With new sustainability frameworks rapidly evolving and proposed legislation to take effect in 2024, Australian resources companies are focusing on their environment, sustainability, and governance (ESG) reporting. In November, our Managing Director John Vagenas presented a keynote on this topic at the 2023 MetPlant Conference – titled: It is ALL in scope.

John gave a compelling overview of some of the important changes in legislation affecting Australian resources companies, discussed the heavy risk of non-compliance and the growing cost of offsetting emissions, and explained why accurate data shouldn’t be considered a “luxury item” but a crucial part of doing business in the current climate. He also explained the link between metallurgical accounting and sustainability reporting and how a digital twin process optimisation solution can help.

Following is a summary of John’s keynote and some of the insights he shared.

Contents

- Why should we be so intently focused on measuring emissions?

- What role does government policy play?

- What impact will this have on resources organisations?

- Understanding the regulatory requirements: a critical priority

- International Sustainability Standards Board (ISSB) Standards

- EU’s Corporate Sustainability Reporting Directive (CSRD)

- Safeguard Mechanism and National Greenhouse Energy Reporting (NGER)

- Biodiversity, Ecosystems, and the Taskforce on Nature-related Financial Disclosures (TNFD)

- Carbon Border Adjustment Mechanism (CBAM)

- Why digital reporting is the only way forward

Why should we be so intently focused on measuring emissions?

Firstly, it’s an undeniable fact that, as the world’s resources sector produces most of the products upon which we all depend, we are also generating most of the world’s emissions. As such, the resources sector needs to have a very central role in helping Australia achieve its goal of net-zero emissions by 2050.

However, there is also a wide assumption that forcing resources companies to dramatically reduce their emissions by implementing levies and offset penalties will solve the problem. In fact, it’s much broader and more complicated than this. We need to find a way to reduce emissions without financially crippling resources companies, and without society slipping into energy poverty.

Secondly, reducing emissions is in our best interest. Pressure to reduce emissions isn’t just coming from regulators. It’s also coming from employees seeking to work in more sustainable sectors; financial organisations wanting to safeguard their investments; and customers who are increasingly discerning about the sustainable origin of the products and resources they consume. If our sector is to continue to thrive— and attract investment and talented people— a focus on reducing emissions needs to be a key priority.

Thirdly, accurately measuring emissions is now imperative from an operational perspective. The list of regulations with which resources organisations need to comply is expanding constantly—both here in Australia, and globally. As well as imposing an administrative overhead, the complexity of this reporting poses a significant operational and compliance risk. To maintain revenue, avoid penalties and tariffs, as well as maintain a social license to operate, Australia’s resources companies must start thinking very seriously about how they are measuring and reporting on their emissions.

What role does government policy play?

The government plays a key role in setting targets for our sector—as well as influencing public opinion about our responsibilities. Earlier this year, the Australian government introduced the reforms to the Safeguard Mechanism. This requires the largest 215 companies in Australia to reduce their emissions by 4.19% annually.

Now, this is where we run into a bit of a problem. A large majority of the emissions produced by resources companies are considered difficult to abate, which essentially means there are no technology solutions available to achieve this reduction. This means companies will have to start buying credits to offset their emissions. Just to contextualise this, based on a likely cap of $75 per tonne of CO2 produced by each of these 215 companies, this equates to approx. $29 billion annually if we were to offset all of scope 1 and scope 2 emissions collectively. If scope 3 is incorporated in the future, this sum will be closer to $180 billion in offsets per year. That’s a staggering sum: more than 10% of our GDP.

What impact will this have on resources organisations?

The impact of these offsets is going to be significant. Let’s consider a recent example. In response to the Australian Government’s Safeguard Mechanism reforms, Rio Tinto was required to write down $1.2 billion of the asset value of their aluminium refineries. Publicly available Rio Tinto data stated that the cost to comply with the Safeguard Mechanism would cost the organisation US$800 million—rendering the value of this refinery almost worthless. The concern here is that if an energy intensive organisation can’t turn a profit in a particular location, they will simply shut down that site and move elsewhere. This could have a devastating effect on many regional Australian communities and our economy.

Understanding the regulatory requirements: a critical priority

As we head into 2024, perhaps the most pressing priority for resources companies is to get a firm understanding of the regulations—to determine how to optimise compliance and minimise the financial impact. The list of regulations and requirements is evolving constantly, so this can be a difficult task in itself, and failing to do so could have serious financial and operational consequences.

IFRS S1 and IFRS S2 International Sustainability Standards Board (ISSB)

Commonwealth Treasury Consultation Paper Proposes Mandatory Climate-related reporting for 2024/2025 FY

NGER and the Safeguard Reforms

From 1 July 2023, reduce carbon emissions by 43% by 2030 (compared to 2005)

Australian CBAM

Minister for Climate Change and Energy announced 2 rounds of consultation on CBAM, final report due third quarter of 2024

Corporate Standards Reporting Directive (CSRD)

- European Sustainability Reporting Standards (ESRS) – double materiality (climate-related financial disclosures and material nature-related impact disclosures) from January 2024.

