looking at lowering emissions across the supply chain (Scope 3) organisations cannot meet their compliance requirements and emission reduction targets on their own. It will require new levels of collaboration, cooperation and technological innovation between suppliers, partners and even competitors.

McKinsey & Company analysis suggests that addressing Scope 3 emissions across industries has the potential to generate whole new operating models and business value.

“Lower emissions can lead organisations to radically transform business strategies by rethinking commercial models, making portfolio moves, and building partnerships across the value chain, as well as sourcing new low-carbon inputs and changes to product specifications to reduce emissions during the use stage.”9

Operations that try to go it alone in the new era of sustainability risk being left behind.

CBAM-like policies in Australia and other jurisdictions

While the EU has led the way with CBAM, it will be important to observe how other large economies respond and when, or if, they introduce their own versions.

While we look deeper at Australia’s plans below, other jurisdictions like Canada and the UK are weighing up similar policies and are expected to move to product-level carbon reporting. For example, in the US the draft Clean Competition Act (CCA) includes 25 sectors that impose a tariff on the difference between product actual emissions and the US baseline emissions.

The Australian Government announced its intention to review whether a CBAM may be suitable with an aim to level the playing field for local manufacturers who face competition from overseas producers that are not subject to the same carbon pricing rules.

The Australian Government’s Safeguard Mechanism Reforms Position Paper10 in January 2023 stated that it is currently considering the option of implementing a system similar to the EU CBAM, which would allow them to levy tariffs on imported goods that are carbon-intensive such as the resource sector. As reported in their paper:

“Many stakeholders raised the issue of carbon leakage and identified a carbon border adjustment mechanism (CBAM) as their preferred approach for managing trade competitiveness impacts. Some of Australia’s trading partners have proposed introducing CBAMs to help ensure trade competitiveness does not compete with decarbonisation objectives.”

“Recognising the strong stakeholder interest in the potential use of an Australian CBAM, the Government will undertake a review to explore policy options to further address carbon leakage. The review will consider CBAMs as one of the potential responses to carbon leakage that could complement Safeguard Mechanism reforms and will take into account the interests of our key trading partners.”

This was supported in August 2023 with Climate Change Minister Chris Bowen announcing that Australia could impose a carbon border adjustment mechanism11, as reported in the Australian Financial Review. He said:

“The right policy settings are important to ensure a level playing field for Australian firms doing the right thing when it comes to decarbonisation. The decarbonisation task is most acute for large industrial facilities, frequently in hard-to-abate sectors and subject to competition in international markets.”

An analysis by Refinitiv12 reported that non-EU businesses, like Australian resources companies, that operate in jurisdictions that have adopted ISSB, EU and SEC standards will need to be able to track, report and comply with these sustainability frameworks.

As reported in The Guardian13 in August 2023, Bowen explained that this was a decision not to be rushed and that his department would launch two rounds of consultation on whether Australia should introduce a CBAM in line with the EU model, firstly considering steel and cement.

“We know of the potential for production to shift from countries with more ambitious emissions-reduction policies to those with lower emission-reduction policies, potentially resulting in increased global emissions. This undermines national and international climate action and has long been a key consideration in the development of climate policy worldwide.”

Recommended actions: How and when to prepare for CBAM compliance

With CBAM reporting requirements now in effect and the first quarterly report due 31 January 2024, now is the time for EU producers and non-EU suppliers to deploy the data capture and reporting capabilities in order to be compliant and prepare for the financial obligations to follow.

At a high level, the first step for leadership is to understand how the initial reporting rules apply to their organisation and sector, determine which products are impacted, and collate all the data that they will need to measure to comply.

Once the reporting baseline is in place, in advance of the financial obligations, the next phase includes reviewing the supply chain to look for opportunities to simplify, streamline and automate processes to minimise costs, tax, reporting and legal compliance burdens.

Steps to CBAM readiness for EU producers

- Allocate responsibilities

Identify which individuals and departments will be responsible for CBAM. - Assess the impact

Identify which products are covered and embedded emissions. - Collate emissions data

Determine what data is available internally and what is needed from suppliers. - Identify data gaps

Consider what data is missing across direct and indirect emissions. - Review existing technology

Investigate what digital tools will be needed to collect and synchronise data. - Create a CBAM reporting action plan

Set up the data and systems to deliver auditable quarterly CBAM reports.

Steps to CBAM readiness for non-EU suppliers

- Gather data across Scopes 1, 2 and 3

Identifying how to measure products and suppliers impacted by Scopes 1, 2 and 3. - Review existing technology

Investigate what digital tools will be needed to collect and synchronise data. - Gain independent verification

Source a verifier who can visit to verify the organisation’s CBAM compliance. - Communicate with EU clients

Inform existing clients they can access the data they need to streamline CBAM compliance. - Find new opportunities

Promote the organisations as a verified CBAM-ready supplier. - Be a low-carbon supplier

As the world goes green, low carbon options will attract new buyers.

Robust CBAM reporting demands transparency, consistency and completeness

Those currently manufacturing in the EU would already have basic reporting systems and data on their organisation’s direct emissions to comply with the Emissions Trading System (ETS), however many producers have little or no visibility into the carbon footprints of the factories and mines of foreign suppliers across their supply chains (Scope 3) due to their current dependence on siloed legacy systems and manual processes to achieve this.

The detailed and data-intensive reporting requirements mandated by the CBAM are among the most extensive greenhouse gas (GHG) emissions standards ever implemented. CBAM’s reporting requirements will necessitate extensive information sharing and collaboration across supply chains, which will require sophisticated digital measurement, analysis and reporting systems.

Producing the granular reports needed to transparently and accurately report on sustainability indicators including GHG emissions, water, energy, air quality, waste hazardous materials and nature-related risk factors, and to satisfy CBAM and other globally guidelines is not possible without digital sustainability reporting software.