- EU Green Deal, Carbon Border Adjustment Mechanism (CBAM)

Taskforce of Nature-related Disclosures (TNFD)

- Published in September 2023 Australian treasury paper highlights the need for reporting on nature and biodiversity

- ISSB working on topic specific standards for nature and biodiversity

International Sustainability Standards Board (ISSB) Standards

It is envisaged that rigorous standards set by this board will be legislated into corporate reporting in Australia in the 2024/2025 financial year. Under these standards, large Australian organisations across several industries—not just the resources sector—will be required to report on a range of climate-related factors. The requirements will broaden over a three-year period, and smaller organisations will eventually be required to report to these standards. The level of reporting outlined by these standards is far more detailed than exists in current Australian reporting practices.

The ISSB reporting requirements contains IFRS S2, a standard built on the Task Force on Climate-related Financial Disclosures (TCFD) framework. Many Australian companies already report to the TCFD, however those transitioning from the voluntary TCFD to the soon to be mandatory ISSB reporting, will notice a significant uplift in the granularity of the disclosure requirements.

EU’s Corporate Sustainability Reporting Directive (CSRD)

These European standards are even more rigorous than those proposed by the ISSB and came into practice in January 2023. European member states are required to incorporate the provisions of the CSRD into their national law. Some Australian companies which operate in Europe are also required to comply. These regulations require organisations to provide very thorough and accurate detail regarding their ongoing sustainability performance, and how they are tracking towards targets.

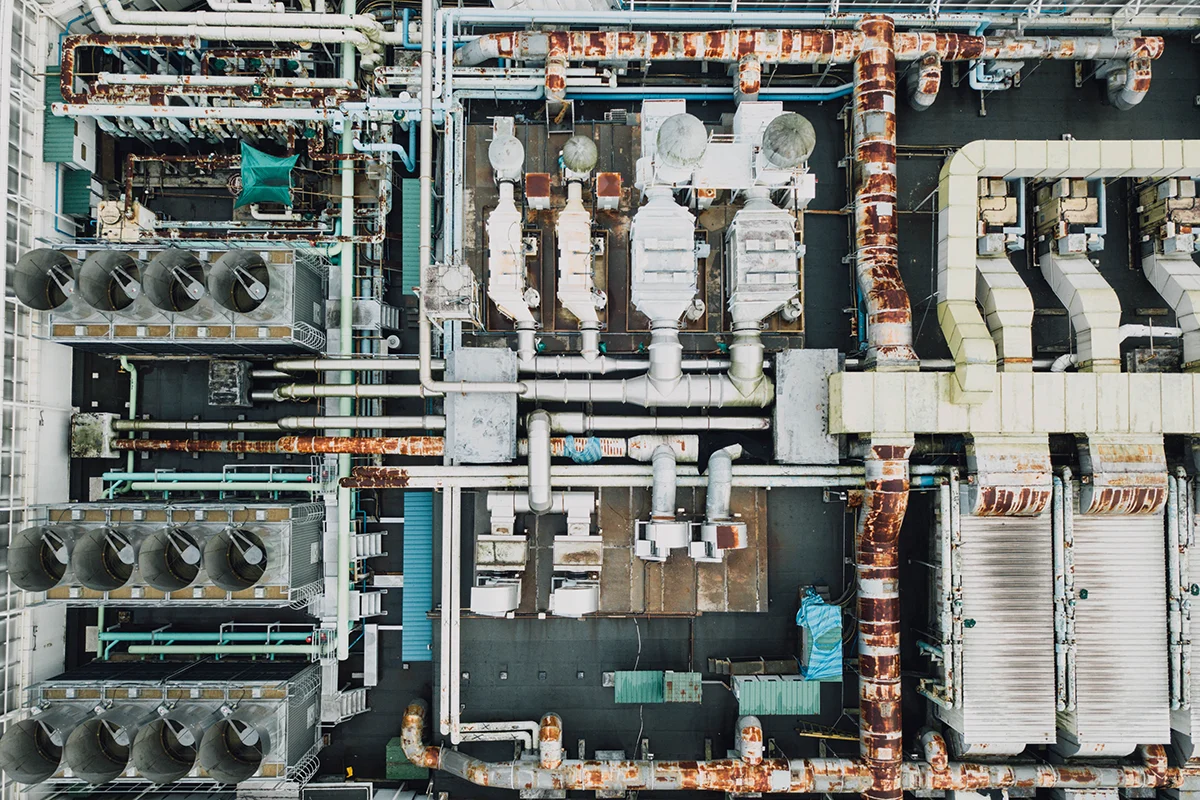

Safeguard Mechanism and National Greenhouse Energy Reporting (NGER)

Set by the Australian Government, this ‘mechanism’ has existed since 2016, and was recently amended in line with Australia’s climate targets. It requires the highest greenhouse gas-emitting facilities in Australia to keep their emissions below a set baseline. Organisations that fail to do so may face penalties.

Biodiversity, Ecosystems, and the Taskforce on Nature-related Financial Disclosures (TNFD)

This framework (though not yet adopted in Australia – but likely to be) requires organisations to provide data on the risks and opportunities associated with biodiversity loss. This could be variability to access of feedstock, or exposure to extreme environmental conditions. This data needs to be provided, even if the risks don’t have a direct impact on the company’s finances.

Carbon Border Adjustment Mechanism (CBAM)

Legislated as part of the European Green Deal, the Carbon Border Adjustment Mechanism (CBAM) or ‘carbon border tax’, is a new tariff applied to a range of carbon intensive products that are imported by the European Union (EU). The CBAM puts a price on carbon intensive products as they enter the EU. It considers direct emissions (scope 1), as well as indirect electricity and other indirect emissions (scope 2 and recently, some scope 3). As part of CBAM, EU organisations will ask Australian resource company exporters to provide details on the carbon emissions embedded in goods scheduled for import.

The Australian Government has also released a statement indicating it is considering the option of implementing a system similar to the EU’s CBAM. This would mean applying a tariff on carbon-intensive goods coming into Australia.

Why digital reporting is the only way forward

Understanding the complex reporting requirements is the first major challenge for resources organisations. The second is providing the required data, on a regular basis, to a broad range of regulators. This is a very complex and time-consuming task. Yet incredibly, Australia is still one of the few G20 countries where corporate digital reporting is still voluntary. A recent survey also found that just 9% of companies measure their total emissions comprehensively.1

Many organisations are still relying on error-prone, time-consuming manual processes and spreadsheets for their emissions reporting. Within the resources sector, there is a very low uptake of systems that automatically consolidate relevant data and make it easily accessible in a transparent way. This needs to change. If you consider the fact that an average report has 87 pages (very time consuming to pull together manually), and that Australian regulatory bodies say they have identified over 8,000 errors in submissions since 2019, the case for corporate digital reporting is very clear.

Increasingly, engineers, metallurgists, data scientists and corporate compliance teams are going to be required to not only understand the requirements—but to implement sustainability improvements, and proactively minimise their organisation’s exposure to climate, financial and nature-related risks. This requires powerful analytics and real-time insight. It simply cannot be done manually.

The good news: while digital corporate reporting is not yet mandatory in Australia, it is imminent. The Australian Accounting Standards Board has said it is “strongly in favour” of digital reporting in Australia.

Can a metallurgical accounting solution help?

A metallurgical accounting solution tracks material through production—measuring consumption and output, and bringing together data from multiple sources to provide very accurate insights.

Conceptually, metallurgical accounting and emissions reporting are similar. To measure emissions, we just need to track a few additional things—for example, a plant’s use of water, reagents, and power. Using a metallurgical accounting system for tracking emissions allows an organisation to centralise its site-based data and consumption, and capture high-value, integrated insights.

Let’s consider a potential scenario from a limestone plant. The plant is required to measure the amount of CO2 released per tonne of limestone used. Most regulators would measure this on a cost basis. So, if the plant purchases 100 tonnes of limestone, it is assumed that it releases approximately 44 tonnes of CO2. However, this mode of measurement has an obvious flaw: not all limestone is reactive. Even if 95% of the limestone reacts during production, the emissions are going to be significantly less than the system initially calculates.

There’s another problem too. If the plant is adding limestone to neutralise mild acidic solutions, the utilisation of the limestone drops significantly. This results in a situation where the plant’s emissions are overstated by 10%, 15% and potentially even 20%. This results in a real risk that the plant pays far more for its carbon offsets than it needs to.

To correctly measure the plant’s emissions, we need to look at the limestone which is consumed and how it is precipitated in granular detail. This calls for a sophisticated digital twin solution.

What about a digital twin process optimisation solution?

Ideally, resources organisations can automate this process utilising a digital twin process optimisation solution. This can help organisations to:

- Simplify the tracking, reporting and management of emissions in granular detail.

- Get insights regarding their largest emitting activities and test alternative scenarios against accurate reduction targets.

- Create accurate budgets and forecasts.

- Track emission and energy consumption on an hourly basis.

- Create and test scenarios which reflect changes in process operations, to see what impact they will have on emissions (e.g. installing different equipment, altering throughput rates, or using alternative fuel).

- Capture data in keeping with all relevant global standards.

In the future, resources companies need to be making digital transformation—and specifically, investing in a metallurgical accounting and process optimisation solution powered by a digital twin—a critical priority. There must also be sufficiently skilled and knowledgeable professionals within the industry to ensure the data captured can be effectively interpreted and acted upon.

Find out more

To learn more about current regulatory requirements and how a process digital twin can help, read this article:

Using a process digital twin to comply with new sustainability reporting rules

Watch the recording of John’s presentation

References

- Business Consulting and Services Carbon Measurement Survey Report, 2021: Use AI to Measure Emissions Exhaustively, Accurately, and Frequently

About the authors

This article has been collaboratively authored by the team at Metallurgical Systems, and fact-checked and authorised by Managing Director and industry specialist John Vagenas.