If there are gaps in an organisation’s in-house expertise or tools, they may benefit from a specialist consultant to assist with advice on technology, data, compliance or reporting.

The CBAM challenge: A lack of digital data, measurement and analytics tools

Having partnered with mining and resources-organisations for over a decade, the team at Metallurgical Systems has seen that many operations simply don’t have the right digital tools and technology in place to support effective, efficient and detailed GHG emissions, water and energy consumption accounting.

For organisations that can’t measure and report transparently on their operations at a granular level, then there is no baseline from which to accurately report on current emissions to demonstrate compliance or calculate reductions.

Even though disclosure has been voluntary up until now, the number of companies publishing a sustainability report has been growing steadily over the past decade, with 79% of the top 100 countries in each company surveyed by KPMG14 producing a report. Businesses that aren’t reporting even at a broad level risk falling behind in a market that demands transparency, as well as facing an uphill battle to deliver the granular data now required by regulations such as CBAM.

While some organisations are making great progress, others are still relying on the same legacy systems and processes they have been using for many years. For these organisations, accurate emissions reporting is going to become increasingly challenging.

The report, How Technology Can Tame the EU Carbon Tax on Imports 5, argues that CBAM requires a digital response.

“Information technology is the key to efficiently implementing the CBAM in a way that will enable the tax to achieve its full potential in achieving the goals of the European Green Deal and driving global action on climate change.”

Without the right data-driven sustainability platform, it’s impossible to meet CBAM and other reporting requirements, let alone implement effective decarbonisation strategies.

To become more sustainable – and meet increasingly strict sustainability compliance obligations including CBAM – industrial organisations are on the look-out for better ways to not just measure and report on greenhouse gas emissions, power and water consumption, but reduce consumption, too.

CBAM reporting is only achievable with effective digital software

Introducing Metallurgical Intelligence® (MI)

Metallurgical Intelligence® (MI) is a sophisticated technology platform that captures, centralises and consolidates huge amounts of disparate data into a digital twin of your operation’s processing operations.

MI’s core functionality powers metallurgical accounting, process optimisation and production reporting. On top of this, it has in-built world-leading capabilities around auditable reporting for direct and indirect GHG emissions, energy and water consumption – ideally suited to CBAM compliance.

Having been proven over a decade in mining and minerals – and readily customisable across diverse industries – MI is the world’s only established sustainability reporting solution to quickly and accurately calculate, validate and report according to the new EU CBAM requirements.

Already implemented in plants across 9 countries globally – and translated into English, Spanish, French and Russian – MI is an enterprise-wide data software platform that captures, centralises, consolidates and validates huge amounts of data across multiple sources, across the end-to-end mining value chain into a digital twin replica of a plant’s processing operations.

It provides unique and unprecedented transparency with the ability to forecast and deliver near real-time auditable reports for emissions and energy use across Scope 1, 2, and 3 levels critical for CBAM. It also covers the increasingly important area of water consumption to keep you a step ahead of critical sustainability measures and fast-changing policies.

Custom reports are automated to simplify complexity and significantly reduce time to comply with diverse frameworks, standards and requirements including CBAM, International Sustainability Standards Board (ISSB), Sustainability Accounting Standards Board (SASB), European Sustainability Reporting Standards (ESRSs) and the Global Reporting Initiative (GRI).

Fully automated and seamlessly integrated with your existing systems, MI empowers mining leaders to draw on both historical and near real time live data to understand how CBAM impacts portfolios, operations, emissions targets and financials at any given time.

To discuss how we can help your organisation take control of your CBAM readiness and sustainability goals, please contact our experienced team of engineers, metallurgists and technology professionals on +61 2 7229 5646 or info@metallurgicalsystems.com

About Metallurgical Systems

Founded in 2010, Metallurgical Systems is a world-leading technology company that achieves operational excellence for minerals processing plants.

Based in Sydney, Australia, our solutions are deployed across the globe – in 9 countries, 4 continents and in 4 different languages – and are supported by a highly experienced team of metallurgists, chemical engineers and technical experts.

Metallurgical Systems has invested over 400,000 hours of product development over the course of 10 years to build our market-leading solutions, and the advanced calculations they are capable of are unparalleled. We continue to invest in research and development to ensure they remain at the forefront of the industry.

Highly customisable to suit the unique needs of every plant, Metallurgical Systems’ award-winning solutions are available as CAPEX or OPEX investments and can be deployed 100% remotely.

About the authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.

- BCG, Carbon Measurement Report Survey 2021

- Council of the EU and the European Council, Fit for 55, 2023

- World Economic Forum, CBAM: What you need to know about the new EU decarbonization incentive, 2022

- Deloitte, EU Carbon Border Adjustment Mechanism (CBAM) Soon to be applicable, 2022

- BCG, How Technology Can Tame the EU Carbon Tax on Imports, 2022

- The World Bank, State and Trends of Carbon Pricing 2022

- EUR-Lex – Access to European Law, EU regulations, 2023

- EU Commission, Carbon Border Adjustment Mechanism Presentation, March 2023

- McKinsey & Company, The Scope 3 challenge: Solutions across the materials value chain, May 2023

- Australian Government, Safeguard Mechanism Reforms Position Paper, January 2023

- The Australian Financial Review (AFR), Bowen’s ‘green tariff’ to shield steel, cement against carbon leakage, Aug 2023

- Refinitv, How many companies outside the EU are required to report under its sustainability rules?, June 2023

- The Guardian, Australia may impose carbon tariffs on steel and cement imports from countries with lower climate goals, Aug 2023

- KPMG, Big shifts, small steps – Survey of Sustainability Reporting 2022